Sign up to receive latest insights & updates in technology, AI & data analytics, data science, & innovations from Polestar Analytics.

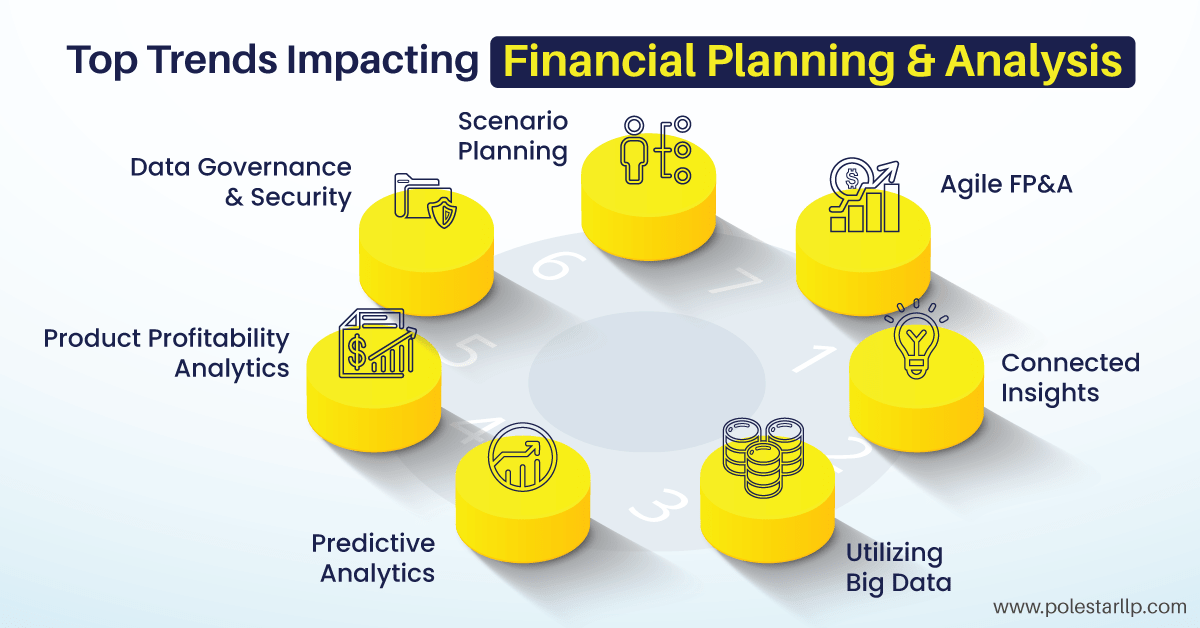

Editor's Note: In the ever-evolving landscape of financial strategy, staying ahead means understanding the currents shaping the industry. Our article delves into the top 7 FP&A trends steering the course of modern financial planning. From technological innovations to data-driven insights, these trends illuminate the path forward for professionals navigating today's financial terrain. Dive into our exploration of these FP&A trends and discover the strategies reshaping the future of financial planning and analysis.

The finance function within modern enterprises needs to transform in order to drive agile and dynamic business operations and processes. The onus is on the Financial Planning & Analysis leaders to shape the business strategy through trustworthy and real-time fact-based financial strategy and insights, rather than relying merely on management intuition and outdated information.

The traditional Financial Planning & Analysis processes involved relying on spreadsheets to make tedious calculations at multiple transaction levels and then compiling them to make a higher level consolidated reporting to drive financial strategy. The spreadsheet-based Financial Planning & Analysis processes are simply not dynamic enough to handle the modern enterprise-grade use cases and provide the decision-makers with the necessary support to make important and smart financial strategy decisions.

In fact, a 2019 survey from SAP shows that teams spend only 23% of their time on high-value activities.

The Covid19 pandemic has only further underlined the importance of moving away from static excel-based platforms for supporting dynamic financial strategy and business plans. As the pandemic ravaged the economy and led to a decline in consumer demand, the lock-down regulations restricted the availability of labor and raw materials.

These unexpected times threw months of planning and forecasting out of the window, and businesses with complex, legacy planning systems suddenly found themselves unable to predict demand accurately, and make the right inventory and production decisions. The challenge with the legacy systems is that it is unable to integrate data across the organization value chain and provide financial planning & analysis managers with the capability to do scenario planning analysis.

So, what is the answer?

Organizations need to embrace technology innovations in their processes. This requires change management and making investments in the right set of technology enable and platforms.

By investing in, and setting up data-driven capabilities, organizations can identify the key levers that can help it achieve the financial strategy goals.

Read our blog post on how EPM can help you make better financial decisions

1. Agile FP&A

Teams have access to a wealth of information at their hands - information pertaining to customer behavior, employee engagement, and productivity levels - which if utilized correctly, can help make highly effective decisions and drive the business forward.

Insights into important information in real-time, such as which products need to increase the production capacity, or hire more sales representatives, which new product/ variant should be launched, and what debts to take without stressing the working capital. All of these insights can be incorporated into an agile planning cycle to make smart, adaptive, and effective business decisions, driven by a solid financial strategy, that impact the bottom line and long term prospects

It is imperative that organizations break down the data silos that hinder 360-degree and actionable insights for finance leaders. Data silos occur due to process or technology shortcomings, due to which the data collected by a particular department is not used effectively and efficiently by the other departments in their analysis. For example, if your operations data is not being aligned with the data coming from your cost center analysis, then it can get difficult for you to assess and identify areas of improvement to bring about operational cost savings and efficiencies.

Today, the proliferation of numerous data streams and the advent of cost-effective data storage and processing systems means that organizations are increasingly utilizing unstructured data and big data to derive competitive advantages, and teams are no exception. By utilizing unstructured data from social media, website heat maps, etc. can better assess the user engagement levels on the different channels, and make effective decisions to maximize ROI and optimize their financial strategy.

By leveraging predictive analytics tools and techniques, your processes can transform their role and act as a lever for driving product innovations, acquisitions, and key capital investments. Predictive analytics can help leaders to into the future's with crucial insights into key areas such as unexpected sales trends, consumer behavior, and supply-chain volatilities.

By leveraging analytics tools, and combining data from different source systems, Financial Planning & Analysis teams can better assess profitability at more granular levels, in terms of product, rather than measuring profitability at higher levels such as company levels. This ability to slice and dice information across multiple dimensions can provide useful insights to decision-makers to make product launch/ innovation/ discontinuation decisions.

A strong and robust data governance set-up is a crucial step in ensuring that your data analytics initiatives are all tying up to a strategic vision. Data governance, among other things, focuses on defining master data management frameworks and ensuring that definitions and objectives are consistent across the different departments that are investing in data analytics capabilities. A data governance mechanism that is built to relies on three crucial pillars to succeed - people, process, and the right supporting technology.

The future can not be gauged by relying on the historical data alone, since there is so much uncertainty and unknown variables that might throw years of careful planning out of the window overnight. It is for this reason that Financial Planning & Analysis leaders require scenario analysis capabilities to use real-time data to assess a set of alternative future scenarios and to predict their impact on the company's objectives and plans. Such an assessment can help the organization put in better contingency measures to address such a scenario proactively.

This report shares how CFO's can become successful in their expanded, modern role with the same number of hours in the day and dollars in the budget.

The function has an important role to play in driving improved decisions, by leveraging the power of financial analytics. Streamlined processes, with strong data analytics foundations, have an important role to play in shaping the agile, adaptive, and smart organization that is prepared to capitalize on the latest innovations and opportunities presented by the market. By leveraging the recent trends in financial management mentioned above, can build dynamic business models that can become the basis for effective and smart decision-making.

At Polestar Analytics, we have helped several organizations build smart and effective processes, by leveraging end-to-end data analytics capabilities. Get in touch with us to learn how to use data analytics for smart decision-making, and we can also discuss the potential opportunities for synergy.

About Author

Insights Explorer

If data is oil, then analytics is the combustion engine of this current era.