Sign up to receive latest insights & updates in technology, AI & data analytics, data science, & innovations from Polestar Analytics.

Editor’s Note: Embarking on the journey through the transformative consumer electronics landscape requires a keen understanding of the intricacies of geopolitical tensions. Join us as we dissect key trends impacting both demand and supply, all while recognizing the pivotal role that data plays in shaping this dynamic sector.

Had enough of the pre-and post-covid narratives across sectors? Eager to discover the latest trends in consumer electronics?

Step into the world of innovation with us as we explore the dynamic landscape of consumer electronics & key trends that have reshaped consumer electronics, both in terms of demand and supply, and uncover the forces shaping its future.

The consumer electronics industry is in a state of constant evolution, driven by shifting consumer preferences, technological advancements, and the profound geopolitical tensions impacting the industry.

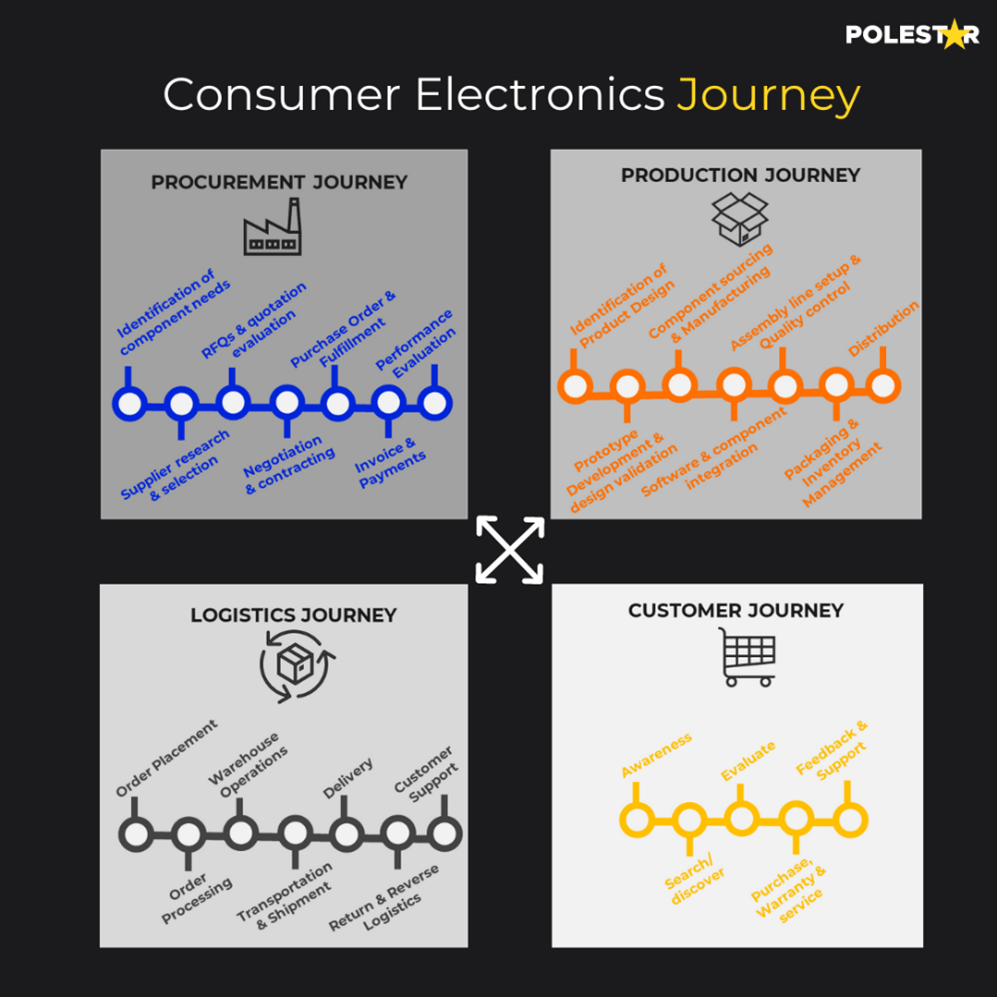

Before delving into the transformative changes that have shaped the consumer electronics industry, it's essential to understand the journey that every consumer electronics brand undergoes within the supply chain.

This supply chain journey can be divided into four distinct divisions, each playing a vital role in the overall process:

It's important to note that these four journeys are intricately interconnected, and they do not necessarily follow a linear or sequential path. Each phase contributes to the overall success and efficiency of the consumer electronics supply chain.

Won’t be bored with long pre and post-Covid trends, but these changes are not merely trends but fundamental shifts that continue to shape the industry's trajectory.

Omnichannel Transformation

Pre-COVID: The concept of omnichannel shopping had already begun, with a significant percentage of consumers visiting physical stores to inspect products before making online purchases. A Google survey revealed that 72% of shoppers followed this pattern.

Post-COVID: The pandemic acted as a catalyst for the adoption of omnichannel shopping. Retailers quickly embraced augmented reality (AR) for online try-ons, while physical stores transformed into interactive hubs for immersive product experiences. The ability to offer accessibility across various touchpoints became imperative to cater to the omnichannel customer. Emerging trends include the use of high-definition product shots, unboxing videos, and the creation of customer-centric content to enhance the online shopping experience.

Rise of Information Sources

Pre-COVID: Even before the pandemic, consumers were increasingly relying on online sources of information, including websites, reviews, and social media platforms, to research consumer electronics.

Post-COVID: The reliance on information sources has surged dramatically. On average, online electronics shoppers now consult over 14 sources when making purchase decisions, while younger buyers engage with up to 21 sources. Online reviews, user-generated content on social media, review blogs, and in-store activations have collectively wielded significant influence over consumer electronics purchases. Astonishingly, a whopping 65% of social media users who spend more than 13.5 hours a week check social channels before committing to buying a consumer electronic product.

Influencer Marketing Dominance

Pre-COVID: Consumers heavily relied on product reviews, often swayed by products with more reviews, which prevailed over competitors 58% of the time. Reviews from genuine product users acted as unpaid brand advocates.

Post-COVID: Influencer marketing has taken center stage to bridge the gap created by the absence of 'touch-and-feel' experiences in online shopping. Users have increasingly turned to review communities, social media platforms, and online tech influencers. Brands worldwide, including Canon, HP, Kindle, and Oppo in China, have harnessed the power of influencer marketing to curate authentic user-generated content. As e-commerce continues its rapid growth, real-time pricing analytics will become crucial for Original Equipment Manufacturers (OEMs) and retailers to maximize their market share.

Digital Revolution in Aftersales Service

Pre-COVID: Traditional aftersales service primarily involved in-person visits to service centers or authorized repair shops for product demos, installations, and repairs.

Post-COVID: The digital transformation has reshaped aftersales service. Social distancing measures have restricted in-person visits, leading consumers to seek assistance through digital means such as WhatsApp video calls, live chats, and chatbots. An emerging trend in online electronics shopping is the growing expectation of extended warranties and protection plans, aiming to circumvent potential local repair hassles and enhance overall customer satisfaction.

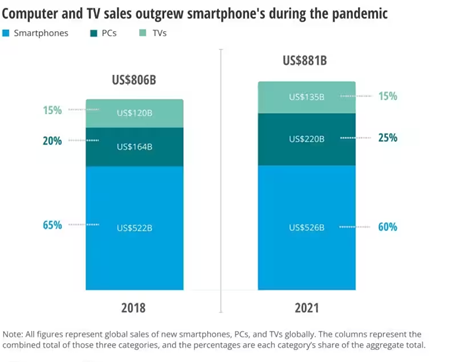

The COVID-19 pandemic, geopolitical disruption, and environmental concerns have prompted significant changes in consumer electronics demand. With consumers working and learning from home, the sales growth of computers and TVs has surpassed that of smartphones.

Comparative analysis reveals that computers and TV sets have exhibited much faster growth (CAGR +34% and CAGR +12%, respectively) compared to smartphones (CAGR +1%) on a global scale.

Source: Deloitte

High-growth segments include computers, laptops, tablets, networking devices, and smart headphones. Conversely, mobile phones, refrigerators, and white goods have experienced slower growth.

| Marginal Growth | High Gainers |

|---|---|

| Marginal Loss | High Losers |

|---|---|

Source: Pwc

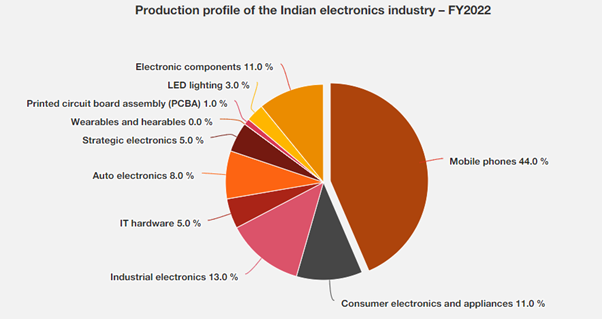

Diversified manufacturing units exist worldwide, with each region specializing in various aspects of production. According to Forbes data, Japan excels in high-tech electronics, Taiwan is a hub for chips and semiconductors, South Korea dominates in display optics, and China focuses on component manufacturing and final assembly. Notably, China is one of the top five producers of semiconductors globally.

Chips Manufacturing

Taiwan stands as the world's largest chip producer, largely due to the dominance of the Taiwan Semiconductor Manufacturing Company (TSMC), which controls over 58% of the global chip market as of Q2 2023. Taiwan is responsible for manufacturing 65% of the world's semiconductors and nearly 90% of advanced chips. Companies like Apple heavily rely on TSMC for their chip needs.

Source: Counterpoint research

Component Manufacturing

China takes the lead in producing large components such as batteries, speakers, and power supplies.

PCB Manufacturing

Chinese PCB manufacturers have mastered the production and assembly of printed circuit boards at both low cost and high quality. An increasing number of Southeast Asian countries are expanding their capacity to produce general-purpose PCBs at competitive costs.

Final Device Assembly

China remains the dominant player in the assembly of final electronic products. The country boasts well-established assembly lines and a surplus of skilled workers, allowing for high-volume production at reasonable costs. Some products are also assembled in countries like India, Vietnam, Indonesia, and Mexico.

High-Margin Electronics

Premium high-tech electronics, including video cards, computer memory, and advanced devices, often yield high-profit margins. These products are typically manufactured in Taiwan, Japan, the U.S., or Europe, due to high entry barriers, limited competition, and strong intellectual property protection.

Medical Devices

The production of medical equipment demands compliance with rigorous standards and certifications, particularly in the U.S., to meet FDA requirements for product design and manufacturing processes.

After facing these demand and supply changes over the years, doesn't it pique your interest to know where consumer electronics practitioners struggle?

What has worked in the past few years, might not work today. There is a need to gradually outgrow legacy business operations. Some areas where experts are struggling these days include:

| Value Chain | Application |

|---|---|

| Procurement Journey | |

| Production Journey | |

| Logistics Journey | |

| Customer Journey |

When the need of the hour is AI and more than 25% organizations struggle with a lack of tools, complex data, and integration capabilities – it means you need a partner who has technical and technology expertise.

Ready to optimize your warehouse operations? Learn from a Consumer Electronics Giant's journey to unparalleled efficiency and profitability. Explore Now

Bravo! Now you’re updated about all the latest trends in the consumer electronics industry. We at Polestar Solutions are a leading CPG data Analytics company helping clients by providing valuable support to businesses looking to optimize their business processes through data analytics.

Book your consultation today!

About Author

Marketing Consultant

Data Alchemy can give decision making the golden touch.