Sign up to receive latest insights & updates in technology, AI & data analytics, data science, & innovations from Polestar Analytics.

Editor’s Note: Is it frustrating to hear “Why are we unable to save more?” year-on-year even when you believe you have the most cost-efficient procurement plan? This is what most of the procurement leaders we’ve spoken to say. True strategic excellence comes when you refine plans for the long term based on categories.

With the rising competitive landscape, category management can separate the true leaders from laggards and pave way for cost reduction in spend analysis, tail spend analysis, and create the basics of procurement analytics.

“According to an analysis by McKinsey, a 1 percent improvement in the cost of goods sold increases EBITDA by an average of more than 18 percent.”

The simplest way to explain category management is “bundling”. Bundling or grouping items purchases/procured based on demand, vendor, purpose, and other characteristics like the type, etc. for consolidating efficiencies, achieving economies of scale, enhancing relationships, and streamlining processes.

Let’s explain this easily, we’ve all seen “The Home Edit” or some version of organize your home video at some point. Bundling is similar to the process of identifying all the products that you use together or have the same color or of the same season clothes etc. and grouping them together to make your day-to-day operations efficient. Just that instead of colors organizations do it based on the UN Standard Products and Services Code (UNSPSC) or by defining their own taxonomies.

Answering the question about where to start, we even spoke about this while talking about spend analysis, the first step is creating the taxonomy should be considered the first step of category management.

But before we delve into the 8-step process and define the building blocks of category management, as a procurement leader you should ask yourself these questions:

These questions are important to be asked and answered as they form a few of the fundamental principles.

1. Contract Management

Contracts outline the terms, conditions, pricing, quality standards, delivery schedules, and other important aspects of material procurement. Effective contract management contribute to cost control, risk mitigation, and clarity in the procurement process. This is especially important as category management is not a short-term process instead needs to think about volumes, discounts and economies of scale for the long term.

2. Cross-functional working

Stakeholders from multiple teams like procurement, finance, operations, and other relevant areas need to work together. Ideally, teams should consist of people who will be using the system and people who will own a specific category e.g. use the RACI model to create a team. This collaborative approach is needed to consider cost, quality, and internal requirements based on use-cases as needed.

3. Categorization and Aggregation

By grouping similar products (categorization) and increasing purchase volumes of items (aggregation) can reduce the number of transactions and agreements which in turn reduces overall prices. This is the first step in analyzing spend patterns and leverage buying power to achieve cost savings. This principle enhances efficiency and reduces procurement complexities.

4. Standardization

Standardization can be two-fold. One: Processes. A series of steps, processes, or guidelines for all the teams across the organization for procuring goods as per categories. Two: Specifications. By standardizing the specifications you can simplify supplier evaluation, streamline supplier interactions, enhance quality control, and reduces errors.

5. Supplier Management

Though we’ve spoken a little about this previously effective supplier management with performance monitoring, communication, and risk assessment can improve reliability, sustained value delivery, and improve mutual benefits for a sustained period of time. With these principles in mind let’s get started with a 8 step process approach for category management.

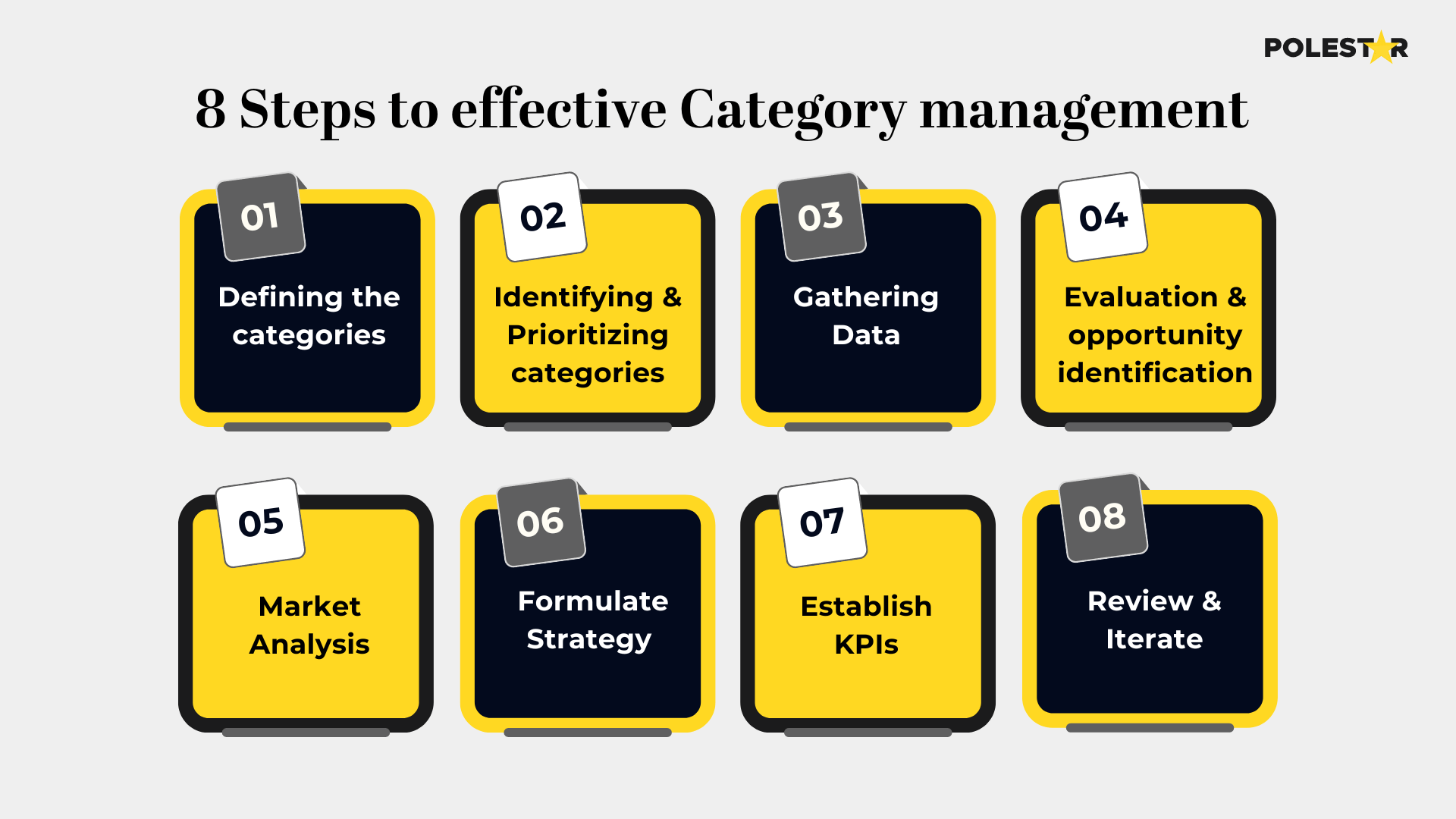

Let’s dive deep into the process of how to start with category management practically.

1. Defining the categories

Categories should be defined based the function that the good provides. The division can be done by value, supplier, type, or volume. For segmentation-based supplier based on value vs volume, you can use techniques like Kraljic’s model, spend allocation model, or based on their use like direct material and indirect material, or CPV (Common Procurement Vocabulary), ECLASS, GPC (Global Product Classification), etc. It is usually better to define multiple hierarchies of categories and sub-categories which would be further useful for spend/cost analysis.

2. Identifying and Prioritizing categories

Once the categories are defined, you’ll need to classify the most important ones based on the risk, volume, and value. This can be done by performing cost analysis (by categories, suppliers, stakeholders) using techniques like АBC- analysis, Pareto principle, Supplier impact analysis, etc. considering factors like TCO, Market volatility, strategic alignment, and supply chain complexities.

3. Gathering Data

Effective data management, governance, and data quality play a major role here. There is a famous saying regarding data analysis: “Garbage In = Garbage out”. Maintaining data sanctity across systems is always important for all analysis operations not just category management. Some of the key sources from which data is accessed (even for subsequent activities like spend analysis) are:

Additionally, there might be data from third-party sources or suppliers' ERP/ procurement systems.

4. Evaluation & opportunity identification

Here a detailed analysis of all the suppliers based on their category is performed based on parameters like demand, value, logistics (delivery time, terms, shipping costs, etc.), volume (frequency, inventory, replenishment, etc.) , and/or any issues or problems faced with existing suppliers or products. This can pinpoint specific areas of improvement and identify opportunities for cost savings, process improvements, and enhanced supplier relationships.

5. Market Analysis

Next conducting a thorough analysis of the market dynamics, including pricing trends, competitive landscape, and emerging technologies is key. You might be thinking you have the best contractual and pricing terms, but unless you are benchmarking it is based on understanding the structure of local, federal, and international markets, there is no validation to this. You can use RFIs, an internet search on multiple browsers (though it sounds basic, sometimes different browsers give different search results), aggregator websites, B2B marketplaces, trade-support governmental organisations, professional industrial exhibitions, etc. to benchmark your pricing strategy.

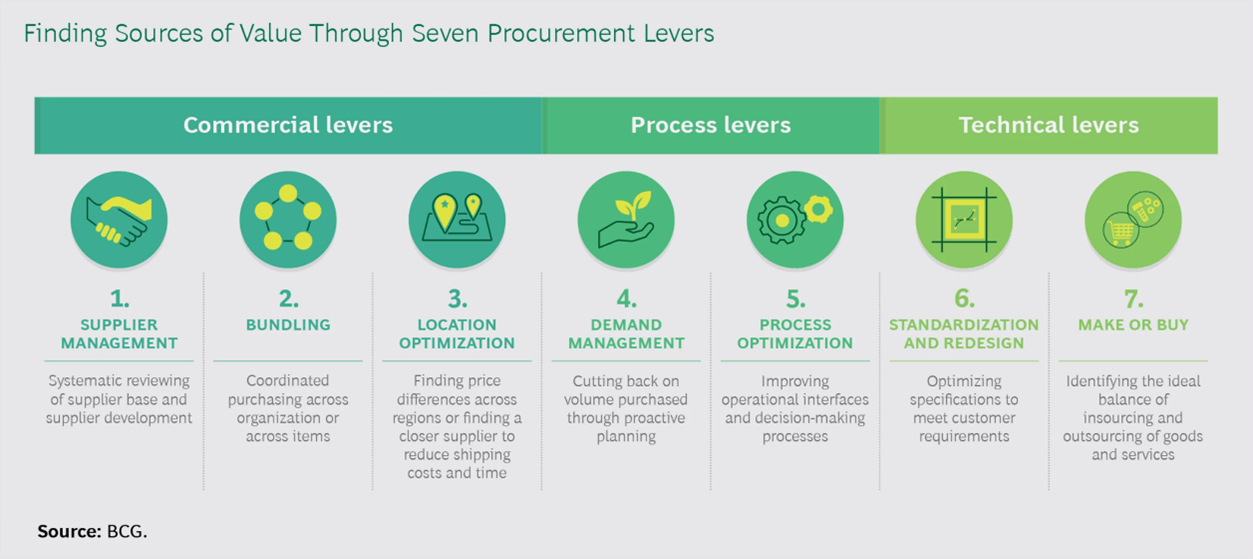

6. Formulate Strategy

In addition to looking at the category in which they belong, the overall strategy should be a function of value that can be provided to the organization.

Source: BCG

Based on the needed scale and available buying and supplier power the strategy per category can be exclusive, selective, hybrid, tender-based, etc. In addition to the seven above-mentioned levels the TCO (total cost of ownership) and Transactional costs should be taken into consideration.

7. Establish KPIs

No process is complete without actually measuring the output and the impact it has to the organization. Some of the key KPIs include:

We’ll talk about the KPIs in detail in our next blog.

8. Review & Iterate

The most important part of any process is examining how the process is going and iterating the steps based on the given review. Companies should adopt the PDCA (Plan-Do-Check-Act) cycle for continuous improvement. By regularly reviewing supplier performance and updating strategies based on changing market conditions or internal requirements you can ensure the company’s relevance in this rapidly changing environment.

Now that you understand what category management is about, what the building blocks it are, and where you can start with it – the next questions are about how to refine it or how to face the common challenges that you face.

These are the questions that we answer in the next blog of our procurement series. What are the KPIs that should be measured, best practices to keep in mind, understanding where you stand in the category management journey, and how to mitigate the challenges you face accordingly.

About Author

Data & BI Addict

When you theorize before data - Insensibly one begins to twist facts to suit theories, instead of theories to suit facts.