Sign up to receive latest insights & updates in technology, AI & data analytics, data science, & innovations from Polestar Analytics.

Editor's Note: Discover the world of Conversational AI in the BFSI Industry, exploring its applications, advancements, and transformative impact. From virtual assistants to chatbots, Conversational AI is revolutionizing technology interaction, offering personalized solutions and enhanced user experience. Join us as we uncover the latest trends with use cases in the BFSI industry.

But have you ever wished for a knowledgeable financial advisor at your fingertips, ready to answer your questions and provide guidance in real-time? Imagine a technology that can make the wish come true. With Conversational AI, this wish becomes a reality.

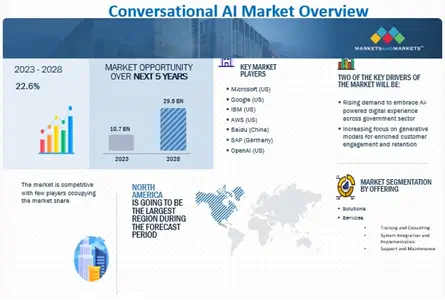

Before we go into the details of the impact of conversational AI in the BFSI market, let’s take a look at what the overall market looks like.

Source: Markets and Markets

The Global Conversational Ai Market size is projected to reach USD 29.8 Billion by the end of 2028 The market size stood at USD 10.7 Billion in 2023 and will exhibit a CAGR of 22.6% during the forecast period, 2023-2028.

This was a showcase of the Swift Advancement of Conversational AI in the market.

According to the Accenture Banking Technology Vision 2019, 79% of bankers believe that AI will have a significant impact on customer communication. The evolving landscape of BFSI, especially in banking, is changing user expectations. Quick and seamless automated support through chatbots and voice bots is no longer seen as a luxury but a necessity.

The growth is tremendous, with Juniper Research predicting a staggering 3150% surge in usage of bank chatbots by 2023.

Conversational AI in the BFSI industry is like having a pocket-sized financial advisor, instantly accessible to answer queries and offer expert guidance in real-time. This ground-breaking technology enables financial institutions to offer a virtual assistant that acts as a knowledgeable advisor, delivering real-time guidance and support, right when you need it.

The BFSI industry is currently experiencing a significant shift towards digitalization, embracing new FinTech and InsurTech services. In this rapidly evolving landscape, banks are recognizing the need to transition from traditional banking approaches to conversational banking strategies.

According to a recent study from Digital Banking Report, a significant majority of 75% of financial institutions are actively exploring the potential of conversational AI, data, and analytics to determine the best strategies for their operations.

This highlights the crucial need for financial institutions to leverage advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) to elevate customer analytics and maintain a competitive edge in the market.

But what exactly is Conversational AI and how can it revolutionize the customer experience in financial services institutions? Let's dive deeper into this innovative technology and discover its potential to transform the way we interact with financial institutions.

Have you ever pondered the mechanics behind engaging with financial institutions using voice commands, text messaging apps, or visual engagement tools?

In Conversational AI, cutting-edge technologies like natural language processing and machine learning come together to create a remarkable synergy, enabling computers to engage with humans in a truly natural and conversational manner. Conversational AI in the finance sector is being used to provide fast, personalized, and efficient support to customers.

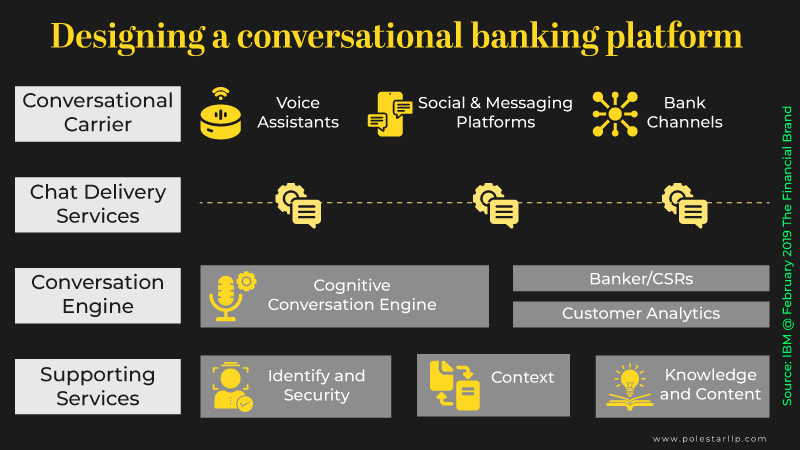

CPaaS (Communications Platform as a Service) and conversational platforms enable conversational banking by providing omnichannel communication solutions with integrated channels and AI capabilities. This allows financial institutes to track, personalize, and learn from customer interactions, delivering tailored support across multiple channels.

Conversational AI bridges the gap between convenience and personal touch on your customer’s preferred channels, enabling direct chat between customers and financial institutions via messaging apps, offering convenience and valuable customer insights for personalized recommendations and relevant financial advice.

It all boils down to the customer experience

Traditional interactive voice system hinders timely resolutions. Users are restricted to choosing from a menu of standard options, with no room for additional inquiries. If a user has a question that falls outside the standard menu, they must contact the bank's contact center. This results in unsatisfactory banking experiences for customers.

Discover the top tech trends revolutionizing customer experience and stay ahead in the competitive landscape.

However, Conversational AI on the other hand prioritizes the user. With real-time, omnichannel conversational tools, smart bidirectional conversations capture customer data at the core. This enhances operational efficiency by successfully guiding and completing user interactions with minimal live agent intervention. Different conversational banking tools enhance user experience like Chatbots, Voice assistants, and In-app banking chatbots.

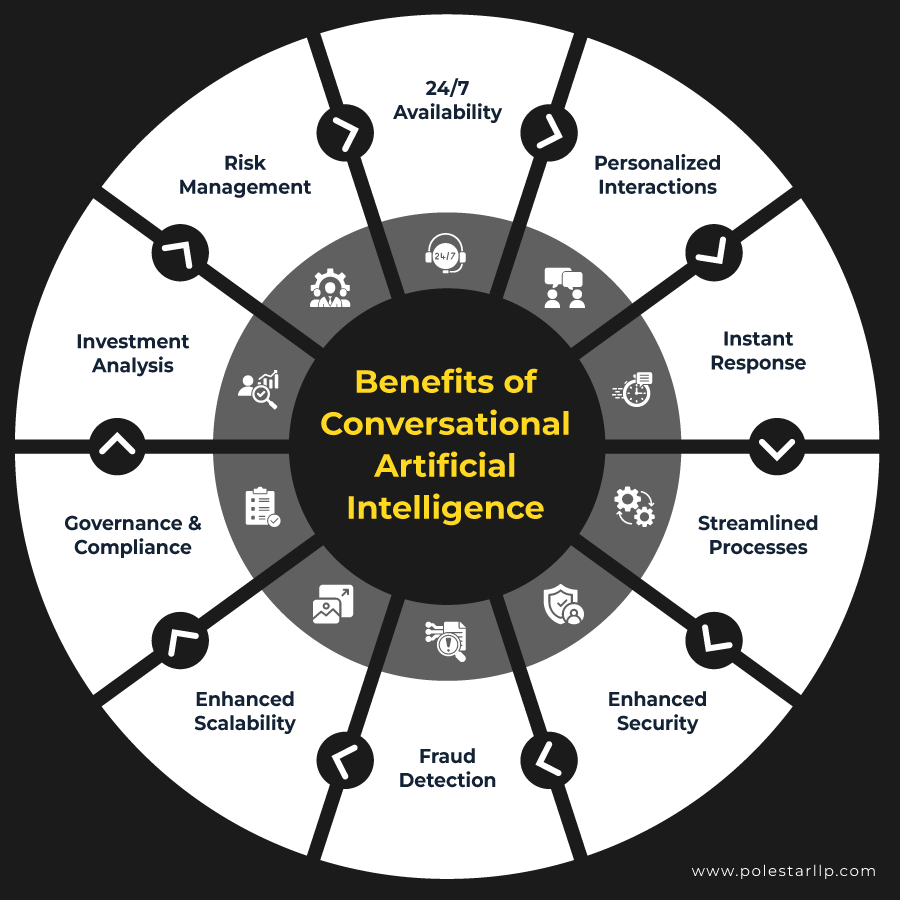

1. Streamlined Processes: Conversational AI can automate routine tasks such as account management, payment processing, and loan applications, making these processes faster and more efficient for customers. This not only improves customer satisfaction but also helps to reduce operational costs for financial services institutions.

2. Enhanced Security: Conversational AI can help to enhance the security of financial transactions by using biometric authentication, reducing the risk of fraud, and increasing customer confidence in the institution.

3. Fraud Detection: NLP (Natural Language Processing) is being used to identify patterns and anomalies in large volumes of unstructured data, helping financial institutions to detect and prevent fraud. For example, NLP algorithms can analyse text data from emails and messages to identify suspicious activity.

4. Scalability: Conversational AI solutions can easily scale to handle increasing customer demands. As the customer base grows, the technology can accommodate a larger volume of queries and interactions without compromising the quality of service.

5. Compliance: Financial institutions are using NLP to analyse regulatory documents and ensure compliance with regulations. NLP can help to identify key terms and clauses in contracts, reducing the risk of non-compliance and associated penalties.

6. Investment Analysis: AI is being used to analyse news articles, social media, and other sources of information to gain insights into market trends and make informed investment decisions. This can help financial institutions to identify opportunities and risks, and to optimize their investment strategies.

7. Risk Management: Advance analytics is being used to analyse financial reports, balance sheets, and other financial data to identify risks and opportunities. This can help financial institutions to make informed decisions and minimize their exposure to risks.

8. 24/7 Availability: Instead of traditional 9-to5 support, Conversational AI chatbots can provide customer support around the clock, which means customers can get their questions answered and problems resolved even outside of business hours. This not only improves customer satisfaction but also helps to reduce the workload of customer support staff.

9. Personalized Interactions: Conversational AI can use customer data to personalize interactions, providing a more tailored experience that meets customers' unique needs and preferences. For example, conversational AI can recommend financial products that are relevant to a customer's financial situation and goals.

10. Instant Response & Reduced Wait Times: Conversational AI can provide immediate responses that help to reduce wait times by automatically routing customers to the right department or representative, ensuring they get the help they need quickly. This helps to improve customer satisfaction and reduce frustration.

Here are the most successful use cases in BFSI Industry

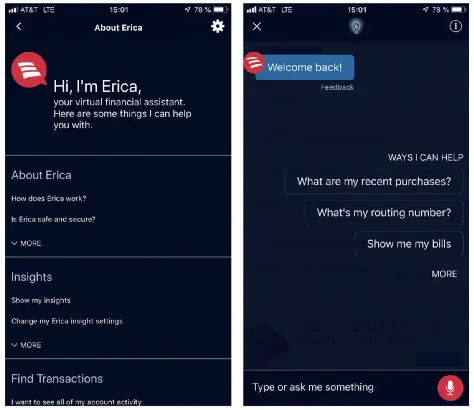

Bank of America: Automated Customer Support

Source: Reve Chat

Bank of America introduced Erica, an advanced virtual financial assistant, to enhance customer support and deliver conversational banking experiences. Erica efficiently manages a range of customer service inquiries, including sending notifications, providing balance information, offering money-saving tips, delivering credit report updates, and facilitating bill payments.

Since its launch, Erica has garnered an impressive user base of over 6 million users and has successfully addressed more than 35 million customer service requests.

First Bank: Personalised Marketing

First Bank, originally an in-person bank established in the 1960s, faced the task of keeping customers informed and engaged in the modern era. To tackle this challenge, they leveraged AI to deliver personalized text notifications and alerts to their customers.

Resulted in nearly 3.5 million text and emails alerts per month including account, credit & balance details, statement availability, payments due etc.

60% of First Bank's online banking customers have opted to receive monthly alerts, adding convenience to their banking experience. Additionally, First Bank utilizes SMS to delight customers by offering complimentary perks such as lunches, treats, and services.

Barclays: Video Chat Assistance

Barclays introduced its Video Anywhere service, revolutionizing the availability of bank representatives across all branches. This 24/7 service enables customers to connect with a video banker using their smartphone, tablet, or computer at their preferred time and location.

Video e-banking has emerged as a valuable tool for fostering stronger customer relationships, facilitating seamless onboarding, and enhancing the sharing of product information. Additionally, it provides flexibility to the workforce by enabling multiple video bankers to be present in a single location.

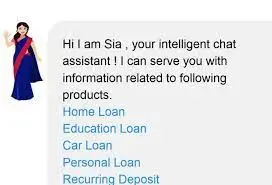

State Bank of India: SIA Chatbot

SBI has introduced SIA, an AI-driven chatbot, from the viewpoint of a customer. SIA is a virtual assistant equipped with artificial intelligence that promptly handles customer queries and assists them with routine banking activities, like the assistance provided by a human bank representative.

SIA, the chatbot, was created by Payjo, a startup headquartered in Silicon Valley and Bengaluru. Payjo reports that since its release, SIA has successfully addressed millions of inquiries from numerous customers. According to a statement from Payjo, SIA has the capability to handle almost 10,000 queries per second or a staggering 864 million queries in a single day. This volume is roughly equivalent to 25% of the queries processed by Google on a daily basis.

In conclusion, conversational AI is a rapidly growing technology that is reshaping the way financial institutes interact with their customers. Market trends indicate a rising demand for personalized, interactive, and real-time seamless customer experiences in BFSI Industry.

Through various channels, such as chatbots, virtual assistants, and voice assistants, conversational AI provides diverse use cases, from customer support to financial analysis, showcasing its versatility and potential to foster business expansion. As conversational AI progresses, financial institutes that adopt this technology can gain a competitive advantage and effectively meet the changing demands of their customers in the digital era.

Let’s get started with your analytics journey. We at Polestar Analytics provide Discovery workshops to review and assess the current state of your analytics infrastructure and provide you with customer-centric solutions.

About Author

Marketing Consultant

Data Alchemy can give decision making the golden touch.