Sign up to receive latest insights & updates in technology, AI & data analytics, data science, & innovations from Polestar Analytics.

Editor's Note: In this insightful article, we delve into the world of ESG and its profound impact on the finance and BFSI sectors. Explore how ESG is driving positive change and creating value for businesses while addressing environmental and social concerns. From sustainable investing strategies to the integration of ESG principles into core operations, discover the transformative power of ESG and its significance in shaping the future of finance and BFSI industries.

As the title suggests, ESG is not just about ticking boxes, it is about creating a positive change – for businesses and the world. It entails lasting results that drive value and growth, while simultaneously improving our environment and societies.

You may have come across the term in various companies' annual reports, but have you ever wondered about the significance of ESG for businesses and its diverse functions?

ESG holds great importance in today's business world, driving a fundamental change in how companies operate and interact with stakeholders & gain competitive advantage. It emphasizes sustainable development, ethical governance, and purposeful strategies that balance economic success with environmental and social well-being.

According to a PwC report, ESG sustainable investing is expected to skyrocket by 84% to reach US$33.9 trillion by 2026, constituting 21.5% of total assets under management.

EY Report also highlights 82% of US chief executives view ESG as a significant factor that will drive value for their businesses in the coming years.

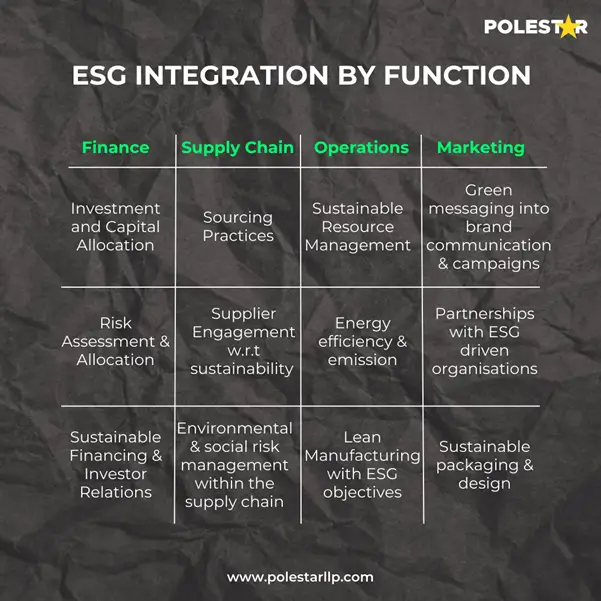

When it comes to its significance across diverse functions, it is considered highly relevant and influential. It can be integrated into different areas of a business, including finance, supply chain, operations, and marketing. Here are several examples showcasing how ESG can be incorporated into these specific functions. If you want to know more in detail about ESG & its importance, you can read more about it here.

In this article, we’ll delve into: -

1. Finance function specifically as it plays a crucial role in transforming businesses, as it involves investment decisions, risk assessment, financial reporting, and engaging with stakeholders; making it a pivotal junction in the journey of sustainability.

2. How Banks & Financial Institutions are modelling their ways to ESG. In response to the growing importance of sustainability and responsible practices, financial institutions are recognizing the need to integrate them into their core operations. They are also adopting sustainable investing options, such as green bonds or sustainability-linked loans, to channel funds toward projects with positive environmental or social outcomes.

Finance plays a crucial role in the functioning of businesses, and when connected with sustainability, it becomes even more significant. The aspect of ESG finance emphasizes the integration of environmental, social, and governance considerations into financial decision-making processes.

Here are some studies highlighting the impact of ESG in finance: -

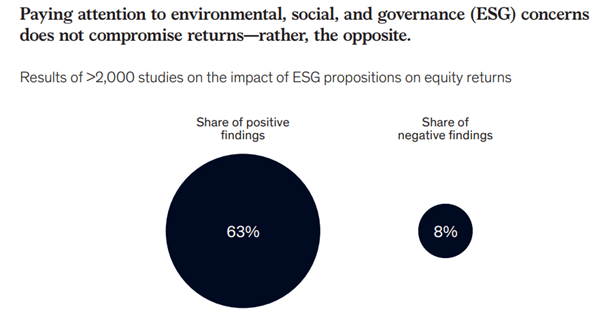

Extensive research by McKinsey consistently demonstrates that the companies which prioritize environmental, social, and governance (ESG) considerations do not face hindered value creation. On the contrary, they often experience positive outcomes (as shown in Exhibit 1).

A strong ESG proposition is associated with higher equity returns, both in terms of sustained growth and market momentum. Companies that excel demonstrate a decrease in downside risk, as evidenced by lower loan and credit default swap spreads and higher credit ratings. These findings highlight the tangible benefits of integrating green factors into business strategies, as it not only enhances financial performance but also mitigates potential risks in the long run.

Exhibit 1

While the argument for a strong ESG proposition grows more convincing, there remains a need for a comprehensive understanding of the underlying reasons that connect these criteria to value creation. How exactly does a strong ESG proposition make financial sense?

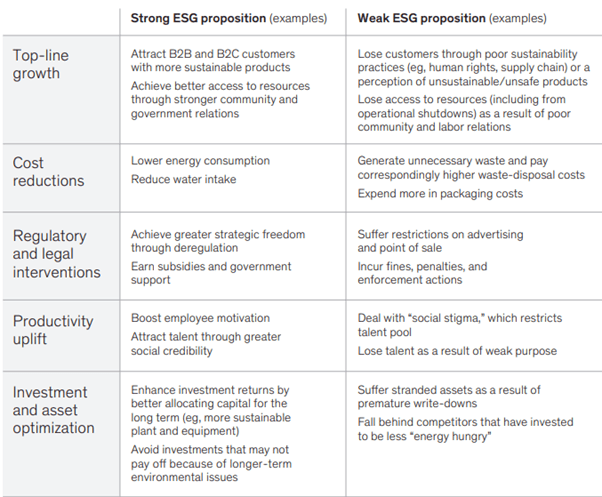

Drawing on experience and research, McKinsey identified five key ways in which ESG directly influences cash flow: (as depicted in Exhibit 2).

Exhibit-2

Leaders should consider each of these five levers when exploring environment-friendly opportunities and should also recognize the importance of the more nuanced, interpersonal dynamics required for these levers to yield significant results. By comprehending and leveraging these factors, organizations can unlock the full potential of their green initiatives, ensuring sustainable financial benefits and long-term value creation.

We’ve talked much about the significance of ESG, its integration across various functions, and its impact on financial performance. Now, let's shift our focus to the BFSI sector.

Discover the Evolution of ESG Analytics and delve into the transformative power of the 3 pillars shaping the business landscape.

At an initial glance, it may appear that finance and climate change are unrelated. However, major fintech companies demonstrate otherwise, as evidenced by the abundance of information in fintech news regarding innovative environmental-friendly alternatives aimed at addressing environmental challenges.

It comes as no surprise that global organizations, including the United Nations, emphasize the significance of safeguarding the planet against degradation. Consequently, embracing sustainability has emerged as a top priority for numerous fintech firms today. So, how exactly do green finance companies contribute to making the planet cleaner and safer to live in?

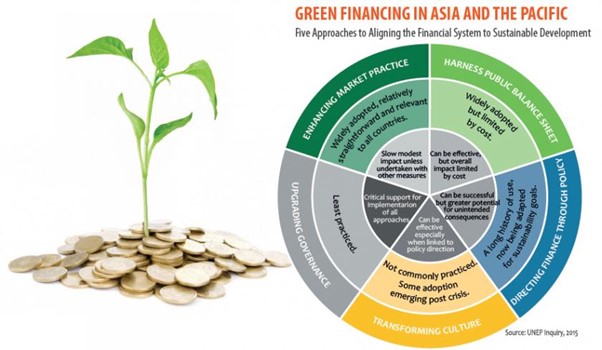

Simply put, green finance refers to loans or investments that support environmentally beneficial activities, such as the acquisition of eco-friendly products and services or the development of sustainable infrastructure. With the increasing recognition of the risks associated with environmentally harmful practices, green finance is gaining widespread acceptance and adoption.

It represents a growing trend in the financial industry, aligning capital with projects and initiatives that have positive environmental impacts.

Green finance helps businesses access environmental-friendly products and services, making it easier for everyone to contribute to a low-carbon society. This has a positive impact on both the economy and the environment, creating a win-win situation as it promotes inclusive growth by ensuring that sustainable practices are available to all, benefiting society as a whole.

Green finance has a growing momentum in the Indian economy recognized as a crucial tool in driving the transition towards achieving net zero emissions.

However, we are still at the early stage of the sustainability journey. Nonetheless, there is a growing realization across the board that achieving the goal of transitioning to a "net zero" state will require substantial investments.

In India, companies are exploring different financing options to support the advancement of capital-intensive technologies like hydrogen and carbon capture, and green finance is gaining momentum. The renewable energy sector in India alone requires an annual Foreign Direct Investment (FDI) of INR 15,000 to INR 20,000 crores, as indicated in the Ministry of New and Renewable Energy's report on financial constraints.

To address this, the government has permitted 100% annual FDI for renewable power generation and distribution projects. Invest India, the government's investment agency reports that ongoing renewable energy projects worth US$196.98 billion are currently in progress.

These developments highlight the increasing importance of sustainable financing and the opportunities it presents for businesses and governments alike.

To meet the rising demand for sustainable practices and in line with the government's commitment to sustainable development, the Reserve Bank of India (RBI) has introduced guidelines for banks and non-bank financial companies (NBFCs). These guidelines encourage the acceptance of "green finance," with the aim to direct funds towards initiatives that promote energy efficiency, clean transportation, climate change adaptation, sustainable water, and waste management, green buildings, and the conservation of terrestrial and aquatic biodiversity.

By channeling funds into these areas, the RBI seeks to ensure that financial resources are utilized in ways that contribute to environmental sustainability and support the country's overall sustainable development goals.

ESG-related opportunities and risks are increasingly important for financial institutions. The significance of its considerations extends beyond environmental concerns, as sustainable practices are associated with improved economic performance. BFSI companies is now not only focused on their green impact but also on the ESG risks and opportunities they face as lenders.

Moreover, the continuous introduction of new regulations adds to the challenges the companies face in terms of compliance and keeping up with emerging trends in the industry.

Let’s see how Banks and Insurance companies can play a critical role in promoting sustainable finance through the integration of environmental, social, and governance factors.

The Banking industry is at a crucial stage where they need to balance delivering a seamless digital experience with demonstrating their commitment to sustainability on a global level. It's not just about their technological innovations anymore; banks are now evaluated based on how well they integrate environmentally and socially responsible practices.

As banks navigate this complex landscape, ESG has become an integral part of their business operations. The question arises: what exactly is ESG in banking? How can banks ensure compliance with the requirements and regulations that can have a significant impact on their institutions?

For banks to enhance their sustainability performance and attract clients and investors, understanding the significance of “ESG banking” is essential. With its ratings as a benchmark, banks must invest in their infrastructure and processes to align with sustainability requirements, demonstrating their commitment to industry standards and gaining the trust of potential clients.

Banks can initiate the process by creating a roadmap for their data and technology that strikes a balance between immediate, practical solutions and a broader, long-term vision. During this undertaking, banks should consider the following elements and stages.

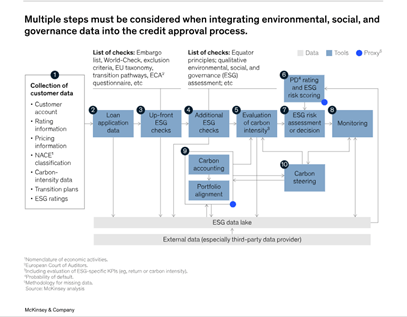

Leaders can identify and prioritize specific sustainable applications, establish well-defined milestones, and gather measurable data to monitor progress in intermediate stages. For instance, they can consider the seamless integration of ESG data into every stage of the credit approval process, including customer data collection, risk assessment, credit monitoring, and reporting.

In June 2021, renowned investment bank JPMorgan disclosed its purchase of Open Invest, a specialized advisory firm focusing on value-based ESG investing.

The insurance industry's core strength is in assessing and managing risks related to life, health, property, and liability, including ESG risks. Particularly in the field of climate change, insurance companies as key underwriters and investors can take the lead in helping other industries comprehend and address sustainability factors, given their expertise in understanding climate risks. Many insurers have already taken steps to align their underwriting and investment practices with ESG principles.

According to PWC Report, 36% of global insurers believe customers are their top priority when they are defining their ESG strategy, followed by regulators (26%) & shareholders (16%).

Also, 56% of insurance companies aspire to cultivate leading capabilities related to the environment in the future. However, at present, only 24% claim to possess mature or leading capabilities in this domain.

Insurance companies, being the second most significant category of asset owners after pension funds, are anticipated to have a crucial role in facilitating the shift toward a more sustainable economy. They can contribute to this transition not only by implementing responsible practices in their operations and investment strategies but also by encouraging other companies and individuals to prioritize environmental, social, and governance (ESG) considerations through their underwriting processes. The extent to which insurance clients have embraced ESG principles varies due to diverse regulatory frameworks across jurisdictions.

However, ESG poses significant challenges for insurers. They not only need to assist others in managing related risks but also grapple with understanding the diverse impacts of ESG on their operations.

Thankfully, numerous insurers are actively engaging in global ESG initiatives and emphasizing their significance. They regularly collaborate with various stakeholders to determine effective ways to meet ESG requirements and comprehend their implications. Moving forward, it is crucial for insurers to consistently demonstrate their actions and how they benefit their stakeholders to become genuine leaders rather than mere participants among many.

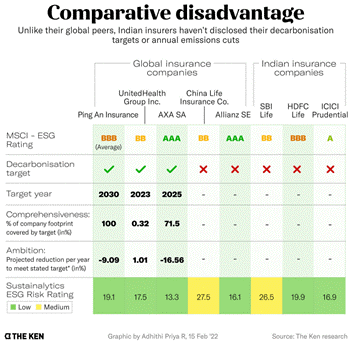

In India, there’s ample room for development and advancement in this domain, particularly when compared to global benchmarks. To illustrate, consider the image below, which highlights the potential for growth in the Insurance Industry:

The image demonstrates that the leading global insurers have significantly higher ratings compared to listed Indian insurers, who currently exhibit a moderate-to-low ESG risk rating. However, the Indian insurers have not yet disclosed their decarbonization targets or provided specific information on their annual plans for reducing their carbon footprint.

In a recent report concerning the world's 25 largest companies, responsible for 5% of global greenhouse gas emissions, it was highlighted that their public commitments often lack clarity, and their emission reduction efforts are limited. Even sustainability-focused brands like IKEA and Unilever received a thumbs down.

However, companies have the opportunity to initiate their ESG revolution through improved strategic planning. For example, let’s talk about one of the biggest Insurance firms in India - LIC.

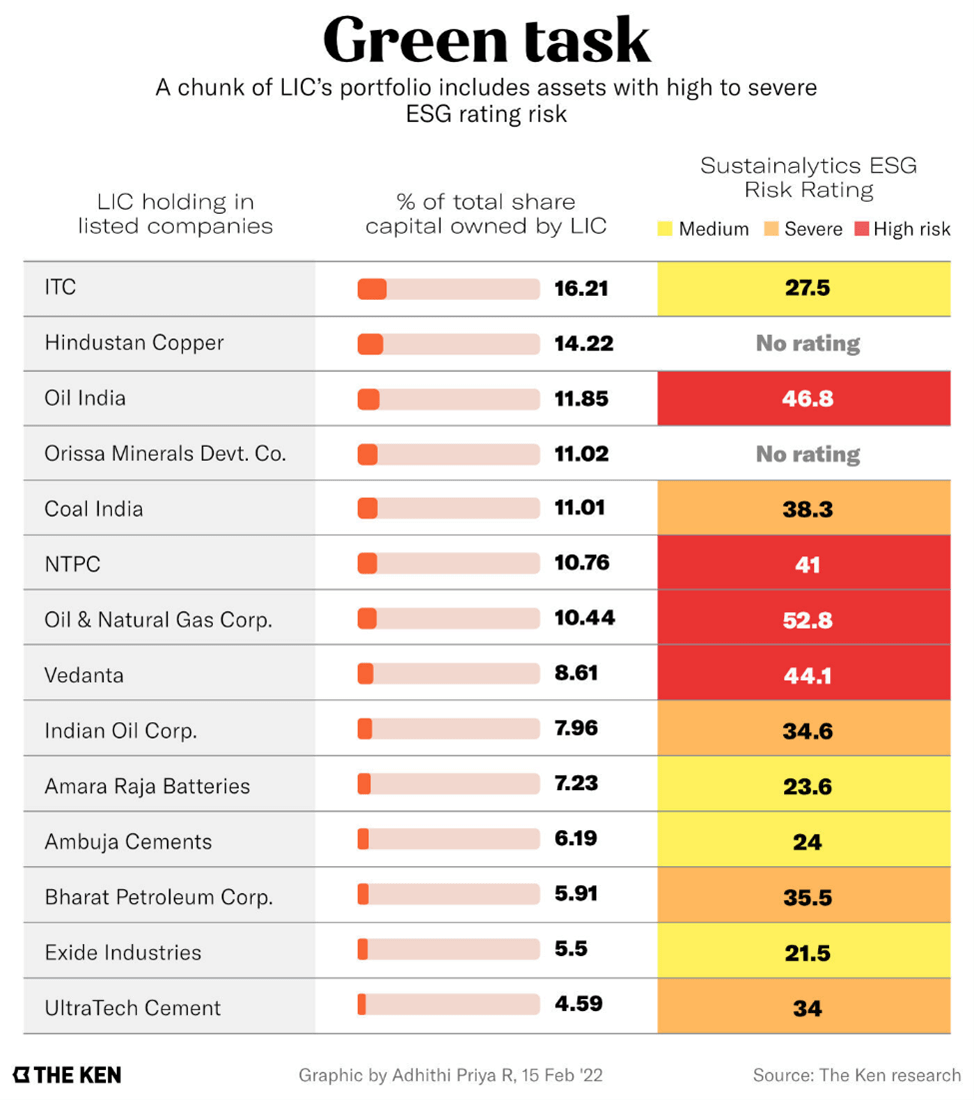

Presently, LIC has significant exposure to carbon-intensive companies, with holdings exceeding 1% in 281 firms. Some of its largest shareholdings are in companies with high-to-severe ESG risk ratings, highlighting the need for careful examination of these investments.

However, this presents an opportunity for LIC to not only improve its own ESG rating but also encourage its investee companies to enhance their sustainable practices. Transparency and data sharing through open-source frameworks can be a starting point in the complex realm of ESG ratings. LIC could also commit to absolute emissions reductions instead of relying on less concrete metrics like emissions intensity. Moreover, instead of divesting polluting businesses to private buyers, LIC can opt for cleaning up these ventures, eliminating arbitrage in the system.

To conclude, by integrating environmental, social, and governance factors into financial decision-making, sustainable finance can help to reduce climate change and other ESG risks, improve economic performance, increase transparency and accountability, and build a more sustainable financial system.

By implementing a robust data-driven approach focused on sustainability, businesses can effectively achieve their environmental, social, and governance (ESG) objectives, thereby satisfying the expectations of customers, employees, and investors.

Polestar Analytics offer valuable assistance to organizations in this regard. Now is an opportune moment for industry leaders to explore the potential of ESG data analytics as a central component of their enterprise. Take the initiative and book a session today!

About Author

Marketing Consultant

Data Alchemy can give decision making the golden touch.