Sign up to receive latest insights & updates in technology, AI & data analytics, data science, & innovations from Polestar Analytics.

Editor Note: The automotive industry will remain vulnerable to global headwinds in 2023, including virtual showrooms, the rising number of electric vehicles on the roads, and easy finance options. From advancements in the assembly line to innovations in the supply chain to personalizing marketing content, automobile organizations are smartly leveraging technology to entice their prospects.

Through this blog look at the bright spots of what automotive has to showcase this year and beyond. Take a dig at all these trends.

With fast-paced technological advancements, changing customer behavior, and increasing market competition due to the ingress of many new players, the automotive industry is entering fast into a revolutionized age. Subsequently, with exponential enhancements in autonomous driving, electric vehicles, machine learning, cloud computing, networking, and blockchain, customers are blessed with a value-added experience.

Moreover, fuelled by the operations and disruption in the supply chain during the pandemic outbreak, the industry players are chalking out new and strong business strategies to stay relevant in this cut-throat competition.

Technology has opened up a wide array of opportunities for automakers to explore emerging trends like virtual showrooms, the rising number of electric vehicles on the roads, and easy finance options. From advancements in the assembly line to innovations in the supply chain to personalizing marketing content, automobile organizations are smartly leveraging technology to entice their prospects.

The Internet of Things makes connected cars safer and more comfortable. They provide a convenient multimedia experience with on-demand features that allow drivers to do whatnot on the web while driving the vehicle. Connected cars can communicate bi-directionally with various other systems and share internet access and data devices outside and inside the vehicle. These cars can share information and monitor services such as - remote diagnostics and digital data, vehicle health reports, access to 4G LTE Wi-Fi Hotspots, data-only telematics, turn-by-turn directions, and car health glitches that allow the user to prevent breakdowns.

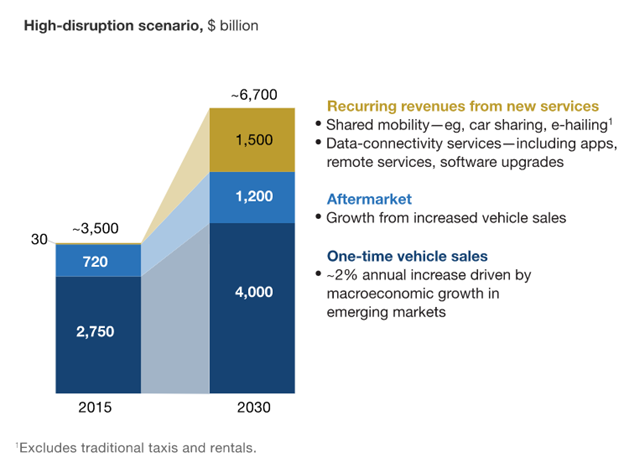

Changing consumer preferences, tightening regulations, and technological breakthroughs add to a fundamental shift in individual mobility behavior. The automotive revenue pool will crucially increase and diversify toward data-driven services and on-demand mobility services. This could curate up to $1.5 trillion—or 30% more—in additional revenue potential in 2030, as compared to about $5.2 trillion from traditional car sales and aftermarket services/products, up by 50% from about $3.5 trillion in 2015.

Source: McKinsey & Company

Connectivity, and later autonomous tech, will increasingly provide the car to become a platform for passengers and drivers to utilize their time in transit to devour novel services and media or dedicate the freed-up time to other personal activities. The accelerating speed of advancements, especially in software-based systems, will need cars to be upgradable. As shared mobility services with short life cycles will become more common, customers will be constantly aware of technological advancements, increasing demand for upgradability in privately used cars.

To make it even easier for consumers to purchase vehicles, automotive companies are exploring numerous options to make the entire buying process online via virtual showrooms. The requirement for the virtual showroom rose tremendously during the pandemic outbreak while there were restrictions on physical movement. After the pandemic, consumers' inclination towards online shopping, even for cars, prevailed. Virtual showrooms are favored by automobile organizations mostly because they make sales effortless and unburden overhead and infrastructural costs allowing retailers to offer lucrative deals and competitive prices. Virtual car tours, online documentation, and secure payment are other benefits of online purchasing.

Data analytics presents the perfect opportunity for car dealerships that are ambitious and ready to take advantage of technology to stand out from their competition. Auto retail analytics allows dealerships to monitor customers' movements from one showroom area to another. Besides that, analytics and behavior-sensing technology enable dealerships to develop heat maps and place digital signage or cameras in an area with the most traffic. In conjunction with an interactive display, for instance, you can target the millennial audience with product and messaging that aligns with their needs.

Leveraging behavior prediction technology can empower auto retail sales teams to work smarter and put the right resources and messaging to help dealers be ahead of the industry curve.

Stricter emission regulations, widely available charging infrastructure, lower battery costs, and increasing consumer acceptance will create new and robust momentum for the penetration of electrified vehicles (plug-in, hybrid, fuel cell, and battery electric) in the coming times. The pace of adoption will be determined by the interaction of customer pull (partially driven by the total expense of ownership) and regulatory push, which will vary enormously at the regional and local levels.

By 2030, the share of electrified vehicles could go up from 10% to 50% of new-vehicle sales. Adoption rates will be on top in densely developed cities with strict emission regulations and consumer incentives (special parking, tax breaks, driving privileges, discounted electricity pricing, and more). Sales penetration will be slow in rural areas and small towns with higher dependency on the driving range and low levels of charging infrastructure.

Through continuous improvements in battery technology and expense, the local differences will become less pronounced, and electric vehicles are expected to gain more market share from standard vehicles. With battery prices potentially decreasing to $150 to $200 per KW-hour over the next 10 years, electrified vehicles will achieve price competitiveness with traditional vehicles, creating the most crucial catalyst for market penetration. In the same manner, it is significant to note that electric vehicles involve a large portion of hybrid electrics, which means even beyond 2030, the internal-combustion engine will remain very pertinent.

Therefore, in the next few years, the automotive industry is set to change more than it's changed in the past 100 years. Electric vehicles, self-driving technologies, and new software-first automotive companies like Tesla, Uber, and Carvana will draw the headlines. Still, seismic shifts are happening just under the surface too.

Some important ones to watch include the shifting role of car dealers, the new thinking required for maintaining and repairing electric vehicles, software becoming a critical core competence for automotive companies, and inspections becoming digital.

In case you're looking out for Automotive analytics solutions, reach out to us at Polestar Analytics.

Hold onto your seats it's going to be a fantastic ride!

About Author

Content Architect

The goal is to turn data into information, and information into insights.