Sign up to receive latest insights & updates in technology, AI & data analytics, data science, & innovations from Polestar Analytics.

Editor's note: This blog is for retail leaders/enthusiasts who want to gain insights into what trends would impact the USA black Friday sale. In this article, we explore the pivotal role of data in shaping a successful Black Friday sales strategy for retailers. By honing in on historical consumer trends and retail competition trends, businesses can make informed decisions. This piece serves as a timely resource for retailers looking to navigate the complexities of the holiday sales season. Enjoy the read!

The name "Black Friday" comes from retailers moving into profitability (due to sales), signified by recording profits in black ink. Without going much more into history let's just jump to the previous year as it is the most relevant for analysis of upcoming trends.

According to Adobe Analytics, Black Friday spending reached $9.12 billion, marking a 2.3% year-over-year increase (2022). Cyber Monday sales garnered $11.3 billion, reflecting a year-over-year jump of 5.8%.

Despite the pandemic and economic uncertainty, Black Friday in 2022 was successful, with 88 million Americans shopping online. The average order value increased by 9%. Online sales grew by 5% year-over-year.

The holiday season is expected to break sales records, but spending may focus on essential items and discounted products. Shoppers are looking for deals and practical purchases, with electronics sales potentially dampened due to the absence of significant product releases.

From the retailer's perspective

Retailers Prioritizing Experiences: The Hybrid Approach

Retailers are revolutionizing the in-store experience by creating a hybrid of online and offline shopping. Instead of traditional aisles of merchandise, the new shop floor is designed to offer hands-on experiences. Customers can now process transactions online, allowing for direct-to-home shipping. This innovative approach not only enhances customer engagement but also streamlines the purchasing process.

The Emergence of a Month-Wide Shopping Season

Retail giants like Target and Walmart are redefining the traditional Black Friday rush by introducing month-long deals. Target has led the way, offering enticing discounts throughout the entire month, with Walmart following suit starting on November 8th. By extending the sale period, retailers are providing customers with more flexibility and convenience in their shopping experience.

A Survey-Backed Strategy: Catering to Crowd-Averse Shoppers

Recent surveys have indicated that shoppers are less inclined to endure crowded stores during major sales events. This insight has driven retailers to rethink their Black Friday strategies. The decision to extend the sale period aligns with the preferences of modern consumers, who value a more relaxed and spread-out shopping experience. By accommodating this shift, retailers are not only meeting customer expectations but also optimizing their sales potential.

Live Stream Shopping: A Page from QVC's Playbook

Taking a page from the QVC playbook, retailers like Target are implementing live-stream shopping sessions. This innovative approach allows brands to directly engage with consumers in real-time, showcasing products, demonstrating features, and offering expert advice. By leveraging the power of live streaming, retailers create an interactive and personalized shopping experience, bridging the gap between in-store and online shopping.

Interest Rates Affecting Borrowing Capacity for Retailers

High interest rates increase the cost of borrowing for businesses. This leads to a credit shortage as lenders become more cautious. Additionally, businesses have reduced their capacity to invest in stock due to constrained liquidity resulting from higher borrowing costs.

Based on market conditions about spending

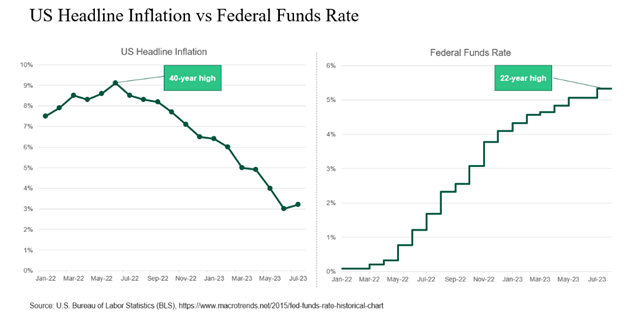

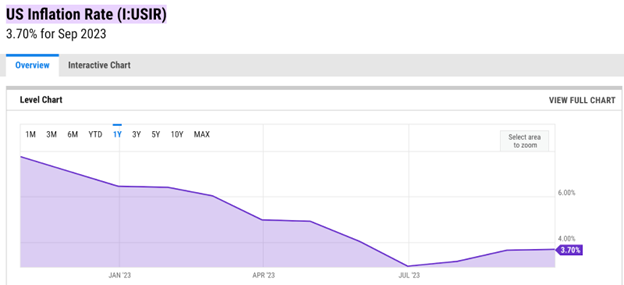

1. Inflation

An inflation cooldown means the consumer purchasing power will be higher as with the same value for money they can purchase a higher amount of basket of goods, thus boosting consumer demand.

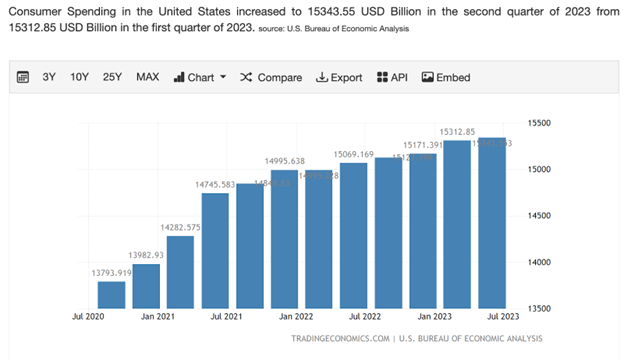

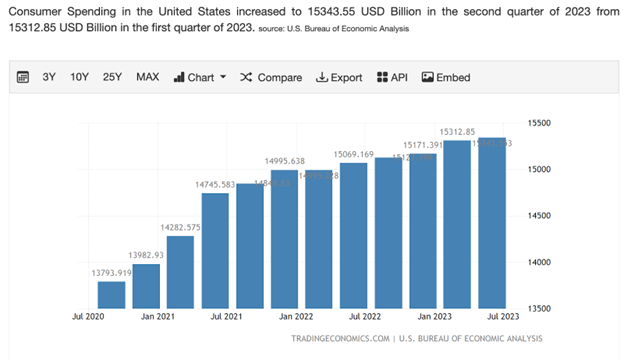

2. Consumer spending

As inflation cooled, both real and nominal consumer spending increased slightly year-over-year. The real spending change rate hovered around 3%, up from 1% in May 2023. Out-of-home entertainment and cosmetic stores saw the largest increases in real spending, followed by the travel segment.

A steady increase in consumer spending is an indicator that for black Friday sales, people will be highly motivated and will have the purchasing power to support that increased enthusiasm.

3. Consumer sentiment

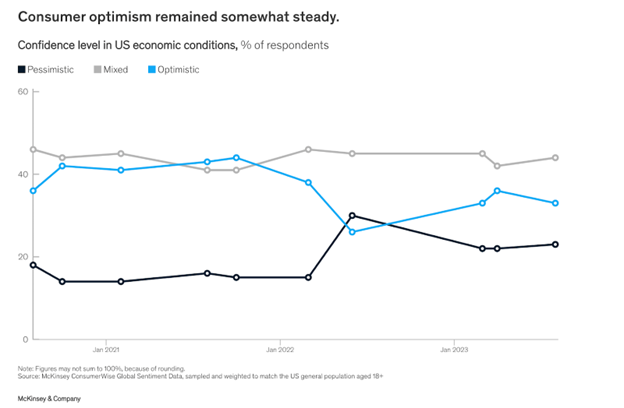

Even though there are fears of war, the overall consumer optimism for the year remains positive overall. This is due to the facts stated above, lower inflationary pressure, and high disposable income. However high interest rates mean that the ability of businesses to capture this demand is still in question/contention.

Despite a slight drop in optimism during the summer, US consumers remained cautiously optimistic about the economy. In the third quarter of 2023, 33% of consumers felt optimistic, while 44% had mixed feelings. Baby boomers showed the most significant increase in optimism, while millennials saw a decline. High-income consumers reported the largest decline in optimism compared to other income groups.

4. Real Spending by Demographic:

Spending growth was consistent across all income and age groups. Real year-over-year spending increased by approximately 3% on average for all segments. Middle- and high-income consumers showed slightly higher growth compared to low-income consumers.

5. Intent to Splurge by Demographic:

Gen Z and millennials, particularly those with middle incomes, expressed a high intent to splurge during the summer. High-income millennials had the strongest inclination to splurge. Intent to splurge was prevalent across age and income groups.

6. Intent to Splurge by Category:

Food and travel remained popular splurge categories. Gen Z and millennials showed an intent to splurge on restaurants, while boomers leaned towards travel. Low-income respondents favored food for home, while high-income respondents preferred dining out.

7. Pandemic-Driven Shifts:

The COVID-19 pandemic significantly influenced consumer behavior, accelerating the transition from brick-and-mortar to digital shopping. According to CNBC, In 2020, online sales saw a substantial increase of 43%, and consumers spent $900 billion more online globally compared to the previous two years.

8. Top Performers:

Retailers catering to consumers with disposable income who sought comfort and convenience during lockdowns, such as Amazon, DoorDash, Grubhub, Uber Eats, and Apple, thrived. Sales of home goods, food delivery, and tech products surged.

9. Cyber Monday Growth:

Cyber Monday spending exceeded Black Friday online spending by approximately $2.4 billion in 2020. Clicks increased significantly, with some days experiencing up to a 300% increase. Sales of desktop devices grew as more people shopped from the office during the workweek.

10. Online vs. In-Store Sales:

In 2021, online Black Friday sales saw a 12.1% increase over the previous year, with a significant 40% increase in in-store sales. Buying online, and picking up in-store (BOPIS) gained popularity. Amazon dominated online sales, followed by Walmart and Target.

11. Black Friday Discount Trends for 2022:

Discounts remain critical, with brands expected to offer competitive deals to attract shoppers. Consider offering bundles, BOGO deals, and flexible payment options like buy now, pay later (BNPL).

These insights provide a snapshot of consumer sentiment, spending patterns, and intent to splurge, offering valuable information for businesses and policymakers to understand and respond to consumer behavior in the current economic environment.

For retailers, staying attuned to consumer trends and monitoring economic indicators allows them to forecast demand for specific sale periods. Employing analytical tools, based on historical data and customer behavior, helps optimize strategies for Black Friday sales, increasing the chances of success during this pivotal event."

About Author

Information Alchemist

Marketeer at heart, story creator by passion, data enthusaist by profession.