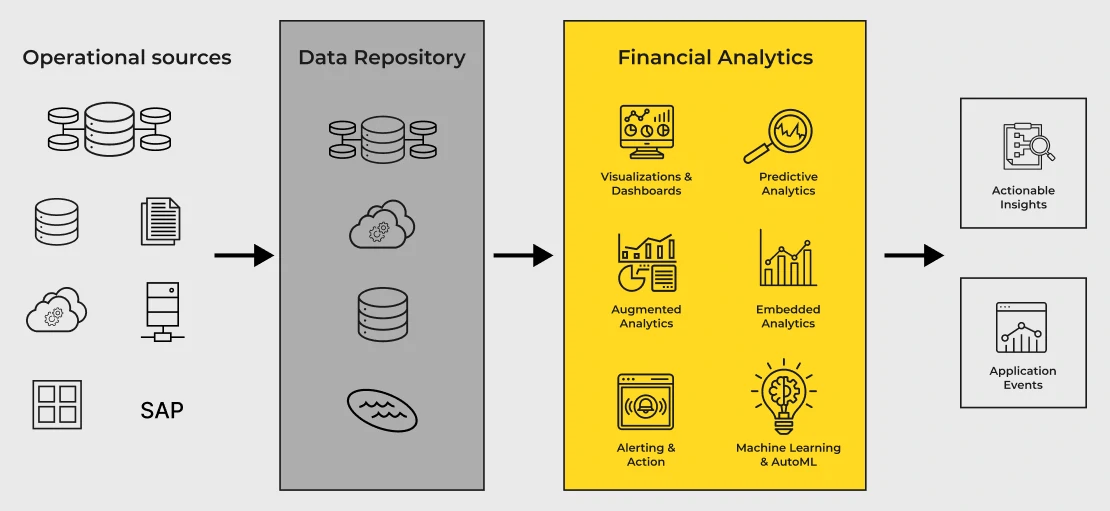

Financial Analytics

Empower your financial prowess with cutting-edge financial data analytics and data-driven intelligence.

Of financial leaders reported facing challenges in managing data effectively.

Of leaders considered managing costs & optimizing operational efficiency as their primary challenges.

Of financial executives expressed concerns about effectively managing liquidity and cash flow.

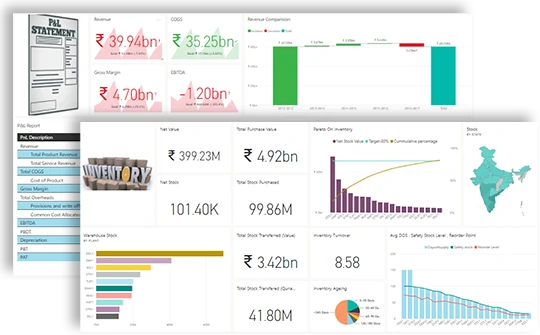

Unlock operational efficiencies, gain deep insights into profit & loss margins, and streamline cashflow for enhanced financial performance.

Organizations can analyze Capex and Opex to uncover cost-saving opportunities. By examining cost structures and analyzing individual components, businesses can optimize spending, streamline processes, and reduce unnecessary expenses to drive smarter investments, leading to increased cost efficiencies.

Simulate numerous economic scenarios to evaluate their effects on financial performance, liquidity, and capital adequacy. By doing so, you can identify vulnerabilities, create contingency plans, and maintain resilience amid market fluctuations.

Utilizing advanced statistical models and ML techniques, firms can create predictive financial models that forecast key financial metrics. This allows you to anticipate market trends, evaluate risks, and make proactive strategic decisions.

Conduct a comprehensive analysis of cost and revenue drivers to uncover strategies for maximizing profitability, reducing operational expenses, segmenting customers, and enhancing the profitability of services or products

Perform a thorough analysis of compliance requirements to identify areas where your company needs to maintain adherence. Enhance decision-making by implementing smarter and more transparent practices, resulting in reduced risks, penalties, and fraud.