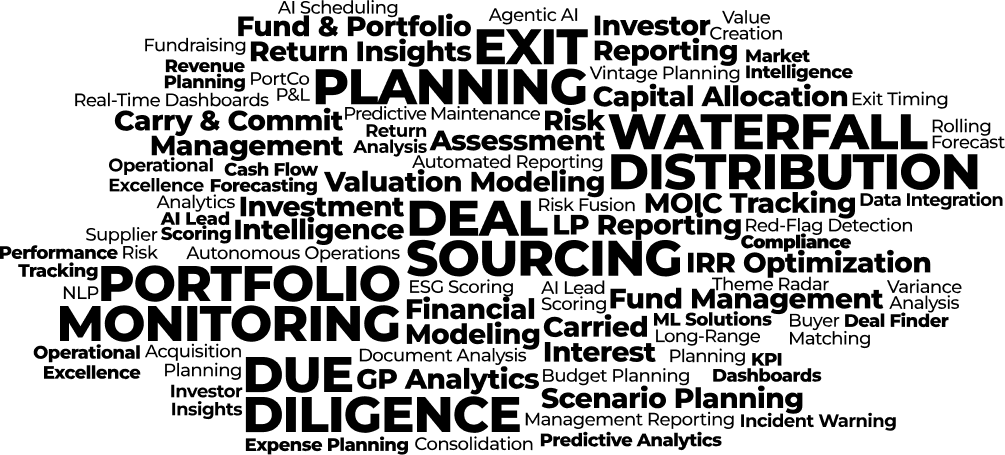

Private Equity Planning & AI Solutions: Fund Modeling to Exit Strategy

Plan Confidently, Invest Wisely, Exit Strategically.

Private Equity firms face mounting challenges—capital raising at 7-year lows, fee pressure, high valuations, time-intensive deal screening, inconsistent data, reactive monitoring, and 4,000+ exits in backlog. Traditional approaches slow critical decisions.

Our solution goes beyond surface reporting. We use connected planning, AI-driven analytics, and advanced modeling to give fund managers a unified view of performance, risk, and exit readiness—including fraud detection—enabling faster, smarter decisions across the fund lifecycle.

We streamline your fund operations with precision planning, smarter modelling, and transparent execution

Plan how much money the fund should raise, map out investments across deals and portfolio companies, and ensure capital is available at the right time for new opportunities.

Strategize exits to maximize returns and use waterfall models to split profits fairly between investors and fund managers.

Run the management company efficiently with clear forecasts of income and expenses across all departments and activities.

Build robust long-term plans and budgets, testing different scenarios to stay prepared for market changes and opportunities.

Centralize all reporting and analytics for management, investor visibility, and carry tracking.

We streamline your fund operations with precision planning, smarter modelling, and transparent execution

Find better deals faster with AI that spots emerging themes, scores opportunities, and surfaces high-potential targets before your competitors.

Reduce due diligence time and remove blind spots with AI that analyzes data rooms, highlights risks, and reveals issues overlooked by manual reviews.

Drive operational excellence across your portfolio with AI that forecasts cash, optimizes resources, and prevents costly downtime.

Maximize exit multiples and meet ESG requirements with AI that automates compliance, detects incidents early, and times exits perfectly.

Portfolio monitored in real-time

Deal evaluations accelerated

Portfolio companies

AUM managed seamlessly

Fund scenarios analyzed

Portfolio companies

Workflow integration

Reduction in reporting cycle time

Source of Truth, Centralized reporting