Sign up to receive latest insights & updates in technology, AI & data analytics, data science, & innovations from Polestar Analytics.

Editors Note- As interest in ESG investing and the importance of ESG analytics services continues to grow, the ability to effectively analyze and leverage ESG data has become a crucial skill for investors. This blog provides a valuable resource for those seeking to stay on the cutting edge of ESG investing.

Raging hurricanes, devastating floods, sea-level rise, heat waves, and other extreme weather conditions are now attributed to climate change. After years of growing awareness, environmental, social, and governance (ESG) factors have transformed from an emerging interest to an urgent need.

By now, most professionals know that the future of business goes hand in hand with social responsibility, environmental stewardship, and corporate ethics. Sustainability and Environmental, Social, and Governance (ESG) have become top priorities for consumers, investors, and regulators.

But creating a better future for all stakeholders requires organizations to re-think what they make, how they operate, and where to make strategic bets for the future. Data analytics and technology are increasingly important in driving innovation and transforming how organizations operate in a responsible and sustainable fashion.

To showcase some of the amazing ways data analytics drives ESG initiatives, let's dive in.

"According to a report, the market for ESG data could exceed $1.3 billion this year and reach $5 billion by 2025. Around 70% of the ESG data market comprises research and analytics, including ESG ratings, raw data, and other dedicated solutions."

Businesses in the current scenario are adapting to a changing world where the accomplishment of an organization is no longer solely determined by its financial outcomes. Increasing importance is given to non-financial metrics, which is where ESG comes into play. ESG refers to a means by which organizations can integrate sustainability into their business strategy to curate long-term value and identify potential risks to the business.

ESG comprises a set of factors utilized to measure the non-financial impacts on the broader stakeholders: customers, employees, regulators, investors, partners, and society.

The business landscape has transformed significantly in recent years, with more and more importance given to how companies carry out their business. It is becoming increasingly apparent that stakeholders prefer associating with an organization that carries out business responsibly.

ESG analytics is a framework for evaluating companies' environmental, social, and governance (ESG) practices. ESG has become increasingly important for organizations as investors, customers, and regulators expect companies to consider ESG factors in their decision-making processes.

| “85% of investors considered ESG factors in their investments in 2022 to build a robust framework to integrate ESG standards within the company.” |

This approach is gradually changing to focus more on optimization and efficiency. The net-zero ambition is a typical example of companies adopting ESG into their business goals across various sectors. Several factors have driven this change in perspective:

Changing expectations: Both employees and customers are becoming increasingly aware of sustainability-related issues and have made it clear that they expect organizations to meet ESG commitments and conduct business responsibly. The proof or validity of this expectation is fulfilled through various reports for which qualitative and quantitative data play a vital role.

Regulatory action: In keeping with global efforts to address issues like climate change and sustainability, there is increased scrutiny from regulators and heightened ESG disclosure requirements. Organizations spend much time in analytics and reconciliations for various reporting requirements. This can be avoided by having the proper governance controls to support the data's overall value.

Need for innovation: According to the recent directives given by governments of various countries and regulatory bodies, many organizations have declared their target of reaching net zero by 2030. This calls for innovation in the current business processes as things need to be done differently to reduce emissions and achieve this target. Any innovation needs a data-driven assessment of the current state and progress monitoring.

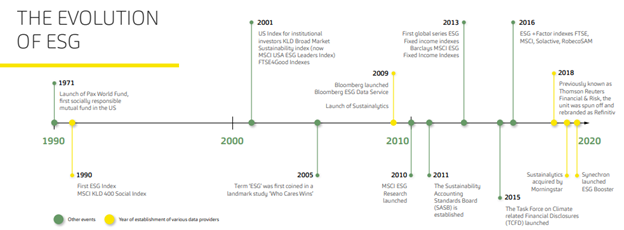

Growing Demand for ESG Data: As ESG becomes a more critical consideration for investors, there is a growing demand for high-quality, reliable ESG data. In response, numerous ESG data providers have emerged, and established providers are expanding their offerings. For example, MSCI launched its Climate Value-at-Risk (VaR) tool in February 2021, which helps investors assess the potential impact of climate change on their portfolios.

Explore how Environmental, Social, and Governance (ESG) factors are driving transformative shifts in the finance and BFSI sectors.

ESG (Environmental, Social, and Governance) data analytics can provide several benefits that help organizations, and here are a few of them:

1. A Better understanding of environmental impact: ESG data analytics can provide organizations with a comprehensive experience of their ecological impact. By analyzing data related to carbon emissions, water usage, waste generation, and other environmental factors, organizations can identify areas where they can reduce their impact and improve their sustainability practices.

2.Identification of risks and opportunities: It can help organizations identify risks and opportunities related to sustainability. By analyzing data related to environmental and social risks, organizations can develop strategies to mitigate these risks and take advantage of opportunities that arise from sustainability trends.

3.Improved decision-making: ESG data analytics can help organizations make better decisions related to sustainability. By analyzing data related to sustainability performance, organizations can develop more effective sustainability strategies and make more informed decisions about investments, partnerships, and other initiatives.

4.Enhanced transparency and reporting: It can improve transparency and reporting of sustainability performance. By collecting and analyzing data related to sustainability, organizations can provide more accurate and detailed sustainability reports, which can help build trust with stakeholders and improve reputation.

5.Increased stakeholder engagement: ESG data analytics can help organizations engage stakeholders more effectively. By collecting and analyzing stakeholder feedback and engagement data, organizations can develop more targeted sustainability initiatives and communicate more effectively with stakeholders about their sustainability efforts. This can help build stronger stakeholder relationships and increase support for sustainability initiatives.

6.Access to new markets: It can assist organizations in accessing new markets by demonstrating their commitment to sustainability. Consumers and investors increasingly prioritize sustainability, and organizations that can show their sustainability performance may have a competitive advantage in these markets.

7.Regulatory compliance: It can help organizations comply with environmental regulations. By collecting and analyzing data related to environmental performance, organizations can ensure they meet regulatory requirements and avoid potential fines or legal issues.

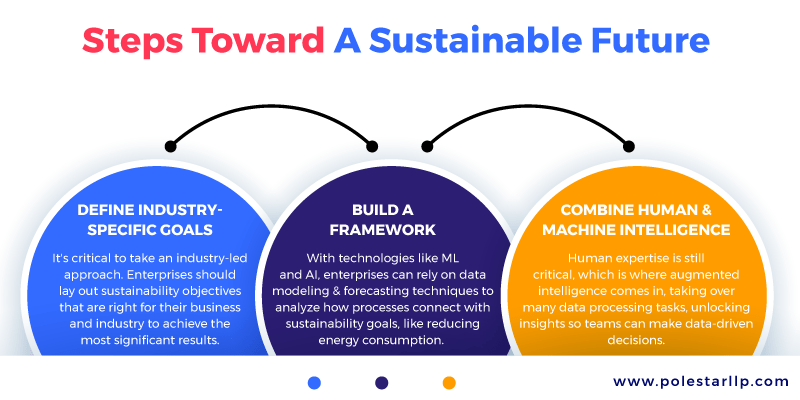

When using data for action and social impact, there are three main steps to take:

Henceforth, data analytics and technology initiatives related to ESG are the latest disruptors in the market. Critical success factors in defining and executing an efficient ESG strategy are the availability of relevant information across the enterprise at the right place, time, and in an accurate format.

With a comprehensive sustainable data-driven strategy, enterprises can meet sustainability goals to satisfy customers, employees, and investors. Polestar Analytics can help your organization with that. There was never a better time for leaders across industries to explore what's possible with ESG data analytics at the heart of the enterprise. Book a Session today!

About Author

Content Architect

The goal is to turn data into information, and information into insights.