Sign up to receive latest insights & updates in technology, AI & data analytics, data science, & innovations from Polestar Analytics.

Forecasting – a term that is crucial to every business, no matter how big or small it is. The role of forecasting is so crucial that it can either help the company achieve new heights or be the reason for the company's collapse. Though it seems simple enough, forecasting is not as simple as it seems. Business owners who deal with forecasting know the challenges that it possesses. The generic idea behind forecasting is using the annual budgets that have been provided for what lies ahead.

Traditional budgeting or forecasting works when you are the sole owner of your business and when everything is a little more stable. However, times today are more competitive edge and uncertain. This uncertainty has led to the fact that it has become more critical to plan and budget an ongoing approach. In addition, this kind of budgeting in itself is a very long and time-consuming process. Business owners are no longer running the business alone. Neither do business owners want to spend time budgeting and instead prefer acquiring more clients for the business.

In addition to this, the other problem that people face with traditional budgeting is that it limits the organization's growth. For example, looking at the current scenario where the industries like medical sectors are mainly seeing a boom, if businesses in these sectors decide to go with traditional budgeting, they might be looking at some massive losses and even seeing competitors getting ahead. A rolling forecast could be a very viable solution in this scenario.

The conditions and the uncertainty in times are leading to or even demanding a change as far as the entire process of forecasting is concerned. Rolling forecasting is a shift that is now being seen as far as forecasting goes.

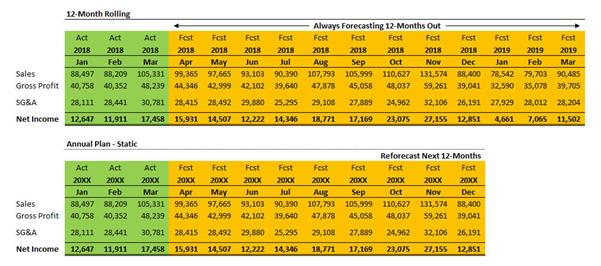

The most significant difference between traditional budgeting and rolling forecast is the process that flows for each. Traditional forecasting requires first calculating the annual budget, which requires time and all of the research so that the upcoming year is planned. Additionally, once the upcoming year has been planned, the rest of the year you are spending counting down to the next year or the next annual budget.

On the other hand, when a rolling forecast is implemented, it is an ongoing process like the living body. The time spent on the planning of the annual budget is no longer required. Instead, this time and even the energy can be used towards more creative tasks like marketing and acquiring more sales for the company or organization. Hence, you are continuously looking ahead and rarely looking back, except maybe understanding past market trends. And, thus, continuously tweaking the budgets as and when the predictions or the scene changes.

So, it can be stated that Rolling forecasting firstly uses historical data to make predictions for the future. These predictions could include sales or even the budgets. However, other than this, the beauty of Rolling forecasting is that it can be updated at predefined periods or even after a month, depending on the dynamicity of your business or the situation.

Our Rolling Forecast solution helps organizations identify new risks and opportunities to provide a consistent, accurate, and forward-looking business outlook.

Other than making the entire forecasting process more dynamic, there are a lot of other benefits that rolling forecasting provides –

Accuracy- So what do we mean by accuracy? The current times are more challenging and require a more dynamic approach. When you use traditional budgeting, the budgeting process is completed, and the budget or the data is no longer valid. Imagine, in a world where the market changes, you are talking about using data that is almost a year old in the blink of an eye.

On the other hand, a rolling forecast offers the flexibility to tweak the budgets and resources as required or as per pre-decided intervals. This way, even if mistakes have been made, a rolling forecast allows you to overcome any mistakes, if any, made; rather than waiting for the next fiscal year to make the changes.

Agility- The entire way of handling rolling forecast makes it more agile when adapting to the trends and changes in the market. Time-sensitive decisions are the crux of the matter and the growth of the business at the end of the day. When you are constantly looking forward, your outlook is continuously getting updated, which, in turn, impacts the decisions the planning, and the forecasting. Additionally, you are looking at more data and hence more accurate decision-making skills.

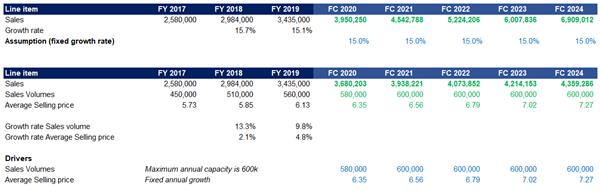

Driver-based- Adding agility and accuracy means that you are also using the current market trends along with previous data to understand the trends. Combining these two sources of data ensures better forecasting and, in turn, better turnover/growth for the company or the organization. Further, ensuring that any irregularities or discrepancies arising are taken care of in an effective manner. It is crucial to include additional metrics like category growth, market share, human capital, and customer satisfaction for effective rolling forecasting.

Like every technology, has its pros and cons. And the biggest challenge is “change”. Change from the age-old methods of traditional budgeting and forecasting to the more dynamic approach of rolling forecast. To add comes the hurdle of change, where there are iconic organizations sticking to traditional forecasting and seeing massive growths. However, that doesn't work for every organization.

Then comes the task of automation and training. When you are looking at something that needs dynamic changes, you need to automate the processes so that there is no time invested in preparing the same reports repeatedly. You also need to work with finance and find the best way to accommodate the constant changes in forecasting.

Too many executives still feel that building an annual plan is enough for business planning. When compared to static annual financial planning, rolling forecasting delivers improved forecast accuracy, less budget preparation time, and more profitability. In 2020, almost 30% of finance officials polled by the Association for Finance Professionals (AFP) said they expected to convert to rolling forecasts.

Hence, implementing a rolling forecast can be made easy through some of the best practices mentioned below –No more spreadsheets

Applications such as MS Excel were used in early versions of rolling forecast modeling, but the challenges of the analysis and the amount of data captured, generated, and managed by organizations operating in the era of digital transformation make this very time-taking and impractical. Implementing a solution that involves advanced data management tools, including analytics and process automation, terminates the requirement to manage disparate spreadsheets or cobble together siloed data sources. Completely integrated with your current software environment and bringing all the data sources into a single system, such a solution assists in ensuring accurate, clean, and complete data that produces exact forecasts of all types and actionable insights that you can utilize for more strategic decision-making.

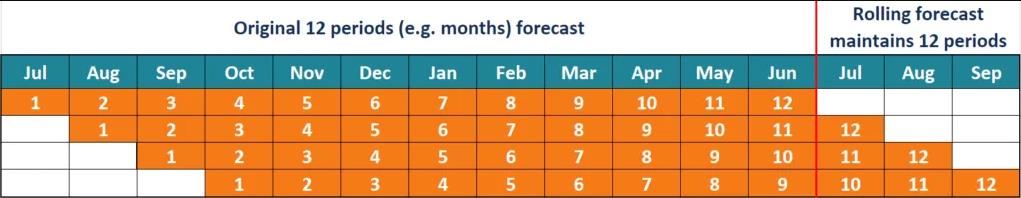

Determine the forecast time-frame

An organization must keep the time frame of rolling forecasts in mind to assist in planning. This includes deciding on how far into the future the forecast turns up. The organizations should determine the forecast increments well in advance. For instance, a company may choose the increment period to be weekly, monthly, or quarterly. If management picks monthly increments for 12 months after one month expires, it gets out of the forecast, and an additional month is added to the end of the forecast. That means the business is continually forecasting 12 monthly periods into the future, as shown in the below image.

Create scenarios and sensitivities.

A crucial step in curating rolling forecasts is assessing possible financial outcomes using certain drivers and assumptions. This gives the organization a view of the possible scenarios that it may have to adapt to, depending on the drivers that the organization uses. As new information becomes available or recent trends appear, the forecast can be updated and current possible outcomes ascertained. Having advanced knowledge of likely or possible scenarios or outcomes helps organization management make better decisions.

Until science finds a way to perfect the time machine or significant advances are made in crystal ball technology, a 100% reliable method for predicting the future will remain a dream. But if you use rolling forecasts, you can chart out a clear course for the coming fiscal year and beyond while maintaining the flexibility to make smart business decisions if things take an unexpected turn.

Every organization or business looks at achieving substantial growth and profits. However, when there is an opportunity to convert substantial growth into massive growth, a risk like that needs consideration. With rolling forecasting, there are no risk factors involved, and even then, we can talk about achieving massive growth. All rolling forecast demands is a change in the process that is flowed. And in exchange,

Thus providing the chance of complete inclusion and empowerment based on the current market scenario or market trends. Therefore, allowing business growth in the right and ethical way.

So, if your organization is looking at the pros concept of the Rolling Forecast model we successfully implemented it into our existing system. Get in touch today.

About Author

Content Architect

The goal is to turn data into information, and information into insights.