Sign up to receive latest insights & updates in technology, AI & data analytics, data science, & innovations from Polestar Analytics.

The rising wave of digitalization is no secret and it has taken the business world like a storm that can be described through the catch-all phrase “Digital Transformation”. It has made inroads into the core business pillars and created dependencies and demonstrated unmatched values to these business units. This Harvard Business Review framework succinctly captures the key departments and decision-makers mapped against these pillars:

A look into this framework clearly highlights the extent to which modern businesses are dependent on digital or cloud offerings like data warehouses, data lakes, CRMs, ERPs, social media, and other SaaS platforms.

We have reached a stage where many of these platforms can charge a premium or stop the freemium offerings, after all, that is one of the stages when a product or platform matures, achieves market validation, and starts to look out for monetization avenues. But that is a natural course and one of the inflationary impacts on product prices.

The kind of inflation that we are going to talk about today is not a natural one, inflation is at an all-time high and if we use the US market as a yardstick, presently it is the highest since 1982. The inflationary push into product prices has many factors at play and even cloud storage costs are not untouched by it, hence the term ‘Cloudflation’ or cloud inflation or simply put a spike in cloud storage costs. In this article, we are going to look at the different factors at play with some interesting examples.

During the pandemic, almost all of the supply chains faced disruption of non-essential nature almost came to standstill. Now, a few of you would be wondering why we are talking about semiconductor supply chains. Well, the data stored in the cloud reside in these huge regional data centers owned by the big cloud computing companies and for storing the ever-exploding data, these companies need more computers. Computers require these tiny chips made up of silicon and other semiconductor materials.

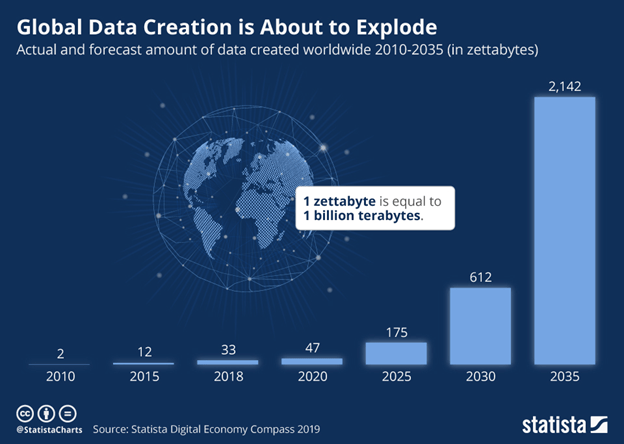

With the semiconductor supply chain disruption, the creation of chips and computers declined and in turn availability of storage space declined with respect to the creation of data. To put things into perspective, this data explosion is here to stay and this image by Statista speaks volumes:

The storage and computation of data require huge energy both for operating and maintaining the temperatures of the server rooms. As we all know energy prices have been soaring ever since the Russia-Ukraine situation escalated, a few weeks before the actual war outbreak. Another factor to this rise is a good cause, the push toward sustainable and safe means of energy production, a number of European countries are taking strict measures in this direction.

Since energy production through renewable sources is still limited, the demand-supply pull drags the prices up and many countries are already seeing a jump of around 20% in electricity prices.

The tension between Russia and Ukraine has already been talked about. Another tussle is between China & the US. The bone of contention here was laid down way back and its knee-jerk reactions keep haunting the world from time to time. In this context - Taiwan is that reason.

Taiwan is one of the leading producers of semiconductor chips and Taiwan Semiconductor Manufacturing Company Limited (TSM) is one of the leading companies in this space that enjoys over 65% of the world's chip market. The backstory is that- the US and other western superpowers, in the hunt for cheap labor and to avoid the emissions and environmental activism claims against them, enabled Taiwan to be that strategic location and hence the country’s emergence as a leader in this segment. (During the pandemic, this furthered the semiconductor supply chain disruption.)

It gets interesting with China coming into the mix, China considers Taiwan to be an integral part of the People’s Republic of China. And if the tensions between the two superpowers flare up, this could take an ugly turn for the world's computers and further to the cloud storage market.

So having covered these primary factors that resulted in Cloudflation, let’s look at how this is impacting the cloud-reliant enterprise world.

The world has started to see the impact of Cloudflation and the early signals have been noticed in the form of a hike in cloud storage costs by two Cloud platform giants - Amazon Web Services (AWS) and Google Cloud. AWS leads the nearly $200 billion cloud market with 34% market share whereas Google ranks 3rd with 10%. And, at least 44% of the end-users have faced the brunt of Cloudflation directly or indirectly.

To put things into perspective, this is not a regular occurrence in the cloud space. Since its launch in 2006, AWS alone has cut down its prices nearly a hundred times. So if we talk about the characteristics of this market, it is one with ‘Price-cuts’ and not ‘Price-hikes’ and the reported operating margins of these big players also haven’t been bad over the years.

Wondering how that was possible? If experts are to be believed, these players were able to offer price cuts on the back of the combined effect of architectural innovation, economies of scale and Moore’s Law resulting in a reduction in chip sizes (covering this in detail requires a separate article). At this time, due to the impact of disruption and excessive storage space, the requirement has surpassed the pace of innovation - resulting in price hikes.

Coming back to the price hikes by Google Cloud, the prices across a number of its offerings are going up such as nearline storage in multi-region going up by 50%, and Coldline storage Class A operations pricing is getting double. Some free services will now have charges associated with them. The complete information on Google cloud storage price changes can be found here on this Google Cloud official page. These prices go into effect starting 1st October 2022.

With AWS, customers are habitual to getting the best prices with the spot instances that offer heavy discounts, but it has a caveat associated with it. AWS can terminate these instances literally at minutes’ notice. Another option and the one that is used by established players is the floating price rates, in which you pay the real-time market rates and off late, these prices have been significantly high due to reduced supply.

68% of IT managers across the world are worried about managing the storage cost and this problem is not going to stop, looking at the voluminous data creation and storage space supply-demand mismatch. So, what are certain strategies that IT managers can implement for better and more efficient usage of the available storage space?

Our next blog in the Cloudflation series covers this in length. We will explore certain strategies that could lead to better cloud budget management in Part 2 of this Cloudflation Series.

About Author

Assistant Vice President

You can't hire somebody else to do your pushups for you.