Sign up to receive latest insights & updates in technology, AI & data analytics, data science, & innovations from Polestar Analytics.

Editor's Note: This guide explores the power of using data analytics in insurance, including how it can improve risk assessment, pricing, fraud detection, and customer experience.

Two patterns have typically stuck with the Insurance Industry in general.

Firstly, the insurance industry has, for a long, remained very static. Bobby Bowden, Chief Distribution and Marketing Officer at Allied World, aptly captures this perception with his following quote.

“If you could wake up an underwriter or broker from 1686, it would take only a few days to get them up to speed."

Secondly, positive perceptions of trust, honesty, and integrity have long baffled insurance agents, and the insurance industry in the global marketplace tends to be associated with public distrust. One nationwide Australian poll in 2013 saw Australians rank sex workers as more trustworthy than insurance salespeople, with only politicians and door-to-door salespeople deemed lower the list.

However, the Insurance Industry is at the cusp of transformational changes today as a result of Technology in Insurance. The tides are changing faster than ever before, and most of the assets that legacy insurance players have built over the years, are now becoming liabilities. It is reasonable to expect that the insurance industry will look much different in the next ten years than it has been in the past several decades.

So, what is causing tectonics to shake so fiercely today? The answer is a fusion of Technology in Insurance.

Digital transformation such as analytics applications in insurance are bringing out radical innovations in product delivery and operating business models. For example, transformational tap and pay features are now becoming standard, in an industry where it used to take on average several weeks, or even months to settle claims.

According to Accenture's Technology Vision survey, 86% of insurance executives surveyed said that the inroads of technology, such as analytics in insurance is growing in an exponential, rather than linear fashion.

The verdict is unanimous - The survivors and winners over the next decade will be those who can innovate and integrate technology into their value offerings rapidly. It is not going to be insurTech Vs non-insurTech anymore.

Technology will drive transformation and evolution across the entire value chain, from underwriting inspection, assessing hidden risks, and policy pricing, to customer service management, claim settlement, and customer relationship management.

The insurance industry is increasingly adopting analytics to enhance its operations, from risk management and risk analytics in insurance to customer engagement.

A broad look at the insurance industry's present condition and significant shifts, including technological, regulatory, and economic factors driving disruption. These include digitalization, data analytics, cybersecurity, and the increasing reliance on big data, machine learning, predictive analytics, customer analytics, and fraud detection in insurance analytics.

A recent finding by DAMCO indicates that 86% of insurance firms are developing insurance data analytics systems for the best possible predictions of big data reports.

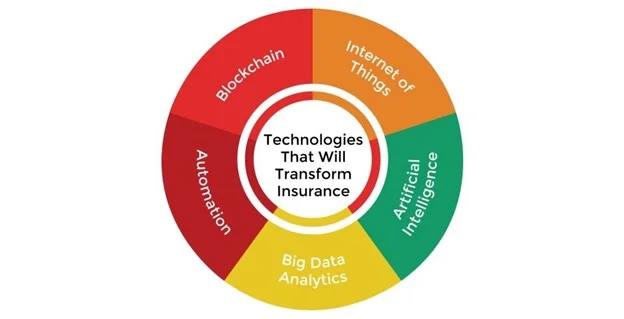

Here are some technologies that will change the Insurance Industry: -

Big Data Analytics: -

With big data analytics, insurance players are better able to assess risk by factoring in data that was not previously collected, such as data from smartwatches, telemetry, historical claims data, satellite imagery, etc.

If there's one thing the insurance industry depends on, it's data.

An enormous amount of information, including medical records and driving patterns, is used to determine premiums and payouts. To assess the risks associated with every strategy, actuaries currently examine as much information as they can. Age, location, and other personal information provided by a client while applying for insurance are all utilized to estimate the chance of a claim. The probability, or risk, that the insurance will pay-out, is used to calculate the premium.

Big data insurance makes it possible to automate these processes, allowing for greater complexity without raising costs.

Artificial Intelligence: -

AI will be a supportive technology, working along with blockchain and big data to provide a new and superior experience to the sales and customer service-centric industry like insurance Chatbots are big business now, with Microsoft, IBM and more dipping their toes into space.

An AI insurance agent could draw on a prospect’s physical location and social media information to personalize the experience, as well as their requested coverage and policy information. Here, public, and private cloud data warehouses and data lakes have emerged as a vital part of their strategy to lower the cost of processing claims and bring greater operations efficiency and business agility at lower prices.

Internet of Things: -

IoT is another technology that is disrupting insurance in a big way. Objects and people can now be monitored remotely, and data fed into applications of data analytics in insurance to proactively manage risk exposure and expand usage-based insurance policies as well as better price the policy with accurate risk assessment.

Vehicle Tracking – IoT is advantageous for auto insurance since it allows providers to receive precise information about a vehicle's mileage, location, and even driving style. It is possible to identify maintenance issues, notify the car's owner, and alter insurance coverage if the issue is not resolved.

Biometrics - One can monitor their health with pedometers, wearable heart rate sensors, and other advanced gadgets. The most extreme case of these gadgets is when they can alert the insured to a medical problem before sending them to the hospital. In its purest form, insurers may provide discounts on their premium to those customers who frequently exercise.

Automation: -

Insurance is only one of several industries adopting automation, which is altering workplaces across many industries. Client self-service, document management, and claim investigation are a few advantages insurance firms can avail and make processes more efficient, improving accuracy, and reducing costs.

Blockchain:-

Here are a few InsurTech trends paving the way through Blockchain. Fraud prevention, claim management, managing reinsurance contracts and facilitating secure and transparent data sharing between insurers, policyholders, and other parties in the insurance ecosystem.

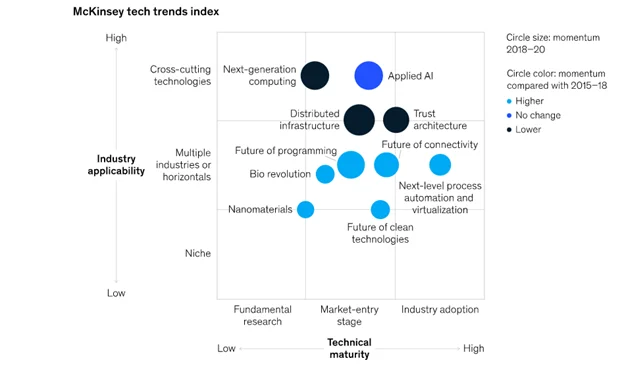

According to the Survey by McKinsey & Company, the top 5 trends in technology which are shaping the future of the insurance industry are: -

While insurance analytics and other transformations open exciting new possibilities, the accelerated pace of change threatens to give rise to unknown risks that organizations must learn to manage proactively.

As the writer, Stewart Brand famously said, “Once a new technology rolls over you, if you are not a part of the steamroller, you are part of the road".

Legacy insurance players know that what we are going to experience in the coming years is a significant change of guards, and digitization needs to become both tightly integrated into the product as well as into the end-to-end customer value chain.

Using data to calculate and assess risks enables better risk management, fraud detection and customized pricing, which can have a direct impact on the bottom line.

Technology, such as analytics, IoT, cloud computing and blockchain, can deliver insurance companies/ insurTech unprecedented scalability to reach out to new target segments.

Bots are replacing brokers in offices. Bots in the back office are actively gathering information, such as from drones, IoT, telematics, and social media data about prior insurers before payout. With so much data already being collected, bots can deliver massive benefits by quickly settling claims at the tap of a button.

However, for data to be effective, it needs to be integrated from a range of sources and across various users within a platform ecosystem. This implies InsurTech companies need to be able to manage the operational aspects, such as harmonizing processes and integrating systems.

As an example, crop insurance firms are utilizing drones to gather farm data that is inaccessible and difficult to monitor by human agents. They are also creating customized AI solutions to address crop insurance and credit issues. The introduction of cognitive credit farm scoring applications has enabled automatic and precise calculation of farmers' potential yield and creditworthiness evaluation.

Value-added insurance products are becoming more and more popular among insurers since they help drive more customer centricity and encourage more frequent touchpoints with customers.

For example

Risk prevention services and technologies are being served by InsurTech companies as a bundled offer for lower premiums.

In the area of Life and Health insurance, health management apps are designed to help people live with a disease or health condition, adhere to medication, or take up a healthier lifestyle.

In Non-Life insurance as well, services such as roadside assistance, travel agency services, or home monitoring via smart home sensors by leveraging the 'Internet of Things technology are valuable add-ons.

These packages are typically offered as an add-on to traditional car, travel, or home insurance products, but are at times provided to non-customers as well. Customers are willing to procure these value-add services as well as share more data with their insurers to avail lower premiums. Such remote data monitoring and value-added services will encourage healthier habits and lifestyles among the customers, such as safer driving, more exercise, etc.

Social media can be integrated with the customer portal to offer ease of use, as well as collect important customer data points.

For example, Kroodle, a Dutch insurance company, has enabled its customers to interact with and login directly with their Facebook credentials, and request for services, providing seamless customer connectivity.

InsurTech firms may use social media data to detect fraudulent activities by comparing the social media behavior of policyholders with their claims history. However, this application of social media data raises concerns about data privacy and security which insurers should take care of.

24*7 chatbots are helping people who use the app have engaging and hassle-free experiences with InsurTech companies.

It is estimated that by 2025, 95% of all customer-facing interactions across industries will be done with the help of chatbots.

Legacy insurance companies are also rapidly innovating, to expand beyond their core offerings, and addressing the rapid explosion in consumer needs, demands and digitalization by devising innovative products and delivering superior customer experience.

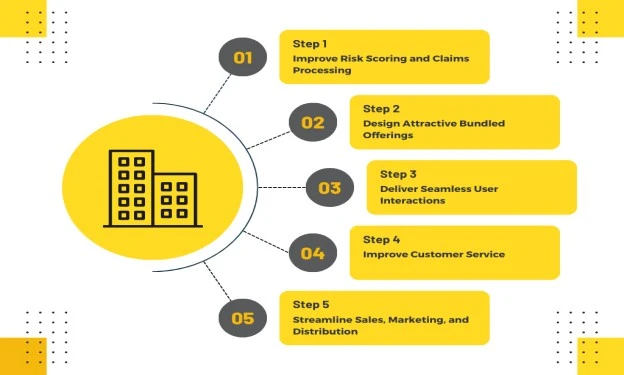

Instant and quick claims disbursal processed aided by AI, transforms the customer experience and lowers the operational costs. Disruptive InsurTech players, such as Lemonade, are using automation, chatbots, and data analytics for insurance to process vast amounts of customer historical data for effectively handle underwriting inspections, aid the customer service representatives in settling claims in a matter of minutes, and help them to be well aligned with their consumers.

Across the board, the ability to capture and analyse data will remain a top priority for insurTech companies because it is the backbone of customer segmentation and identifying cross-sell and up-sell opportunities.

Data Science in insurance industry is helping capture diverse customer data points, companies can also identify reasons for attrition, analyse campaign effectiveness and devise effective and targeted marketing strategies.

Insurance analytics will continue to transform the business context, processes, and the entire insurance product portfolio. Insurance Companies will have to become more forward-thinking and future-focused by investing in cutting-edge technology and applications.

Such an approach will help define a successful strategy and align offerings, processes, and capabilities with the expectations and needs of the target customers along their end-to-end journey. It will require the companies to shift away from a traditional, product-focused set-up to deliver superior customer-centricity.

The current market environment is pushing the players in the insurance sector to rethink their strategies and operations and develop effective use cases of insurance analytics to improve their business value and forge a loyal customer base.

Insurers of the future will require the six key capabilities, albeit in varying degrees: data, customer centricity, technology, innovation, talent, partnership, and ecosystems management. Whatever the chosen strategy, insurers will have to make all their processes digital-enabled and data analytics in insurance will become a critical part of the toolkit.

As of tomorrow, insurance will be digital, or it will not exist. While insurance companies lag most other service industries including banking, insurers that wish to thrive in the future must improve and ramp up their processes quickly using cutting-edge analytics in insurance.

Companies must adapt fast and learn how to use data analytics for insurance along with, cloud, AI, and blockchain as enablers to pivot effectively to a more streamlined response to the changing market conditions.

Companies that fail to understand it and take effective measures risk getting left behind and this applies even to large legacy players who will be labeled anachronistic if they don't move fast enough. Change management is going to be very crucial. Companies need to be aware that developing the capability and recognizing the value from it will take time - Progress will Necessarily Precede True Success.

At Polestar Analytics, we help insurance companies derive success on top of their data from the stage of data capture and management, cataloging, profiling, and automating pipelines, to the stage of deriving insights

About Author

Marketing Consultant

Data Alchemy can give decision making the golden touch.