Sign up to receive latest insights & updates in technology, AI & data analytics, data science, & innovations from Polestar Analytics.

Editor's Note: In this sequel blog, we will traverse the components of the financial services value chain and witness the transition to insights-driven business and operations paving the way for unprecedented opportunities. Explore now!

In the previous blog, "Top Financial Services Banking Analytics Use Cases," we delved into the transformative power of data analytics in the financial services industry, exploring how cutting-edge technologies are revolutionizing banking practices. Today, we embark on the second part of this journey, delving deeper into the heart of the financial services value chain and uncovering a plethora of innovative use cases that are reshaping the industry landscape.

As technology continues to rapidly evolve, the financial services sector finds itself at the forefront of a digital revolution. In this sequel blog, we will traverse the components of the financial services value chain and witness the transition to insights-driven business and operations paving the way for unprecedented opportunities. Furthermore, by examining the use cases, we will gain a comprehensive understanding of how financial institutions are leveraging advanced technology and analytics to their advantage.

So, gear up as we venture into the dynamic world of financial services analytics, where transformative technologies are reshaping the landscape and propelling the industry toward a data-driven and customer-centric future. Let's explore the possibilities together!

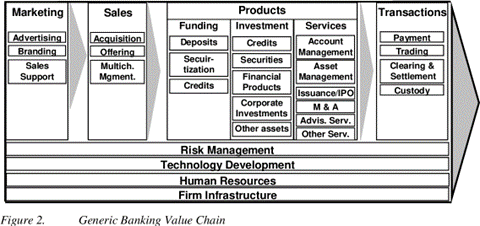

The financial services value chain refers to the series of activities and processes involved in delivering financial products and services to consumers, businesses, and other entities within the financial industry. It represents the journey of money and financial transactions from the initial stages of creation to the final consumption by end-users. The value chain in financial services typically includes the following components:

| Marketing: In the BFSI industry, marketing holds special significance, just as it does for other businesses. The sector has become highly competitive with an influx of international players, making effective marketing crucial for firms to withstand these competitive pressures. To attract and retain customers, firms must place a greater focus on their marketing efforts. Additionally, segmentation plays a vital role for banking and insurance companies, as different consumer segments require tailored approaches. | Product:The products offered by firms constitute a vital component of their value chain. From loans to deposits, companies provide a diverse range of products and services. However, in the banking context, it is not only essential to have a strong product portfolio but also imperative to deliver exceptional customer service. Banks offer both tangible and intangible products and services. |

| Sales: Sales plays a pivotal role in the financial services value chain, given its importance in the competitive banking landscape. Besides expanding into new markets and attracting new customers, retaining existing customers is equally essential for banks. | Transactions: A primary activity along the BFSI industry's value chain is transactions. Thanks to technology, this task has become easier, with millions of transactions taking place worldwide both online and offline every day. From ATMs to online payments, vast sums of money exchange hands in various transaction forms. Banks globally employ a variety of payment clearance and settlement systems, such as ACH networks, ATMs, bankcard networks, and check-clearing systems. |

The value chain involves multiple stakeholders, including banks, insurance companies, investment firms, asset managers, payment processors, regulators, and, most importantly, the customers. Each entity plays a specific role in ensuring the smooth functioning of the financial ecosystem and providing valuable services to consumers and businesses.

BFSI organizations hold more data than money, and this trend is set to grow over the next few years. Data is spread across business lines, corporate functions, and external utilities. In the rapidly evolving financial services landscape, businesses are constantly seeking ways to stay competitive, improve efficiency, and deliver better services to customers.

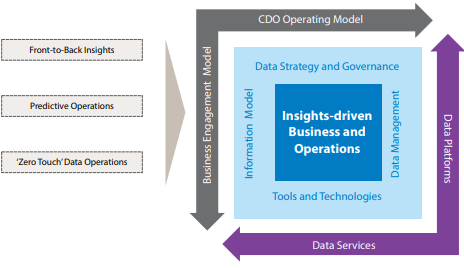

Transitioning to an insights-driven approach is crucial for financial institutions to remain relevant and successful. In this context, we will explore three key aspects of this transformation: Front-to-back insights, predictive operations, and 'zero-touch' data operations.

1. Front-to-back Insights

Front-to-back insights refer to the ability to gain a comprehensive view of the entire financial services value chain, from customer-facing interactions to back-end operations. This involves harnessing data and analytics across all stages of the value chain to drive informed decision-making and enhance overall performance.

Customer Insights: Understanding customers' needs, preferences, and behaviors is vital for financial institutions. By leveraging data from various touchpoints like mobile apps, websites, social media, and customer service interactions, banks can gain valuable insights into customer preferences and pain points. This data can be used to tailor personalized services, offer targeted marketing campaigns, and improve customer experience.

Operational Insights: Front-to-back insights also involve analyzing data from internal operations, such as transaction processing, risk management, and compliance. By integrating data from different systems and processes, financial institutions can identify inefficiencies, streamline workflows, and reduce operational costs.

Market Insights: In financial services, market insights are crucial for making strategic decisions. By analyzing external data sources, such as economic indicators, market trends, and competitor activities, businesses can make more informed investment and trading decisions.

2. Predictive Operations:

Predictive operations involve leveraging advanced analytics and artificial intelligence (AI) to anticipate future events, trends, and potential risks. By employing predictive models, financial institutions can optimize their operations, reduce risks, and provide proactive customer solutions.

Risk Management: Predictive analytics can be used to assess credit risks, detect fraudulent activities, and predict potential market downturns. By identifying risks in advance, financial institutions can take preemptive measures to mitigate them, protecting both the institution and its customers.

Fraud Detection: Financial institutions can utilize machine learning algorithms to analyze vast amounts of transaction data and detect suspicious patterns indicative of fraudulent activities. Real-time fraud detection can prevent unauthorized access and ensure the security of customer accounts.

Asset Management: Predictive analytics can also be applied to asset management, helping financial firms optimize investment portfolios and tailor investment strategies to individual client goals and risk profiles.

3. 'Zero-touch' Data Operations:

'Zero-touch' data operations aim to automate data-related tasks, reducing manual intervention and improving data accuracy and efficiency. This is especially crucial as financial institutions handle vast amounts of data from multiple sources.

Data Integration: Automating data integration processes enables financial institutions to seamlessly collect and combine data from various internal and external sources. This ensures data consistency and timeliness, enabling quicker decision-making.

Data Quality Management: Automating data quality checks helps maintain the accuracy and reliability of data. Financial institutions can set up data validation rules to identify and rectify errors automatically, reducing the risk of flawed analysis.

Data Governance: Implementing automated data governance processes ensures compliance with regulatory requirements and internal policies. It enables tracking data lineage, access controls, and audit trails, promoting data security and regulatory compliance.

Therefore, transitioning to an insights-driven approach is a critical step for financial institutions to thrive in the digital era. By focusing on front-to-back insights, predictive operations, and 'zero-touch' data operations, financial firms can optimize their value chain, enhance customer experiences, and stay ahead of the competition in an ever-evolving industry.

In the BFSI sector, it is crucial to ensure that financial applications, models, and systems are thoroughly tested before deployment to prevent any potential risks or errors that could lead to financial losses or regulatory non-compliance. However, accessing real customer data for testing can be challenging due to privacy concerns, security issues, and regulatory constraints.

Generative AI, particularly using techniques like Generative Adversarial Networks (GANs), can be employed to generate synthetic financial data that closely resembles real-world financial data. These generated data can include customer profiles, transaction histories, credit card information, and market data.

By leveraging Generative AI to generate synthetic financial data, the BFSI industry can perform comprehensive testing, analysis, and optimization of their systems in a safe and controlled environment. This approach enhances the overall quality, security, and compliance of financial applications and services, thereby improving customer trust and confidence.

Advanced technologies like AI and machine learning are revolutionizing the BFSI industry, empowering firms to create innovative business models that deliver highly personalized customer experiences and drive financial inclusion.

Banks are now leveraging AI-powered bots equipped with cutting-edge features like sentiment analysis and multilingual support to provide customers with convenient and personalized services, akin to an experience one would receive in a physical branch.

Furthermore, the implementation of advanced AI-driven smart analytics and Big Data analytics allows for the in-depth analysis of customer needs, behavior, and profiles. These insights enable the suggestion of tailored financial products and services to customers.

With the incorporation of sophisticated machine learning and natural language processing capabilities, these technologies accurately identify customer intents, fostering meaningful engagements that go beyond basic interactions and offer contextual experiences that enhance overall customer satisfaction and CSAT scores. For instance, an AI-enabled voice assistant not only determines a customer's eligibility for loans but also facilitates the loan disbursal process and keeps track of EMIs.

In addition to this, chat and voice-enabled bots leverage customer data to offer intelligent savings and investment advice, providing customers with personalized financial guidance tailored to their specific needs and preferences.

Robust technologies such as AI and machine learning are driving a transformative wave in the BFSI industry, empowering firms to craft innovative business models that deliver highly personalized customer experiences and promote financial inclusion.

Banks have embraced AI-powered bots, equipped with cutting-edge features like sentiment analysis and multilingual support, to offer customers convenient and personalized services akin to in-person branch experiences.

Moreover, the integration of advanced AI-driven smart analytics and Big Data analytics allows for profound insights into customer needs, behavior, and profiles. These valuable understandings facilitate the recommendation of tailored financial products and services, resulting in a personalized approach for each customer. The incorporation of sophisticated machine learning and natural language processing capabilities ensures accurate identification of customer intents, fostering meaningful engagements that surpass basic interactions and provide contextual experiences to elevate overall customer satisfaction and CSAT scores.

A tangible example of this can be observed in AI-enabled voice assistants that not only assess a customer's eligibility for loans but also streamline the loan disbursal process and monitor EMIs effectively.

Furthermore, chat and voice-enabled bots leverage customer data to offer intelligent savings and investment advice, delivering personalized financial guidance aligned with their specific needs and preferences.

Traditional banking and financial services institutions are encountering substantial challenges from emerging players, notably FinTech's. These disruptors have reshaped the BFSI landscape by offering personalized digital banking services at more affordable rates.

To not only thrive but also ensure their long-term survival and profitability while standing strong against this competition, traditional banks must undertake a strategic modernization of their operations. This entails:

“Digital banking,” “super apps,” “hyper-personalization,” “customer experience,” and “agility” — are the terms redefining the BFSI industry today. - Business Innovations

It is crucial for BFSI firms to undergo a transformation into data and insights-driven entities to effectively navigate changing market conditions, fulfill evolving customer needs, and drive innovation. To accomplish this, BFSI organizations must proactively adopt a well-defined data analytics strategy to successfully navigate challenging circumstances.

At Polestar Analytics, we specialize in meeting the current demands of the financial services sector. Our analytics consulting approach enables BFSI companies to build robust data strategies, enhance customer experiences, optimize business processes, and more.

To learn more about our tailored services for the BFSI industry, we invite you to schedule a personalized consultation with our team of experts.

About Author

Content Architect

The goal is to turn data into information, and information into insights.