Sign up to receive latest insights & updates in technology, AI & data analytics, data science, & innovations from Polestar Analytics.

Accurate, timely, and reliable information is crucial for effective decision-making for any real estate investor. Without it, you will end up making either an inappropriate decision that will damage the performance of your property investment or – even worse – no decision at all. In the past few years, the real estate industry has seen accelerated growth in technology adoption. And with technology, the industry is also leveraging data as one of its largest commodities. Whether it is understanding market trends or increasing occupancy rates, data helps property management companies to generate higher revenues.

Many organizations utilize data to improve various facets of their operations. It can also benefit investment functions, particularly for real estate investors seeking to maximize their portfolios. When complex data is presented, it can strongly impact your investments. For instance, it can show which markets are ripe for investing and which to avoid. You can analyze past and current trends to assess the income potential. In a recent survey by Ernst & Young, 92% of real estate owners wanted technology that addressed data analytics. But only 35% of them have adopted suitable tools. If you also want to leverage real estate data for your business, here are the top ways to get started.

Historically, real estate investors have made decisions based on professional experience and opinions on the market. However, today, data and data analysis help to make it possible to utilize accurate insights — in real-time. As a result, this authorizes those in the real estate sector, including developers and investors, giving them a bigger picture of prime investment opportunities and a holistic measure of risk. But the question arises-

Understanding the fundamentals of property buying is incredibly crucial if you make wise investment decisions, whether buying an investment property or purchasing a family home to add to your portfolio. But, what is often overlooked is the data on property investment. While fundamentals such as cost cycles and growth potential will help you narrow your search, actual complex data should be something you consider before diving into the fundamental aspects of property investment.

Supply and demand for housing will always significantly impact property pricing, as is the case with any market. Understanding how supply and demand are affected and will be involved in the future is the key to making intelligent investment decisions. Knowing how to predict these fluctuations in demand and supply comes down to interpreting the data.

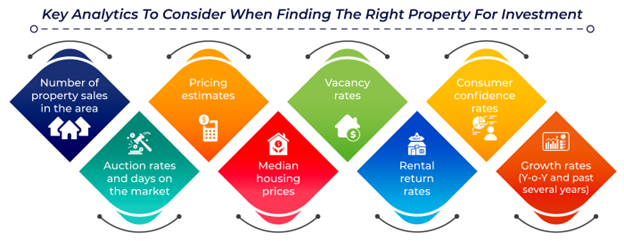

Of course, when we talk about data, we refer to analytics and statistics produced by research. These types of figures are not subjective – which can be the case when considering fundamentals – but are objective; the cold, hard facts, if you will. So, what are the statistics we want to look at?

1. In analyzing and monitoring market trends

To sustain a real-estate business, it is significant to understand every aspect that plays a role in the valuation of the property. With the increasing factors, keeping an eye on the trends and understanding what your competitors are doing is essential. Also, so many new data points like Human mobility, Demographics, connectivity, etc., are impacting the price of real estate. Data has become very significant in evaluating and monitoring the market trends and understanding the impact of other factors on the real-estate cost.

2. In optimizing the buyer selection process

Data Analytics can not only assist you find the value of your property, but it can also help you find the right people who are likely to be more interested in the property based on their budget, preferences, location, etc. Data that the buyers capture can be utilized to recommend to them the properties that fit their requirements the most, and likewise, the real-estate organizations can get all the details of the buyers who're the right fit for their offerings so that they can invest the apt amount of energy and time to the actual buyers.

3. In understanding patterns to anticipate future growth

Unlike Retail, Real estate shows a specific pattern in its growth, which typically compliments the demographics, local trends, government policies, economic stability, interest rates, provisions/subsidies around buying real estate, and more. By utilizing Data Analytics, all these together reflect the correlation with the price and help in uncovering the patterns that help in anticipating the future growth of the real estate; it becomes more straightforward than it may sound to detect patterns using the power of data analytics.

4. In digitizing and automating real estate evaluation (Predicting property prices)

Presently, the biggest deal-breaker in the real estate sector is the price. The current or expected price in the future of the property helps in deciding if it will be the right investment. With the assistance of data analytics, models can be curated using ML algorithms to evaluate the valuation of any property based on historical relevant information like age of property, location, and condition. They can provide an evaluation in a few seconds for overall consideration.

5. In boosting profits and reducing overall development costs

Real-estate organizations invest their money majorly in two things, land acquisition and then development. Data Analytics provides visibility into the valuation of the land to make sure that they purchase the land at the exquisite cost, and development cost can also be managed easily by tracking how much raw material is required to build any building space by analyzing and crunching the historical data to minimize the wastage, resulting in an optimized cost of development. And again, with the assistance of Analytics, real-estate organizations can predict the price of the property and can sell accordingly to make sure of boosted returns on each sale.

Hence, real estate as an industry has immense potential to become entirely data-driven. Moreover, data-driven processes in real estate bring intelligence around property valuation, inventory, growth patterns, buyers' behavior, expenditures, and searching out the right buyers, which streamlines all the operations for any mid to large-scale organizations in the real estate industry.

At Polestar Analytics, we believe in the data-driven approach in the real estate industry, delivering efficiency and visibility into what buyers want to get from their investments. Book a session to know more about our real estate offerings.

About Author

Content Architect

The goal is to turn data into information, and information into insights.