Sign up to receive latest insights & updates in technology, AI & data analytics, data science, & innovations from Polestar Analytics.

Editor's Note: We are delighted to present this insightful blog that explores the remarkable impact of predictive analytics on the pricing and underwriting processes within the insurance industry. With a keen focus on harnessing data-driven insights, this blog unveils the scope of predictive analytics, enabling insurers to optimize pricing strategies, enhance risk assessment, and drive profitability. Dive into this thought-provoking piece to unlock the potential of predictive analytics and its profound implications for the future of insurance.

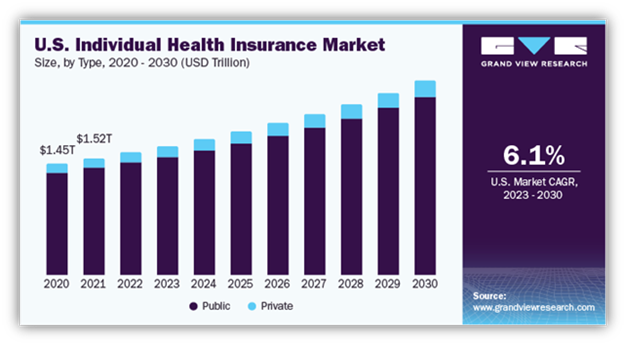

The insurance industry is undergoing a transformative shift driven by technological advancements and data analytics. One of the most impactful developments is the integration of predictive analytics in insurance, which leverages vast amounts of data to inform pricing strategies and underwriting practices.

By utilizing sophisticated algorithms and machine learning techniques, insurers can better assess risk, tailor premiums, and optimize their operations. In this blog, we will explore how predictive analytics in insurance underwriting shape price elasticity and underwriting aspects.

How often have we been seeing phrases like “Get your Health Insurance for free!” or “Gift your beloved Insurance only for XX cents/days”?

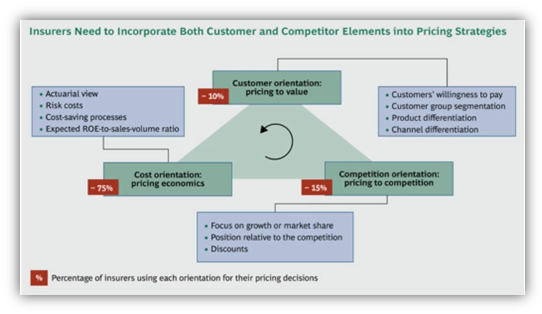

Pricing in the insurance industry has undergone significant changes in recent years, primarily influenced by advancements in technology, marketing mavericks twisting their content, and the availability of vast amounts of data.

Insurers are shifting from traditional rating models to more dynamic and personalized pricing approaches. This transition is driven by increased competition, changing customer expectations, and the need for more accurate risk assessment.

Predictive analytics plays a crucial role in this transformation.

It is pretty simple to understand how Insurers make money – The premiums they get comprise the revenue, and processing the claims incurs them a cost.

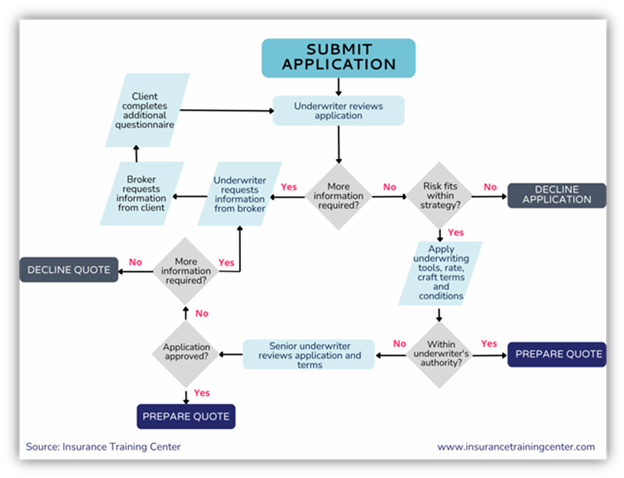

Underwriters are tasked with assessing the associated risks with onboarding any clients. The higher the probability of an insured exercising his claims regularly, the more it will cost the insurer.

As a result, Underwriters in the insurance industry analyze the risks associated with insuring persons and assets. Insurance underwriters dictate the rate for accepted insurable risks.

Receiving compensation for your willingness to pay a prospective risk is known as Underwriting. Underwriters use knowledge structures and actuarial data to estimate the possibility and amount of risk. Insurance underwriters assess the risks of insuring persons and property and figure out the cost of risk.

Commercial bank underwriters evaluate the damage of lending to people or organizations and charge added fee to cover the cost of taking on that risk. Insurance underwriters take on the risk of a future event in exchange for a pledge to reimburse the client in case of harm or loss.

Insurance analytics services help underwriters assume the risk of a lease agreement with a person or a company. For example, an underwriter may bear the risk of a fire in a property in exchange for a premium. A vital role of an underwriter is to assess an insurer's risk prior to the policy period and at the time of renewal.

Insurance has always been a data-driven industry. Each of the competition’s inexperienced players gets access to data, but only those who can turn data into insightful knowledge can turn it into a gold mine. A recent study’s findings say that 86% of insurance businesses are developing insurance data analytics systems for the best possible projections of big data reports.

Pricing and underwriting in the insurance industry are not without their challenges. Insurers face complexities in accurately assessing risks, determining appropriate premium levels, and maintaining profitability. Traditional underwriting methods often rely on historical data and broad risk categories, which may not capture the nuances of individual risk profiles. Let us look at a few challenges that insurers face in determining their pricing strategy.

Data Availability and Quality: Insurance companies heavily rely on data to assess risks accurately and set premiums. However, according to a study by McKinsey, only 15-20% of insurers believe they have the necessary data to support their underwriting decisions effectively. Limited availability and poor quality of data help ensure accurate risk assessment and pricing. For example, incomplete or outdated claims data can lead to underestimating or overestimating risk, impacting pricing accuracy.

Regulatory Environment: There is a slew of regulations governing the Insurance pricing and underwriting industry. One of them is, the Affordable Care Act (ACA), which introduced norms in the health insurance market, requiring insurers to adhere to community rating rules. This restricted the ability of insurers to differentiate premiums based on individual risk factors, making pricing and underwriting more challenging and requiring alternative risk assessment strategies.

Catastrophic Events and Natural Disasters: Natural disasters pose significant challenges to insurers in terms of risk assessment and pricing. According to the Insurance Information Institute, the United States experienced 22 weather and climate disasters in 2020 alone, resulting in $95 billion in insured losses. Accurately pricing and underwriting risks associated with catastrophic events, such as hurricanes and wildfires, require sophisticated modelling techniques and historical data analysis.

Emerging Risks: Technological advancements and evolving industries introduce new risks that insurance companies must assess and price accurately. For example, the rise of autonomous vehicles presents unique challenges for underwriters. Insurers need to determine the appropriate premiums considering the risks associated with autonomous driving technology, including cybersecurity threats and liability concerns.

Underwriting Accuracy and Profitability: Accurate underwriting is crucial for insurers to maintain profitability. According to a report by Deloitte, underwriting performance has been declining in the US property and casualty insurance industry, with the combined ratio reaching 107.4% in 2020. Achieving the right balance between risk assessment, pricing, and profitability is vital to avoid underpricing risks and incurring losses or overpricing and losing customers to competitors.

Ethical Considerations: Pricing and underwriting decisions must adhere to ethical guidelines and avoid discriminatory practices. The use of data and analytics in underwriting has raised concerns about potential bias and discrimination. For example, a study by ProPublica found that some auto insurers charged higher premiums to customers with similar risk profiles but different ethnic backgrounds. Ensuring fairness and avoiding discriminatory practices is essential for insurers to maintain public trust and regulatory compliance.

By addressing these challenges through improved data management, advanced analytics, regulatory reforms, and ethical considerations, insurers can enhance their pricing and underwriting practices, mitigate risks effectively, and maintain profitability in the dynamic insurance industry landscape.

Discover the Power of Analytics in Insurance and Gain Actionable Insights. Dive Into Our Ultimate Insurance Analytics Guide to Explore Use Cases and the Latest Trends and Strategies.

Connect With Our Experts NowInsurance has long Predictive analytics offers insurers a powerful tool to address the abovementioned challenges and refine their pricing and underwriting processes.

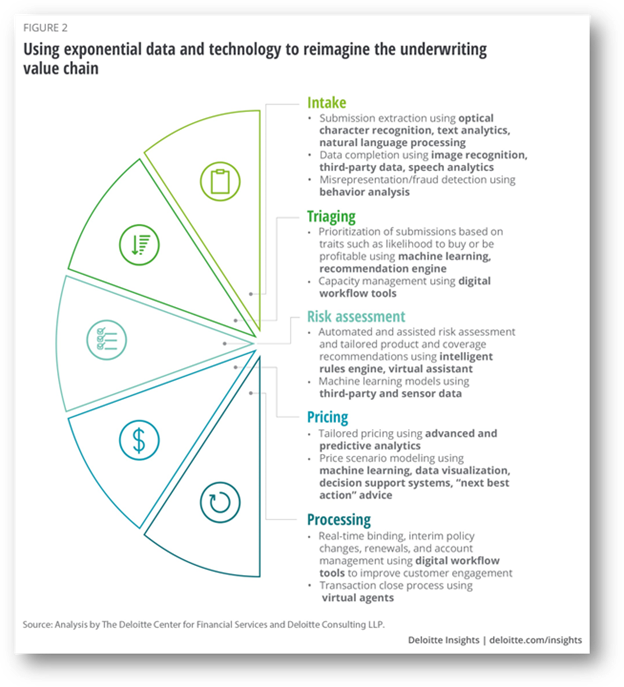

By harnessing the power of data, insurers can leverage advanced modeling techniques and algorithms to analyze historical and real-time data, identify patterns, and make accurate predictions. Here are a few notable use cases of predictive analytics in the insurance industry:

Risk Assessment and Underwriting Automation:

Predictive models can analyze vast amounts of data, including a wide range of data points, including policyholder information, credit scores, claims history, and external data sources, and insurers can evaluate risk levels more comprehensively. Polestar helps you automate the underwriting processes to reduce manual effort and improve the overall efficiency of underwriting operations.

Pricing Optimization:

Predictive analytics enables insurers to develop sophisticated pricing models that consider multiple variables, such as customer demographics, claims history, policy coverage, and external factors like weather patterns or economic indicators. By understanding the price elasticity of demand, insurers can refine their pricing strategies and offer more personalized and competitive premiums.

Fraud Detection:

Predictive analytics can detect patterns and anomalies in claims data, helping insurers identify potential fraudulent activities. Polestar Analytics leverages machine learning algorithms enabling insurers to continuously improve fraud detection capabilities, saving substantial costs and enhancing overall risk management.

The Coalition of Insurance Fraud estimates that $80 billion is lost annually from fraudulent claims in the United States alone. Additionally, fraud makes up 5-10% of claims costs for insurers in the United States and Canada.

Predictive analytics helps insurers detect fraud patterns and anomalies in claims data, leading to significant cost savings.

The National Insurance Crime Bureau (NICB) utilizes predictive analytics to identify suspicious activities and potential fraud in the insurance industry. Their system, known as "Pattern Search and Recognition" (PSAR), analyzes vast amounts of data to detect fraud rings and protect insurers from fraudulent claims.

Customer Segmentation and Targeted Marketing:

By analyzing customer data, Polestar Analytics develops predictive models to help segment policyholders into different groups based on risk profiles, preferences, and behavior. Insurers can tailor marketing campaigns, policy recommendations, and personalized offerings to specific customer segments, improving customer satisfaction and retention.

For 67% of insurers, improved customer relationships are one of the main reasons to invest in predictive analytics.

Identifying Potential Markets:

Polestar Analytics offers insurance analytics services to help insurers to identify and target potential markets by revealing behavior patterns, standard demographics, and characteristics, so insurers know where to target their marketing efforts.

Since there are 3.2 billion people on social media around the world, these platforms have become increasingly important when it comes to identifying potential markets. It also influenced customer service: about 60% of Americans say that social media has made the customer service process easier for obtaining answers and resolving problems.

Some highlights from the industry….

Transform Your Organization With a Robust and Comprehensive Underwriting Process to Mitigate Risks, Streamline Claims and Enhance Profitability.

Connect with our experts nowWhile predictive analytics offers significant benefits to the insurance industry, it also presents challenges and ethical considerations. Privacy concerns, data security, and algorithmic bias are some of the issues that need to be addressed. Insurers must ensure that the data used for predictive analytics is collected and stored securely and that it complies with relevant privacy regulations.

Furthermore, efforts should be made to mitigate algorithm biases to prevent unfair discrimination and ensure transparency in decision-making processes.

Predictive analytics is revolutionizing the insurance industry by providing insurers with valuable insights to enhance pricing strategies and underwriting practices. By leveraging vast amounts of data, insurers can accurately assess risk, tailor premiums, and streamline operations.

However, it is essential to strike a balance between utilizing predictive analytics for improved outcomes and addressing the ethical considerations associated with data privacy and algorithmic bias. As technology continues to advance, the insurance industry must adapt to these changes, embracing predictive analytics responsibly to deliver better customer experiences, optimize risk management, and drive overall industry growth.

While there are challenges to overcome, data analytics can play a pivotal role in navigating pricing complexities and underwriting risks and apprehensions. By leveraging data-driven insights, firms in the Insurance sector can adapt to the evolving landscape and thrive in the digital realm of the industry.

To equip your Pricing and Underwriting team with Advanced Analytics insights, get in touch with our Industry experts.

Reach Polestar Analytics now!

About Author

Sports and Tech Enthusiast

In a world of opinions and cold numbers, data tells a compelling story.