Sign up to receive latest insights & updates in technology, AI & data analytics, data science, & innovations from Polestar Analytics.

Editors' Note: Pharmaceutical companies are constantly striving to improve their business impact and stay ahead of the competition. In today's digital age, the power of data and analytics cannot be underestimated. This blog highlights the importance of leveraging pharma analytics to drive business impact and provides insightful tips on how to achieve this goal. With the right analytics tools and strategies, pharma companies can make informed decisions, streamline processes, and deliver better outcomes for patients. This is a must-read for anyone in the pharma industry looking to unlock the full potential of analytics.

While the global economy was reeling under the crippling blow of the health crisis caused by COVID-19, the pharmaceutical industry was proving its prowess to the world. The significant therapeutic advancements in the last decade have given new hope to patients. The development of Coronavirus vaccines in record time helped save the world during a death-defying pandemic.

For sure, the pandemic helped the pharma sector to do groundbreaking innovation but the pharma sector also witnessed its shortcomings like returns from pharma companies lagging the S and P by about one-third.

A PwC conducted a stock performance analysis of the top 50 pharma companies and realized that the gap between the performers and laggards has been growing. The five-year total shareholder return (TSR) for drugmakers in the top quintile increased by 29% in 2021, while it decreased by 11% for those in the bottom quintile. Investors are paying more attention to which pharma businesses are best positioned to succeed as performance pressures increase and are shifting their funds accordingly.

Drugmakers are struggling with lengthy medication development cycles, intense price scrutiny, expensive regulatory and legal costs, and growing competition in every market. There will soon be generic or biosimilar options in more therapeutic areas as a result of the upcoming wave of patent expirations.

Because medicine is becoming more personalized, manufacturers can generate returns on smaller patient populations because gross margins for some novel treatments, such as chimeric antigen receptor T-cell (CAR-T) therapy, are far behind historical averages. Higher shareholder returns require overcoming each of these pressures.

First, pharma leaders should make daily decisions with a stronger focus on creating shareholder value as they chart the future course.

To help turn excellent research into great profits, it is imperative to connect product-market decisions (such as production expansions, portfolio selections, and launch investments) to shareholder value creation across the organization.

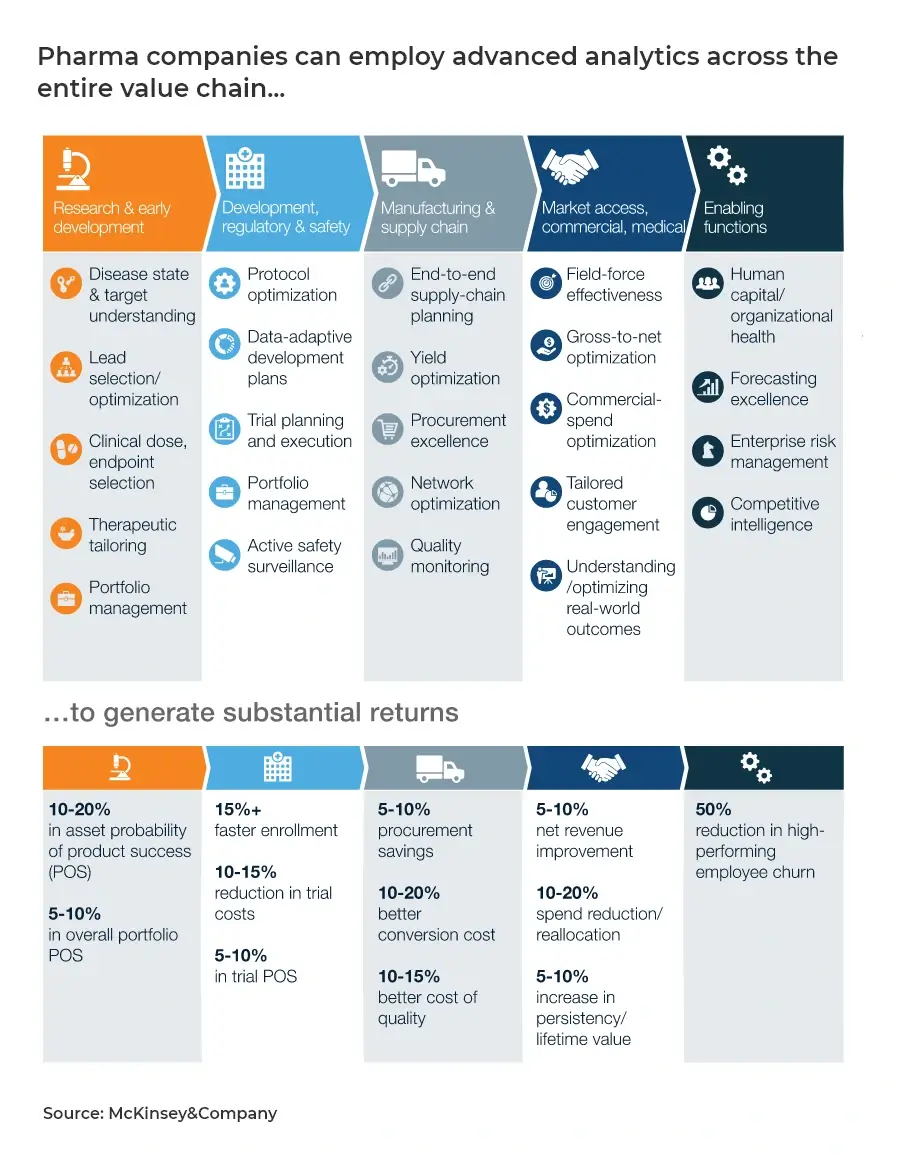

Delivering the promise of digital innovation will be another significant need. Developing digital products, personalizing client engagement, leveraging new types of data, implementing analytics solutions for the pharmaceutical industry, and operating in a more agile manner are just a few of the areas where pharma companies can benefit significantly from leading tech companies in the future.

Pharma players can position themselves to compete and gain a competitive advantage by focusing on these key actions:

A new wave of business process automation will be brought about by cloud and mobile technologies, sensors, and next-generation business analytics. This will result in simplified, automated workflows with few handoffs and end-to-end, real-time transparency on progress, costs, and business value.

This will lead to a significant improvement in a wide range of complicated, frequently cross-functional operations, whether they are in the back office, supply chain, R&D, or commercial. Banks have demonstrated that by redesigning these cross-functional processes from scratch and enabling cutting-edge digital technology to reduce processing time and expenses.

The move to the cloud infrastructure and use of pharmaceutical analytics will help pharma companies increase operational efficiency, expand service offerings, and reduce operating costs. For example, call centre operations can detect safety events and product faults using voice-to-text and natural language processing services, enhancing the quality and minimizing review work and time.

Also, machine learning techniques automate product complaints and adverse events processing to help pharma companies save time & effort. Although moving old applications to the cloud may result in cost savings, businesses must invest significantly in updating their IT infrastructure in order to take advantage of cloud-native architectures for their outdated legacy systems.

The latest survey by Spherical Insights reveals that in 2021, the size of the global market for big data analytics in healthcare exceeded USD 16.87 billion and is likely to increase at a CAGR of more than 19.1% from 2022 to 2030. Pharma companies have access to a lot of data that is typically hidden away in various technical and organizational silos.

To enhance their pipelines, products, and strategies, some already link and mine their data sources. However, there is still a tremendous possibility to create value from pharma data analytics using both internal and external data sources to provide better outcomes.

Pharma analytics will help marketing and sales professionals to understand prescribing behavior and potential patient profiles and enable precise targeting of providers.

For example, a "patient finder" technology will allow sales forces and medical science liaisons to focus on providers caring for patients who are likely to have those diseases, even though they are undiagnosed. This technology mines electronic medical records to identify patients suffering from rare diseases.

To outperform their peers, pharma companies must improve the outlook for future profits and ensure that plans to deliver are in place. The allocation of resources across the organization is a key driver of both growth and returns.

Are costs, capital, and people being optimized to their best, as measured by strategy alignment and ability to create shareholder value?

A strategic capability that can provide a long-term advantage is the ability to align resources with their most valuable use over and over. But it is not simple. Value-based planning necessitates an objective understanding of where and how value is created in the enterprise (e.g., products, customers, and markets), as well as how resources are consumed by each unit.

Workforce operational drivers should be linked to their true cost and tested for alignment with both strategy and value. Value-based planning leads to stronger business outcomes in both the capital and product markets.

In any industry, the ability to personalize interactions with stakeholders is a key value driver of digital technology. Pharma companies can realize this value primarily through sensors and digital services to provide personalized care around the clock.

In the future, a significant portion of the pharmaceutical and life sciences portfolio will generate value from sources other than drugs. Many drugs will be part of a digital ecosystem that constantly monitors the condition of a patient and provides feedback to the patient and other stakeholders.

This ecosystem will prove helpful in improving health outcomes by tailoring therapy to a patient's clinical and lifestyle needs, as well as enabling remote monitoring of a patient's condition and treatment adherence by health professionals. Many wireless sensors for measuring a patient's biophysical signals are already available in the market.

While traditional product efficacy and safety measures remain important, digital innovations open up new avenues for physicians and patients to achieve better outcomes.

Tracking digital biomarkers, providing digital therapeutics and innovative clinical decision support tools, and developing connected treatment ecosystems create new possibilities for predicting disease progression, engaging patients more deeply in their treatment, and assisting them on their path to recovery.

With significant value at stake for the pharma sector as well as patient benefits, the time has come to consider the aforementioned key actions in practice.

Most businesses are aware of this and have made a good start. The next step will be to accelerate, scale, and capture true value. Biopharma management teams are currently determining what their company's unique recipe for achieving scale will be and evaluating whether it is worthy of additional investment.

Pharma companies that deploy next-generation technologies aligned with pharma analytics solutions to streamline their business processes will be better positioned to thrive in a digital world.

They will be able to achieve near-real-time transparency of their clinical-trials portfolio in R&D, for example, and frictionless sales and operations planning in the supply chain, as well as cater to new customer, employee, patient, and supplier efficiency and agility expectations.

About Author

Data poet

Stories are data with a soul. They are always looking for a way to be heard.