Sign up to receive latest insights & updates in technology, AI & data analytics, data science, & innovations from Polestar Analytics.

✔ Unpack hidden profits: Discover why inventory aging could be silently draining your cash flow and margins.

✔ Master the numbers: Learn simple methods to calculate inventory age and generate inventory aging reports to turn data into smart decisions.

✔ KPIs that matter: Uncover the must-watch metrics to spot slow movers and monitor your stock performance.

✔ Slash aging inventory: Proven strategies—from forecasting to audits—to prevent dead stock and lost revenue.

✔ Supercharge your supply chains: Leverage analytics and dashboards to optimize inventory and magnify efficiency.

What’s the value of a product? Is it the MRP or the suggested price or is it the cost price? Though it appears simple on the surface, to determine the true value of a good for a company multiple parameters (in addition to the material and labor costs) like storage costs, market demand, product shelf life, carrying costs, brand reputation, scarcity, accessibility, etc. come into play.

Of these many components, one of the key parameters in determining the value of a good for a company is the age of the inventory. By tracking the movement and storage of items, brands can find ways to decrease the inventory holding period & curb losses resulting from stale or dead stock.

Inventory aging or stock aging refers to the stock that’s not selling out fast or is stuck in your warehouse for a longer period of time (varies from company to company ~ 3 to 6 months). For example, fashion brands need to keep track of the flow of their goods based on season, as seasonal or in-fashion clothes might no longer be needed after 2-3 months creating a need for discounts.

Inventory aging or maturity is a natural part of any product but where is the problem? Only when the stock is being held with you for a longer time and/or is not showing signs of being sold. What does this stock signify? How does it affect the companies?

Dead inventory: The inventory being stuck needs to be labeled as dead stock and needs to be strategized for offers – bundling, clearance sales, etc. For example, in the case of the food industry goods that go beyond a few weeks can be literally marked as dead (or expired).

Disconnect between sales and inventory: When the sales expectation vs reality doesn’t match, inventory holding might be a common effect. This is when stores or brands need to revisit their KPIs like sales velocity and check if there’s a cause like seasonality affecting the sales levels.

Carrying, Overhead costs, and opportunity costs: Every item stored has a carrying cost based on the warehouse rental costs (which is done per volume basis = the more you have, the more you pay). By keeping a stock of slow-moving products for a longer time, retail stores miss the opportunity to display and store fast-moving products in their store stock. In maintaining the inventory for a longer time, they need routine inspections, quality checks, insurance, storage condition check, and more.

Reduced Liquidity & margins: Aged inventory ties up working capital, creates cash flow issues and hampers a company's ability to invest in new products or respond to market changes swiftly. With longer inventory, there is an increased maintenance costs which also result in decreased margins on the products.

Promotions and discounts: Age of inventory can guide the promotion strategy, for example, some of the promotions can include, BOGO, combination offers or bundling, free gifts, donations, clearance sales, discounted rates, trade promotion increases (for channel partners), etc.

Waste and Environmental Impact: If the inventory becomes unsellable or obsolete, it may end up being discarded, leading to waste generation and negative environmental consequences.

Therefore, in addition to finding the right balance between stock-outs and excess storage i.e. being “in-stock”, you need to take care of the demand & understand trends – and more often than not, overstocking is due to improper inventory planning – inaccurate forecasts, lack of an inventory management system, seasonal demand, or sales cannibalization.

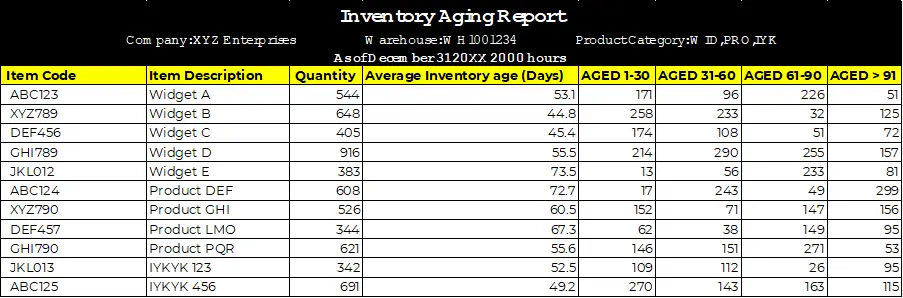

To keep track of what’s coming in and what’s going out – inventory aging reports are a good way. For example, a sample report can contain information about:

There can be more information that can be added based on the specific needs of the organization like cost or value, and reason codes for any delays which can help with the root-cause analysis, action points, location of stock, etc. Based on these you can create graphs and dashboards which we’ll be discussing further later.

Generally speaking, the faster the TAT (turnaround time) for a product, the better it is for companies, but not all products can have a sale time of a few days. Therefore, understanding and managing it becomes an issue. This is where reports can play a key role.

Calculating & analyzing KPIs and metrics can give you an idea about not just what the slow-moving products are but you can also:

The bottom line: Optimizing the value generated from each product by identifying the best way to sell them. Therefore having a real-time dashboard to keep an eye on the product movement and analyzing the trends is the best route.

Now the question comes to, what should you track?

First and foremost calculation of the age of inventory is important. Please note all inventory-related formulas or costs are usually calculated for a time period be it a week, month, or year. Therefore both the starting and ending date are crucial in all calculations.

Calculation of inventory age can be done with Inventory Age (Days) = Current Date - Date Added.

For example, let's say an item with Item Code ABC123 was added to the inventory on May 1, 2023, and the current date is July 25, 2023. To calculate the inventory age for this item:

Inventory Age = July 25, 2023 - May 1, 2023

Inventory Age = 85 days

As simple as that. This is usually used at Warehouse or store level.

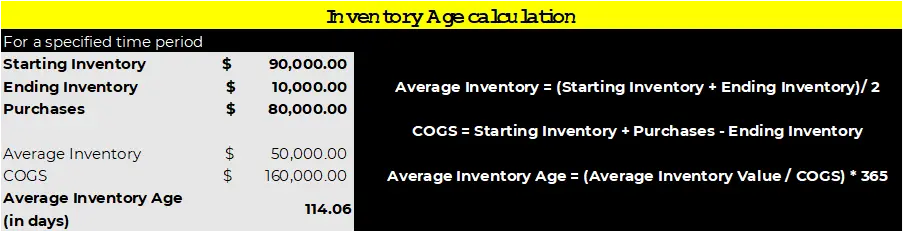

But if you are looking for a bird’s eye view this kind of calculation is not feasible nor practical in nature. Another simple way to calculate is by understanding the average inventory values and COGS.

Average Inventory age = (Average Inventory Value / COGS) * 365

For example, the calculations would go like this:

Get value mapping for your supply chain operations & know how to scale for the future

Start your Supply Chain Generative AI journeyThe age of inventory is just one parameter. What about others which should be analyzed? Here’s the list of a few other KPIs that should be kept in mind:

Inventory Turnover ratio: How quickly inventory is sold and replaced over a specific period. A higher inventory turnover indicates efficient inventory management, while a lower turnover may suggest slow-moving or stagnant inventory.

Inventory Turnover = Cost of goods sold (COGS)/ Average inventory value

Percentage of Inventory Aging: Shows the proportion of inventory falling within different age categories (e.g., 0-30 days, 31-60 days, 61-90 days, over 90 days). It helps identify the distribution of aging inventory and any potential issues with slow-moving items.

Carrying costs: The sum of all expenses related to holding and managing inventory, including warehousing, insurance, taxes, and obsolescence costs. Monitoring carrying costs helps identify areas for cost reduction.

Percentage of slow-moving inventory: The percentage of inventory that is not moving quickly, helping to identify the proportion wrt total inventory. Useful to understand if there are any issues wrt demand planning.

Percentage of Slow-Moving Inventory = (Value of Slow-Moving Inventory / Total Inventory Value) * 100

Inventory Carrying Cost as a Percentage of Revenue: Carrying cost of inventory as a percentage of the total revenue generated.

Inventory Carrying Cost as a Percentage of Revenue = (Inventory Carrying Cost / Total Revenue) * 100

These KPIs are the ones that are most commonly used or tracked. It is to be noted that every organization differs in what they look for and what parameters they track. Therefore you should take a detailed assessment before you start your analysis.

Access our interactive Procurement KPIs Periodic Table

Know What KPIs to TrackTwo-word answer: Inventory management. But the two words contain in themselves a sea of activities. Right from improving communication between sales and operations to effectively identifying trends this is a multi-domain task.

Some of the best ways to reduce this is:

Effective Sales and Operations Planning: S&OP is not a new concept anymore most organizations have tried or are in the process of trying this. Effective S&OP involves continuous planning of the demand side activities and the inventory. When done efficiently this can eliminate slow-moving products by identifying them continuously.

Demand Forecasting: Accurate demand forecasts enable businesses to plan inventory replenishment, avoid overstocking and understocking, and minimize holding periods. The issue is with forecasting a slow-moving product as more popular due to information lag, more bias, lack of data collaboration between other functions, etc.

AI Agents for Inventory Aging: Gartner's prediction says that by 2028, Agentic AI will make least 15% of everyday business decisions autonomously—up from virtually 0% in 2024. Forward-looking firms are now deploying Agentic AI systems that can constantly analyze multiple demand signals, market trends, economic indicators, weather patterns, and competitor pricing to generate forecasts that are way more apt than conventional methods.

Regular Inventory audits: Managing the stock levels with routine audits can not only match the record with the sales data but also improve the inventory data accuracy. With such audits, you can see the trends of slow-moving products well before they can be deemed to be dead stock. This can help you decide how to reduce the low-demand inventory with marketing campaigns or trade promotions or discounted offers before the season ends (in the case of seasonal products).

Root-cause analysis: Are your inventory levels for certain products always above normal? Did you identify the reason behind the same? With root-cause analysis or diagnostic analysis of your inventory data, you can find out the reasons behind slow-moving products and take appropriate measures. Some of the causes can be:

Stakeholder collaboration: By connecting and maintaining relationships with suppliers, retailers, and other external stakeholders to ensure a quick flow of goods across the supply chain. For brands, any trade promotion activities can be identified beforehand that can promote a few products, or for e-commerce, you can think of a few marketing campaigns. Inventory movement can also be analyzed with holding costs vs logistics, whether instead of holding they can be shifted to some other place where the demand is comparatively faster.

You would always love to have the freshest products in front of customers. It not only enhances the TOMR (top-of-mind recall), improves overall branding but also increases the chances of a resale. But how to do it effectively? We’ve just spoken about this briefly above with a sample report.

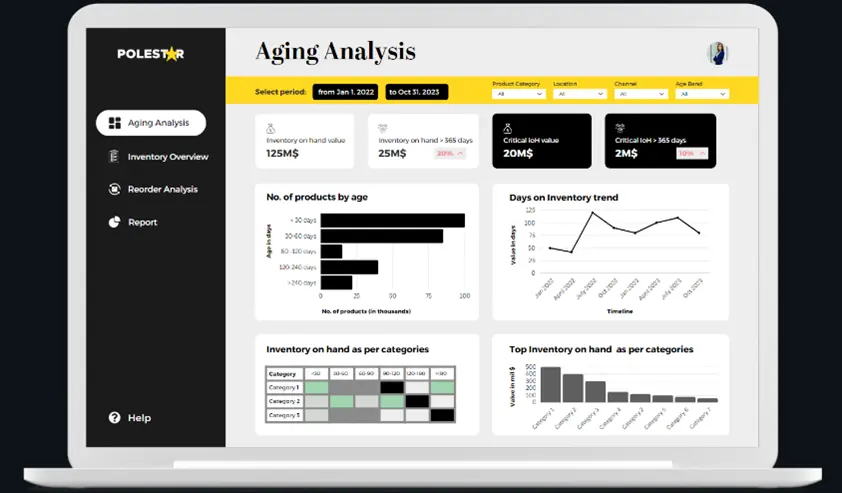

But to have effective inventory management you need to have real-time or near-real-time data (which also supports overall S&OP) supported with dashboards and reports.

Here’s a sample dashboard for reference:

While creating dashboards for inventory aging it is to be noted that this is a part of inventory management dashboards and has to be taken in addition to other dashboards like overview, reorder, status, WIP goods, etc.

To diminish the carrying cost from aged inventory it is better for organizations to sell products rapidly through - discounts, bundling, or remarketing, and consider making tax-deductible donations for unsold goods. To get rid of future aged inventory, organizations should have a robust inventory management system in place, apply better demand forecasting, negotiate supplier terms, improve warehouse management, and apply lean practices such as Just-in-Time (JIT) inventory.

Delaying inventory audits can really put companies at risk at financial level like lost sales and tied-up capital. It also come up with operational headaches such as - shortages and overstocking, and customer-facing risks, which involves lost trust and damage to reputation from the inability to complete orders. Without regular audits, a company might miss out on spotting theft, administrative mistakes, or damaged goods, leading to inaccurate financial reporting and poor decision-making. This can seriously impact profitability and a company's position in the market.

Organizations should take some active steps to avoid slow-moving inventory by embedding robust demand forecasting and supply chain coordination. By using advanced inventory management systems for performing regular audits, building customer and supplier relationships, real-time data and alerts, tracking changing market dynamics. Additionally, making strategic adjustments like - running targeted promotions, bundling slow-moving products can also assist in diminishing costs and improve sales before any issue escalate.

Leaders sitting at decision making level utilize insights from inventory aging to track slow-moving and high value stock, optimize replenishment, and prioritize products that sell fast. These valuable insights can assist with better promotions, pricing strategies, and stock transfers, which frees up the working capital. By reducing dead or excess inventory, companies enhance liquidity, maintain margins, and allocate resources efficiently, ultimately supporting smarter investment and growth decisions.

Before you start your inventory reporting, make sure you answer questions that are relevant to you, like:

The Future: Inventory management is evolving at a rapid pace, as organizations increasingly adopt Agentic AI . These systems can help eradicate the inventory aging issues by executing corrective strategies, continuously optimize across the entire supply chain network — revolutionizing inventory management from a cost center into a competitive growth driver.

If you are looking for expert advice to optimize, improve, or start your inventory management, our experts can guide you.

About Author

Data & BI Addict

When you theorize before data - Insensibly one begins to twist facts to suit theories, instead of theories to suit facts.