Sign up to receive latest insights & updates in technology, AI & data analytics, data science, & innovations from Polestar Analytics.

Editor's Note: As interest in leveraging cutting-edge technology and enhancing customer experience continues to grow, the ability to effectively select the correct Cloud Banking service models & strategy has become crucial for organisations. " How are banks modelling ways to the cloud?" provides an ultimate guide to cloud computing in Banking sector. This blog is a must-read for bank leaders looking to stay ahead of the curve in digital transformation.

| "Data analytics is changing the way we do business in BFSI. It is providing new insights and opportunities to improve customer experience, manage risks, and drive growth." - Ajay Banga, President of World Bank

|

In our previous article, you read about how analytics help in banking & financial institutes in different business operations like Sales Analysis, Lending, Payment & Transaction Analysis, Risk Management & Investigation, Financial Planning, Marketing & Product Management. Through analytics, financial institutions may be able to offer a more personalized, proactive, and effective client experience which may eventually result in greater customer satisfaction and loyalty.

However, the banking and financial services sector is still catching up when it comes to providing for customer needs. This resistance to change in the digital world may have a direct effect on how financial institutions treat their clients

According to a recent survey, 80% of consumers say their experience with an organization is just as essential as its goods and services, and 59% of consumers have higher expectations for customer service than they did a year ago.

What does this shift in customer expectations indicate?

1. Financial institutions need to leverage cutting-edge technology now more than ever to provide better customer experiences in real time and for a lower cost. For example, customers are increasingly using their mobile devices for banking transactions. Financial institutions need to leverage mobile banking technology to provide real-time updates on account balances, transfer funds, and pay bills. In a survey by J.D. Power, 31% of customers said they used mobile banking most frequently to check their account balances, and 21% used it to transfer funds. This not only provides convenience to customers but also reduces operational costs for banks. This critical need is challenging to meet for many institutions since it necessitates both the collection and processing of numerous data sources as well as upgrading outdated operational models and legacy technologies. Financial institutions won't be able to stay up with more responsive and creative competition until they update their infrastructures.

When we talk about updating IT infrastructure, it involves replacing these systems with modern, cloud-based solutions that offer better functionality, security, and scalability.

According to Accenture Survey, application modernisation was named as the top priority for end-user cloud adoption in the banking and investment services industries – 94% of banking executives believe that cloud computing in banking is critical to their business strategy, with more than 50% planning to increase their cloud investments over the next three years.

The idea that every business is a technology enterprise was accepted by banks even before the pandemic. They have understood for a while that the cloud is the cornerstone of an effective digital transformation. Banks now have a stronger understanding of the importance of system resilience, agility, adaptation, and scalability in the wake of the COVID-19 crisis's devastation.

The percentage of banking workloads overall that have moved on average to the cloud banking service according to The Accenture Banking Cloud Rotation Index: Profile of 100 Global Banks is as follows:

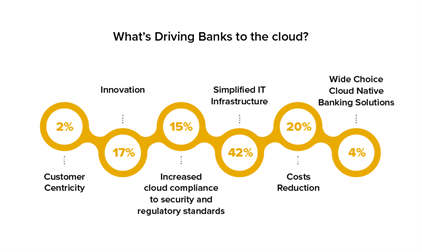

The argument over when and how to embrace Cloud Technologies has been resolved due to Covid-19, which has forced banks to concentrate on the advantages of Cloud Banking services:

1. Better Data Security - Systems security and resilience are being put to an unprecedented test. Cloud computing for banks demonstrates that a bank's operations may run with security as the top priority through updated software. However, in order to make sure that the goal is fulfilled, it is crucial to pick a cloud computing service that complies with the requirements like:-

Banks use cloud adoption to leverage long-term infrastructure cost reduction, reinvesting annual savings in expanding the business. They have the option of switching to a significantly higher percentage of variable vs fixed technology expenditures. Given the rising expenses of maintaining old technology, this is becoming increasingly appealing.

According to Accenture Survey, banks moving their applications to the cloud results in 10–20% reduction in operational costs. Additionally, because of the distinctive features of cloud computing, financial institutions are free to pick and select the services they need on a pay-as-you-go basis.

3. Operational Efficiency - A banking organisation is significantly more efficient when using a cloud environment. Banks can gain the following advantages by hosting their services on the cloud:

The institutions may concentrate on reducing their fixed and variable costs with 99% uptime guarantee by hosting financial portals in the cloud.

4. Green IT - Transferring banking functions to the cloud reduces the consumption of energy and carbon emissions. Additionally, it reduces idle time, which increases how effectively computer power is used.

According to a study by Microsoft, Cloud Computing in banking and financial services can lower organisations' per-user carbon footprints by up to 90% for small firms and 30% for large enterprises.

5. Gain Competitive Advantage - FinTech and challenger banks are taking advantage of the cloud's speed, agility, and wide range of service options to enter markets with cost-effectively innovative services. The adoption of the cloud empowers incumbents to quickly counteract these digital attacks.

6. Ensures Business continuity - Financial organizations can benefit from faster product development cycles because of the flexibility of cloud-based operational models. This encourages a quicker and more effective response to banking customer needs. The initial setup time is reduced since less infrastructure expenditure is needed because the cloud is available on demand.

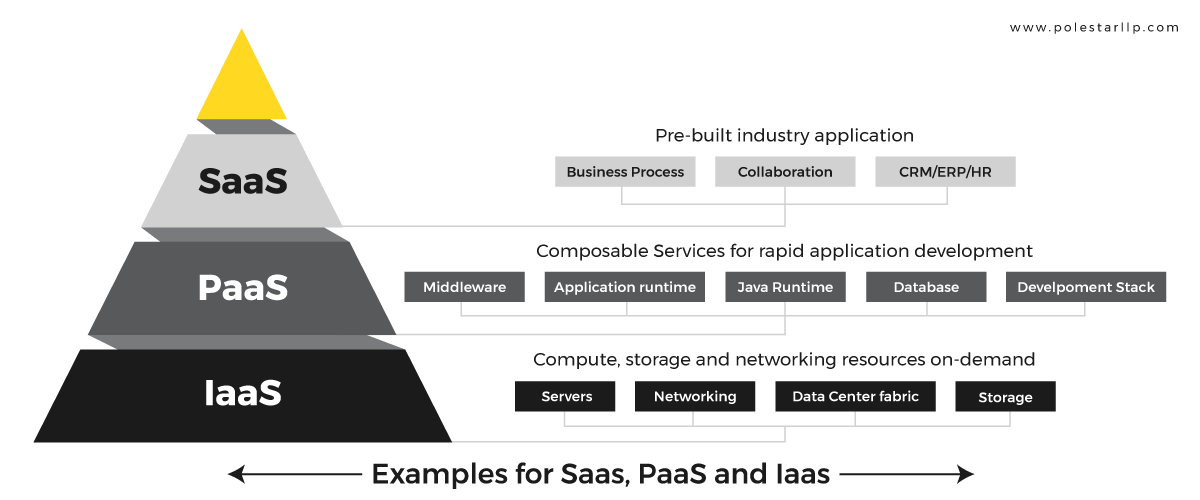

Choosing the appropriate cloud computing architecture, however, is essential for a smooth cloud development and integration process. Financial institutions have the choice to switch from a capital-intensive strategy to a more adaptable business model that reduces operational expenses due to cloud models. In this section, let’s discuss alternative models of cloud computing services, operations, and deployment.

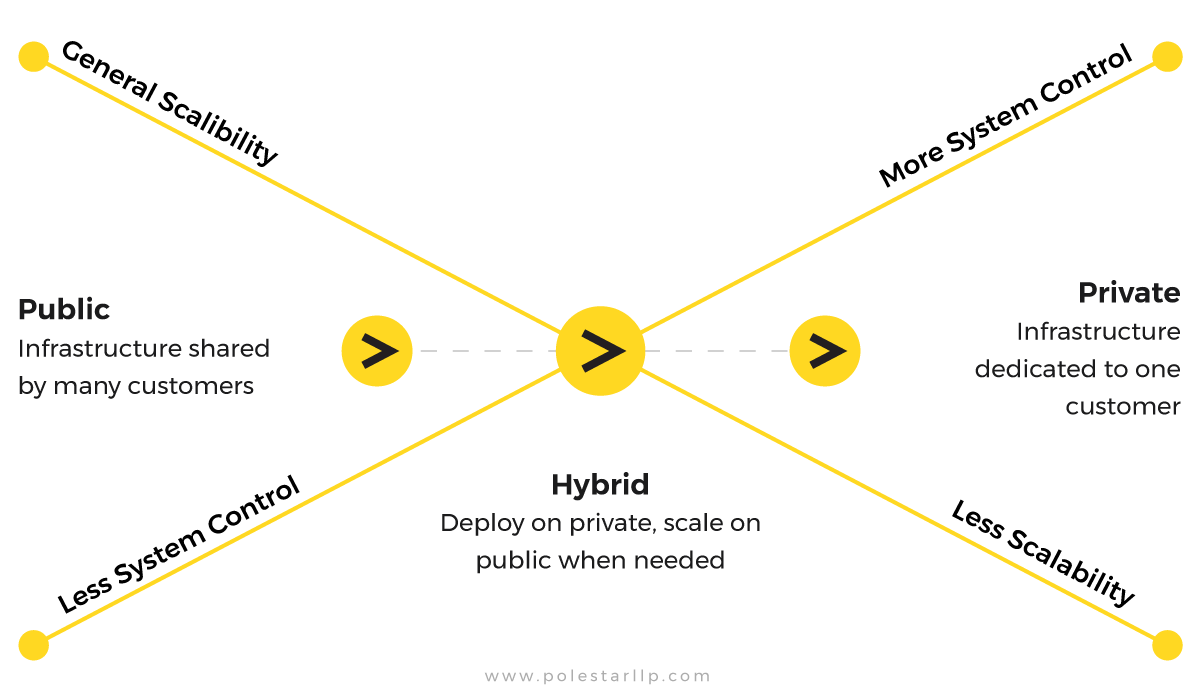

In Public cloud service, IT architecture makes use of the public Internet to share infrastructure and on-demand computing capabilities among numerous organizations. Microsoft Azure and Amazon Web Services (AWS) are two examples. Banks can elastically scale their service consumption in response to business demand but may cause data sovereignty and privacy issues, which some institutions are worried about.

In order to protect themselves, banks typically establish a Private Cloud Service, and secure connection with the cloud service provider, such as through AWS Direct Connect or Azure Express Route. Cloud infrastructure is run exclusively for one particular business. In this model, a bank might have more control over its infrastructure as the security level is the highest, but it will not have access to the public cloud's scalability, economies of scale, and flexibility.

A hybrid cloud combines private and public cloud services. Utilizing cloud services from several service providers, whether public or private, is referred to as multi-cloud. Banks can benefit from cost arbitrage between competing cloud service providers using hybrid and multi-cloud architectures while minimizing the risks associated with vendor lock-in.

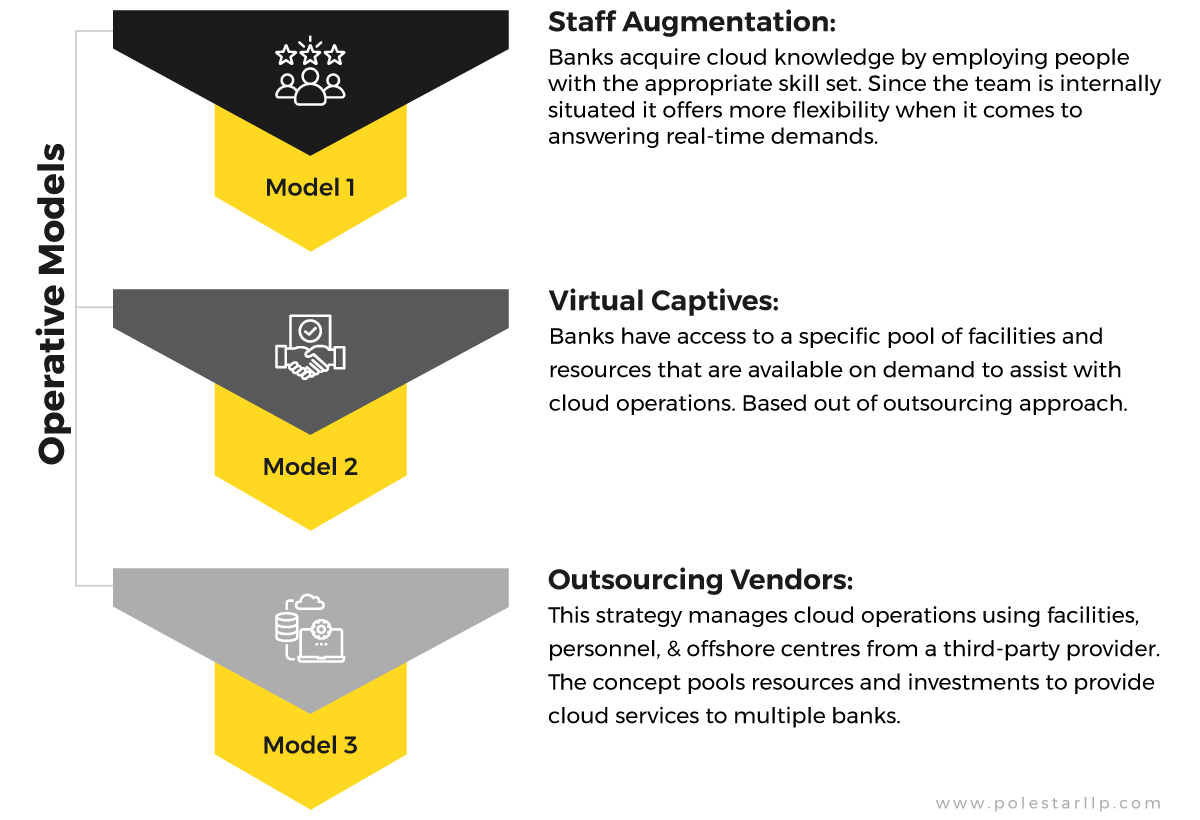

The third consideration in selecting the ideal cloud delivery model is selecting the ideal cloud operating model for the necessary combination of resources and assets.

Here it is,

Microsoft created the 6-5-N architecture as a cloud migration approach. The framework is intended to assist businesses in organizing and carrying out a smooth migration to the cloud. An outline of the 6-5-N framework is given below:

6 Actions: It is a three-dimensional matrix that considers six actions on a horizontal axis, including: -

5 Perspective: 6 actions, each with 5 perspectives. These perspectives include: -

N Iteration: N depicts the several iterations over the lifecycle of a cloud strategy. It's possible that cloud strategy will need to be iterated and changed over time. The strategy might need to be reviewed and revised in order to continue serving its purpose moving forward whenever significant new business demands, new apps, new technology stacks, new processes, new governance requirements, or new insights from early cloud implementations are discovered.

The 6-5-N framework's flexibility and adaptability enable businesses to customize their cloud migration approach to meet their unique requirements and objectives. Organisations may reduce risk, maximize the advantages of cloud computing, and complete a successful migration to the cloud by adhering to this framework. For more details, detailed documentation is available at ‘A Framework For Developing Cloud Strategies’.

| Banks can select a cloud model that fits the needs and objectives of their organisation and complete a successful cloud migration by using the 6-5-N framework to direct the decision-making. |

Clouds are not brand-new. However, many established banks have just dabbled in it. Due to technical complexity, compliance and data sovereignty issues, and a fear of change, a large fraction of workloads continue to run in on-premises data centers. Banks that don't move most of their workloads to the cloud are losing out on chances to improve their organization's productivity, resiliency, and customer-centricity.

Polestar Analytics can help your organisation choose the right cloud model and cloud banking strategy for better building infrastructure that will be flexible, secure, and cost-effective for delivering innovative services and solutions to customers.

As a part of Cloud Computing Services, Polestar Solution provides multi cloud banking solution with Consultation, Cloud Data Analytics & Implementation, Cloud Migration Strategy and Cloud Operations Strategy.

About Author

Marketing Consultant

Data Alchemy can give decision making the golden touch.