Sign up to receive latest insights & updates in technology, AI & data analytics, data science, & innovations from Polestar Analytics.

“Digitally interconnected operations represent the most comprehensive, agile, innovative, creative and emotionally connected way of conducting business.”

The words of Dr. Henna Karna, Managing Director, and Chief Data Officer, XL Catlin when asked about how the insurance industry will look in the future.

There are two issues with being fully interconnected in the insurance industry. Primarily, Acceptance of technology for increasing the ease of business, like using GIS technology to check the authenticity of claims, or having an Enterprise Performance Management in place to ensure the flow between divisions.

Secondly, leveraging the data generated which has been traditionally low in this sector with the increasing regulation and uncertain times. But, with consumers going increasingly digital and are comparing products and prices online, the decision-making parameters are changing. But with this behavior, there are new data touchpoints that are being created and the opportunity to leverage this is huge.

With all the changes coming into place, the market leader would ultimately be the one who would be able to provide the best customer experience for which leveraging the data is of primary importance.

Though the data adaptation in the insurance industry is quite low traditionally, there has been a lot of traction in recent times, for starters you can read the previous article about analytics use cases for insurance companies. So, in the journey of being a data-driven insurance company, firms must rethink their approach to current data usage and start building upon the various data assets to create maximum value.

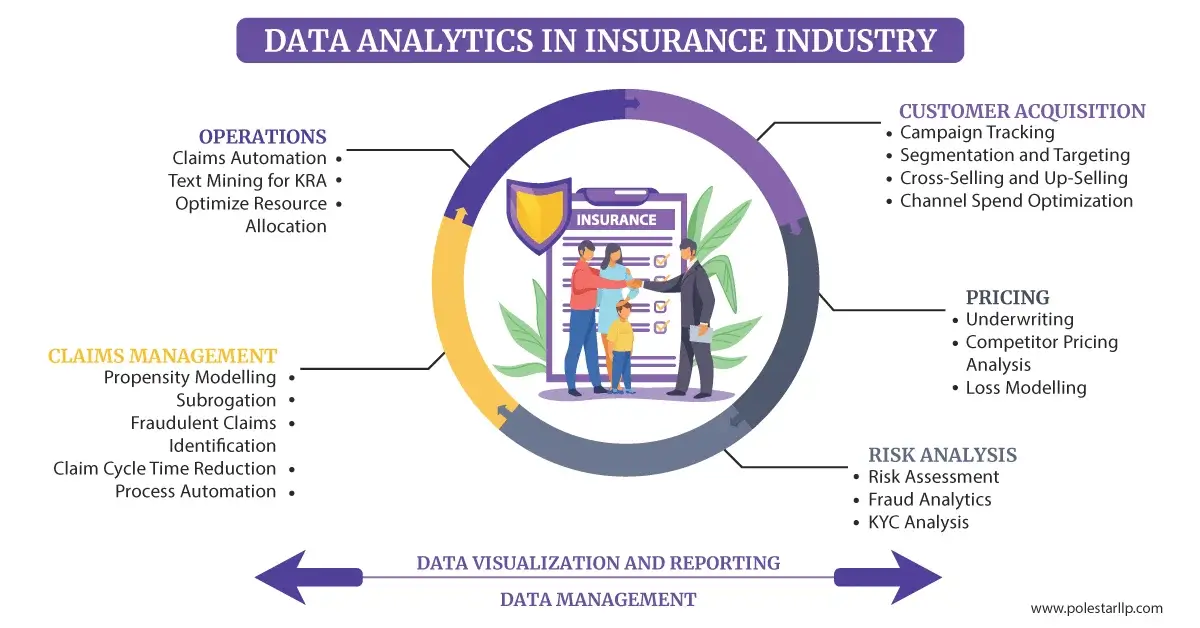

In this process of digital transformation, it is extremely important to know the possible opportunities to leverage to develop go-to-market strategies depending on your requirements and current situation. Data Analytics would help solve various problems that arise at various stages of the life cycle of an insurance consumer, right from the acquisition to post-sales.

Understanding the first point of interaction is of high essence as the data and their medium (website, email, referral, social media, agent, etc.) can provide a lot of information. According to a recent report by Bain, insurance buyers are also signing up for services beyond the core insurance policies, which can be analyzed only using the data. A few areas where data analytics can be used in Customer Acquisition are:

Business Intelligence tools can be used for understanding the pain points of demographics and various customer segments that can help analyze the marketing budgets and spending for the future.

We no longer live in a world where one-size-fits-all is used. By identifying the right customer segmentation, we can ensure high conversion rates by ensuring that the customer is being targeted for the right insurance policy. Also, we can stay updated with the competitor pricing and also we can determine the insurance premiums with Loss modelling and automated underwriting to ensure profitability. With predictive analytics, the method of manual scoring and basic statistical analysis can be shifted to make data-based predictions automatically, which can reduce the manual interventions and improve the quality while keeping the risk in check.

Predictive analytics with the help of quality data of the clients can help them to classify all the policyholders into high or low risk and help assess the possible risk of the consumers and help the company mitigate and plan future activities like Expense allocation, premiums to be charged and fraud analytics accordingly. Also with techniques like What-if analysis and scenario-based simulations can also help understand the risk in other scenarios and help the firms be prepared for the same.

Managing the claims raised is a vital touchpoint for the insurance industry. In this area, there is the need to settle the claims as well as stay aware of possible fraudulent claims. Analytics can help in:

Also, possible litigations can be identified to have early intervention and reduce the costs to the company, and have techniques like text mining to go through huge amounts of data.

This is one of the key support activities to ensure a good customer experience throughout the insurance buyers' life cycle. Some of the areas that can be improved through digitization are

Additionally, analyzing the available data from the call trends can help in people management for the optimization of resource allocation and also identify the KRA or the areas of improvement.

This is one of the key areas both for the purpose of regulation which demands agile data management with stringent data quality requirements and the privacy and safety of customer data, which the increasingly digitally aware consumers are seeking in this present scenario. Also, without proper data management techniques, the extraction and transformation of data would take a longer duration and cause more costs to the company. Having a good data management plan with cloud services can help ensure low cycle time for both the customers and the firms and the insurance providers

Data Management and Visualization would play a part across all the functions to give a better understanding of the financial health to the metrics that one wants to measure, moving away from the spreadsheets to dashboards will also help in understanding the key focus areas.

Leverage your data to the maximum by understanding your data needs and employing personalized solutions as per your requirements.

we can see that data analytics is changing every phase of the consumer life cycle in insurance, right from core activities like Underwriting, Subrogation, etc. to the support activities like Process Automation or Expense Optimization.

Data Analytics can help in calculating estimates of losses more accurately and understanding customer behavior and claims outcomes, which ultimately results in efficiency gains. Analytics will provide the expertise to have a 360 degree of all the processes and have a futuristic outlook on them with a data-driven approach.

Also, we at Polestar Analytics, help insurance companies with their data management, cataloging, insight generation, and reporting. Go through our expertise or just let us give you a call by filling in the details.

About Author

Data & BI Addict

When you theorize before data - Insensibly one begins to twist facts to suit theories, instead of theories to suit facts.