Sign up to receive latest insights & updates in technology, AI & data analytics, data science, & innovations from Polestar Analytics.

Editor’s Note: The evolving role of a CFO into a value generator demands innovative strategies and initiatives. Data insights and the integration of AI emerge as pivotal value drivers for enterprises in the near future. This blog centers on illuminating how financial departments can adeptly wield these tools to play their part in the digital transformation journey.

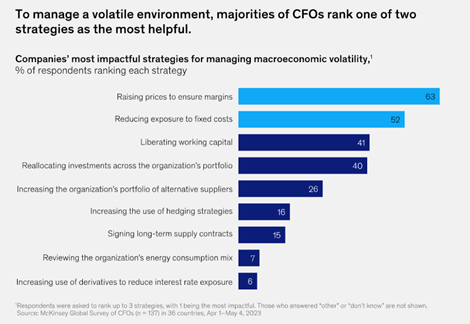

Enterprises today, are grappling with significant challenges, including rising costs, inflation, and, margin pressures due to soaring energy and commodity prices. Despite the volatility, 57% of CFOs will increase internal investment over the Next 12 Months. Implying a positive outlook on the future, reinforcing the aggressive growth plan for the future.

They are adopting the role of “digital challengers”, a counterweight to the Chief Information Officer (CIO) or Chief Digital Officer, and ensure the efficient reallocation of digital resources to cater to the new challenges.

According to ComputerWorld, CFOs and CIOs need most communication in data security first (63%), data accessibility next (48%), and IT simplification/integration and IT costs tied for third (37%.). These are some common problems that need to be addressed by both CFOs and CIOs, with the advent of AI the key focus areas going forward will be

Before we get started, we'll take you through the vital considerations that modern CFOs need to navigate. These form the biases of the changing role of CFOs to harness the full potential of AI and Analytics, maximizing their benefits for the organization's growth and success.

The pressures are concerning the financial leaders who have relied on cost-based planning. However, in the pursuit of propelling organizations forward, the focus of financial leaders has shifted towards not only reducing costs but also driving revenue growth. So, today's CFOs have the added responsibility of value creation on top of being the guardians of financial health.

Key Considerations for the CFO Office

The modern-day CFO has a lot of complex problems to solve, from strategy to implementation, from tech to accounting, they wear multiple hats. Value creation can be achieved via three core methods of Value arbitrage-

A)Technology arbitrage:

Integrating AI and analytics tools into existing financial systems requires careful planning. CFOs must consider factors such as system compatibility, scalability, and ease of implementation. Choosing the right technology solutions ensures seamless adoption and enhances the overall efficiency of financial operations.

B) Talent and Skill Arbitrage:

To fully harness the potential of AI and analytics, CFOs need a skilled workforce. Bridging the skills gap is crucial; nurturing data-savvy professionals within the finance team ensures that the organization can extract meaningful insights from data-driven processes.

C) Process arbitrage:

Embedding financial transformation into the culture. Optimizing and standardizing financial workflows, integrating automation and data, to enhance efficiency, reduce dependency on working capital, and improve cashflows while adhering to compliance standards.

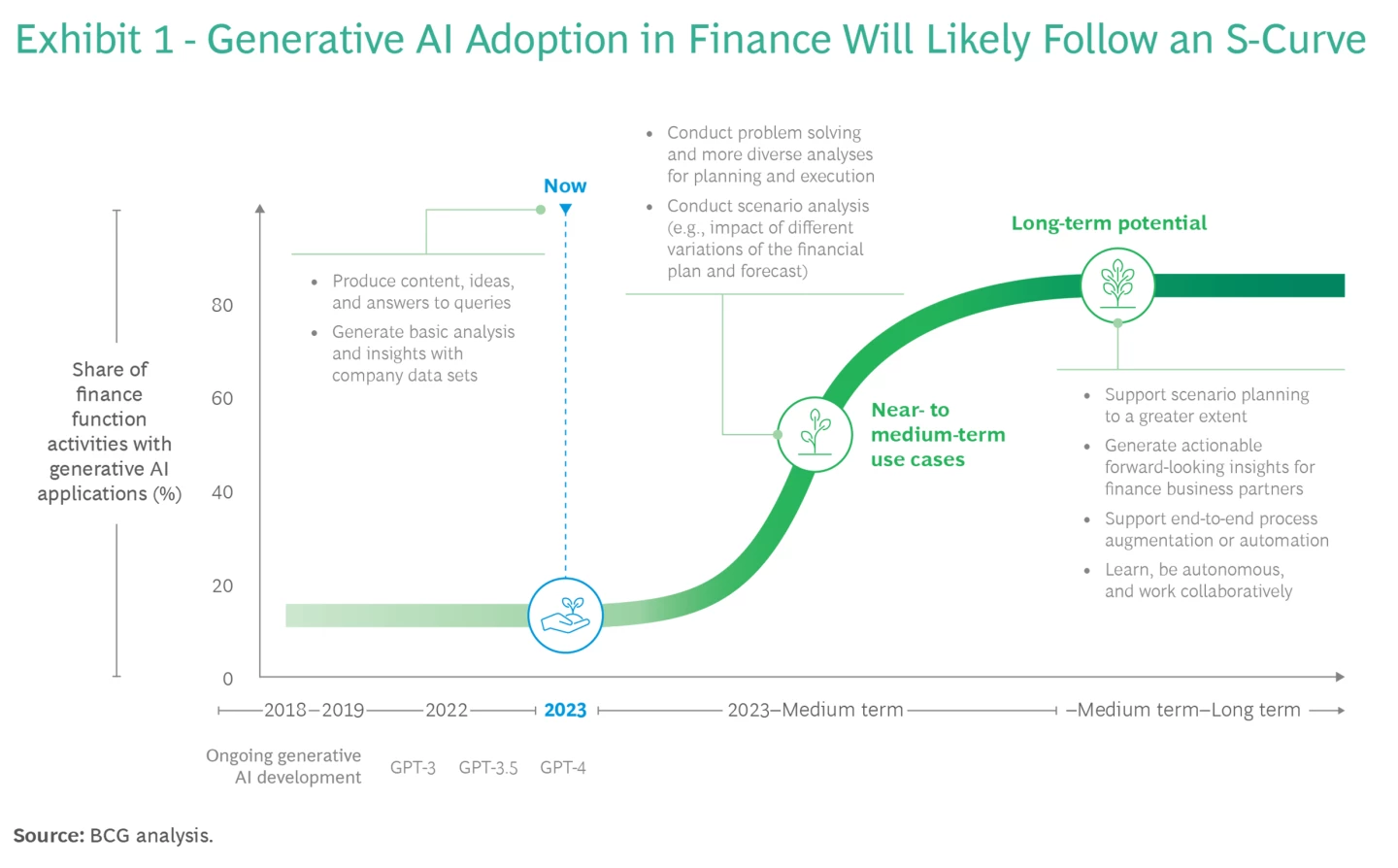

Enter the era of the AI boom, a transformative force that has reshaped the way both individuals and organizations perceive and process information into knowledge. This has led to executives' question: how can we harness the potential of AI within organizations without compromising data security?

At the heart of all three value-generating engines for the coming few years would be AI. It will fundamentally transform the way we look at tech for the future. Training to use AI will be essential not just for individuals but for organizations as well. Integrating AI into the financial process to boost efficiency and speed will become the norm.

The transformation has already commenced, with 50% of AI adopters noting a reduction of 7% or more, and a substantial 25% reporting a decrease of 14% or more in the total annual finance function cost as a percentage of revenue.

Now that we've established the transformative potential of AI in finance, it is prudent to take a deep dive into the core areas where this technology stands to make the most significant impact. From lease contract analysis to fraud detection, each area presents a unique opportunity to enhance efficiency, accuracy, and decision-making.

Lease Contract Analysis:

AI-powered lease contract analysis tools can extract key terms, obligations, and financial details from contracts, ensuring compliance and accurate financial reporting. This reduces manual review time and minimizes the risk of overlooking critical information.

Asset Valuation Enhancement:

Implementing AI in asset valuation can leverage predictive models to assess depreciation, market trends, and risk factors. This enables more accurate and timely valuations, improving financial reporting precision.

Fraud Detection and Prevention:

AI-driven fraud detection algorithms can analyze large datasets to identify irregularities or suspicious transactions. By continuously monitoring patterns and anomalies, AI helps in proactively preventing financial fraud.

Invoice Processing Automation:

AI can automate the extraction of data from invoices, validate it against purchase orders, and enter it into the accounting system. This reduces manual data entry efforts, minimizes errors, and speeds up the entire procure-to-pay process.

Receivables Management:

AI-based tools can track receivables and predict payment timelines based on historical data and customer behavior. This allows for better cash flow management and more accurate revenue forecasting.

Working Capital Optimization:

AI algorithms can analyze the order-to-cash cycle to identify bottlenecks and inefficiencies. This information can be used to streamline processes, reduce customer debts, and optimize working capital.

Reconciliation and Risk Assessment:

AI-powered reconciliation modules can automatically match sub-ledger transactions, identify discrepancies, and perform risk-based assessments. This enhances accuracy and reduces the likelihood of financial discrepancies.

Financial Forecasting and Scenario Planning:

AI models can process large volumes of data to generate accurate financial forecasts and perform scenario analyses. This provides valuable insights for strategic decision-making and planning.

Cost and Revenue Analysis:

AI can automate the collection and aggregation of cost and revenue data from various departments, providing a centralized repository for financial analysis. This improves data accuracy and reporting efficiency.

Financial Reporting and Audit:

AI tools can offer initial insights for financial statements during month-end closures and assist in audit trail documentation. This streamlines the reporting process and ensures compliance with accounting standards.

Variance Analysis:

AI-driven analytics can perform ad-hoc variance analysis, comparing actuals to plans and generating reports to explain financial performance. This helps in identifying areas for improvement and driving business growth.

General Ledger Reviews:

AI can assist in automating general ledger reviews, and flagging potential discrepancies or anomalies for further investigation. This increases the accuracy and reliability of financial records.

Procure to Pay

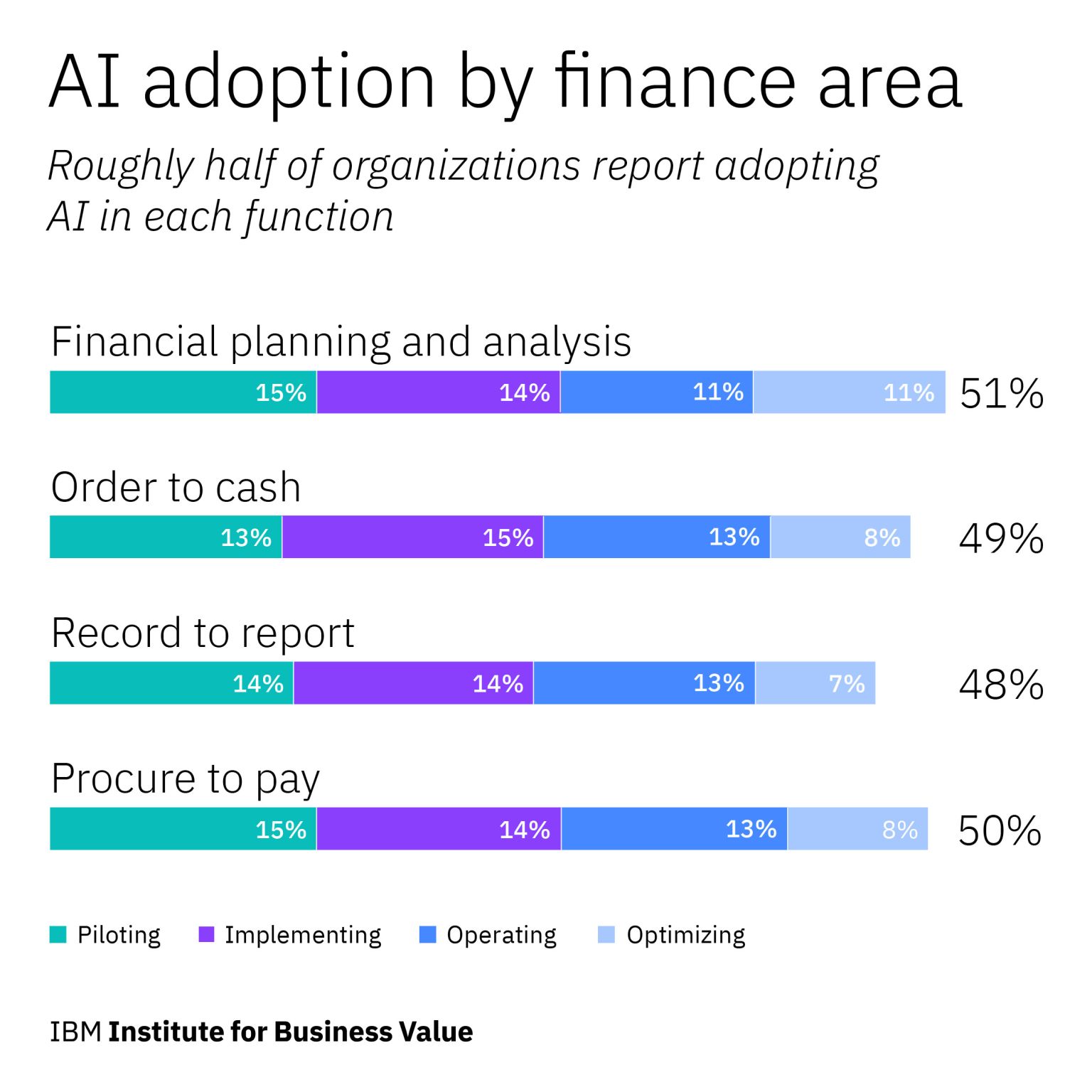

Leveraging AI for Procure-to-Pay (P2P) automation has proven to boost productivity, enabling finance teams to identify a greater number of fraudulent invoices.

FP&A

AI and advanced analytics stand as pivotal elements within the financial planning and analysis (FP&A) process, energizing and coordinating the activities of planning and performance management.

Integrating AI into financial processes can significantly enhance efficiency, accuracy, and decision-making within the finance department. By automating routine tasks and providing advanced analytics capabilities, AI empowers finance teams to focus on strategic initiatives and value-added activities.

Incorporating AI into a Centralized Data Platform (CDP) takes the capabilities of financial management to new heights. AI algorithms within the CDP process analyze vast amounts of financial data, uncovering patterns and trends that might otherwise go unnoticed. This infusion of AI-driven insights enables the CFO to make not only informed but also forward-looking decisions.

Additionally, AI augments risk assessment by identifying potential vulnerabilities and irregularities in financial processes. By integrating AI into the CDP, the CFO is empowered to harness the full potential of data-driven financial strategies, propelling the organization toward greater efficiency and success.

However, it's important to consider factors like data accuracy, security, governance, and potential challenges associated with generative AI tools in the implementation process.

Things to keep in mind

Elevating Financial Flash Reporting with Strategic Insights

In the journey from AI to Analytics, CFOs wield transformative power. Embracing these technologies isn't just a challenge but an opportunity to elevate the finance function's role. By leveraging AI-driven analytics, CFOs can drive growth, innovation, and sustainable success while leading their organizations into a future where data reigns supreme.

About Author

Information Alchemist

Marketeer at heart, story creator by passion, data enthusaist by profession.