Editor’s Note: The blog explores the pivotal role data plays in fueling collaboration among suppliers, distributors, and retailers. We explore not only why data is important but also highlight the pain points faced in harnessing its full potential. Moreover, by identifying KPIs and best practices, we provide a roadmap for businesses to maximize the value derived from the data assets.

Do you know that organizations that diligently utilize supplier, distributor, and retailer data have experienced a 25% decline in extra inventory and a 30% reduction in out-of-stock circumstances, contributing to improved customer loyalty and satisfaction?

Picture this: You're the CEO of leading Alcoholic beverage brand. Your new line of breweries is about to get hit in the market, but sales require to be sturdier a month after the launch. You muddle up to understand why. Distributors report desolate shelves; however, retailers claim they are fully stocked. Have you ever wondered where's the disconnect?

Let's just say, a leading CPG brand is coming up with a new product line. The success of this venture not only depends on the quality product but also on understanding customer preferences, the effectiveness of the supply chain, and market trends.

This scenario is regrettably not uncommon in the CPG sector. Shattered data across the supply chain- from suppliers to distributors to retailers - curates blind spots that can impede even the most well-designed marketing campaigns. However, what if you could see the complete picture?

In the present connected data-driven scenario, leveraging the power of supplier, distributor and retailer marks the CPG's success. Without further ado, let's explore why data is significant, highlighting the pain points, and KPIs to unbolt its complete potential.

The Essential Trio: Why Each Data Point Matters

1. Supplier Data

At the heart of any CPG company lies its suppliers. These are the entities responsible for providing the raw materials and components necessary for manufacturing. The importance of supplier data must be balanced, as it influences product quality, production timelines, and overall operational efficiency.

Maintaining a database of supplier data enables CPG companies to monitor and ensure the quality and compliance of raw materials. This is paramount in a sector where products safety and consistency are significant. By leveraging supplier data, organizations can identify potential risks, track performance of their suppliers, and take actionable measurements to maintain high standards.

Additionally, it also look at the complexities of the supply chain. From lead times to production capacities, having accurate and up-to-date information about suppliers allows CPG companies to optimize their supply chain processes. This visibility helps reduce lead times, manage inventory more effectively, and ultimately enhance responsiveness to market demands.

Generally, supplier data bounds this significant product info:

Stock Keeping Units (SKUs): Typically, identifiers that track products across the supply chain, help retailers manage inventory and sales.

Product Descriptions: Clear and acute descriptions that inform consumers regarding the product's advantages, features, and intended utilization.

Specifications: In-depth technical information that helps customers to make informed and intelligent purchasing decisions.

Images and Videos: Visual assets that showcase the product from multiple angles, improving the customer’s understanding.

2. Distributors

Well, distributor data offers valuable insights into the movement of your product, but it focuses on the supply side rather than the demand side. This means it primarily tracks your product's journey from the distributor to the retailer, not its performance at the retail store.

While distributor data won't tell you how many units are sold to consumers (known as sell-through data), it typically includes details like shipment information, revealing which retailers received your product and when. Additionally, it often provides inventory data for the distributor's warehouses, allowing you to track how much stock they hold at any time. This information can be crucial in understanding the overall distribution landscape of your product, pinpointing where it ends up, and gauging the volume of product flowing to each retailer.

3. Retailers

Retailer data provides a window into consumer behaviour by capturing scan data (items purchased at checkout) and sales data (total sales volume per store). This allows retailers to analyze product performance, identify top-selling stores and their locations, and gauge the effectiveness of marketing efforts and pricing strategies. Additionally, retailer data may include inventory information, revealing stock levels at warehouses and individual stores. This data-driven approach provides retailers to make informed decisions, optimize operations, and drive business growth.

Common Pain Points: How brands can accomplish more with data

1. Data analysis takes time: CPG businesses generate extensive daily data, and consolidating this information can prove to be time-consuming. Given a typical CPG manager's many responsibilities, delving into this level of data may be a complex task. Additionally, managing multiple data sources further complicates the analysis process. The automation solutions help streamline the manual report-pulling process and facilitate the extraction of valuable insights, empowering more informed decision-making.

2. Skill requirements: Joining, cleaning, and analyzing data require a specialized skill set. Many CPG companies need help finding professionals with the expertise to navigate complex datasets. This shortage of skilled talent can lead to incomplete or accurate analyses, undermining the reliability of the insights derived from the data. So, tools that automatically clean and analyze retail data can help you get more accessible, faster, and more accurate analysis.

3. Technological limitation: CPG businesses have ever-growing datasets that must be analyzed, stored, and secured. Outdated technology infrastructure can pose a significant barrier to effective data utilization. Legacy systems may need more compatibility and processing power to handle the volume and complexity of modern data sets. So, brands must upgrade to data warehouses that can handle the increasing volume. That means brands need to upgrade their data processing tools that can quickly query large amounts of data.

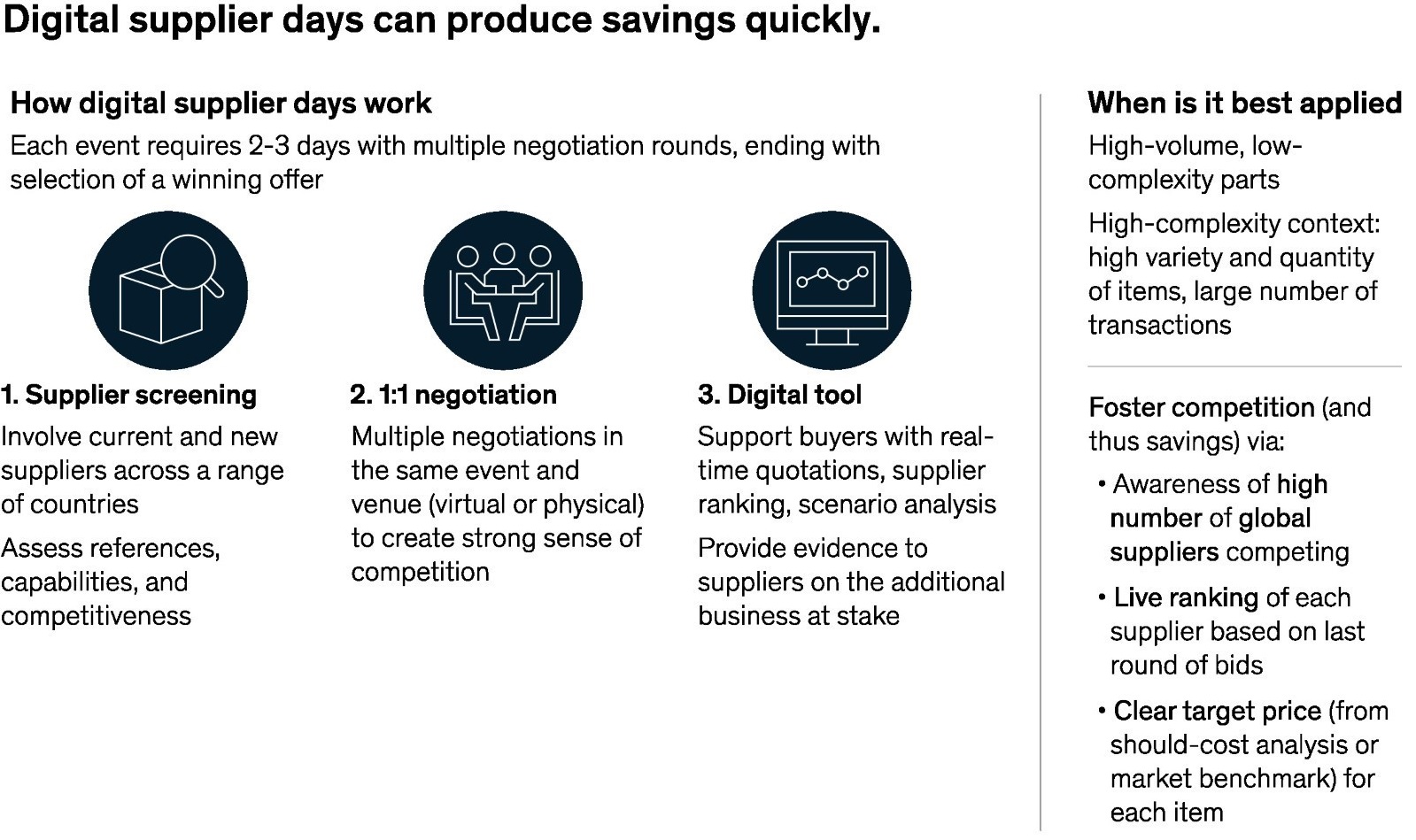

4. DIY Data Pipelines Are Expensive to Develop and Maintain: As the volume of data generated by businesses expands, it becomes imperative for brands to make substantial investments in the development and upkeep of their do-it-yourself (DIY) data pipelines. However, numerous companies need help with both technical know-how and essential resources for constructing and managing their data ingestion engines. Creating a comprehensive data pipeline entails significant financial commitments, reaching into the millions of dollars, and demands teams of highly proficient engineers and data scientists to ensure ongoing maintenance. This is particularly crucial as vendor portals undergo updates, new data is integrated, or disruptions occur.

Now that you know the bottlenecks and how to access your CPG data easily and often, here are the metrics you'll want to keep on hand:

Top KPIs for Suppliers, Distributors, and Retailers

1. Velocity

Many brands would expect to find velocity, which measures units sold per store per week, at the forefront of the must-have list. It stands as a key indicator of CPG growth, providing insights into the effectiveness of brand initiatives in accelerating product sales and identifying stores that may require extra support. Tracking velocity regularly intervals at the store, brand, and product-level assist you:

Velocity serves as a potent storytelling tool for CPG brands aiming to secure partnerships with new retailers and fortify relationships with the current ones. When you get granular, velocity tells CPG teams what's working and what's not. Velocity data provides comprehensive insights, revealing the success of promotions and pinpointing the geographic regions where product performs exceptionally well. These valuable findings can be leveraged to foster additional growth for your brand.

For instance, a tea-selling company realized that one of its slower-selling products nationally was a significant success in the Northeast. With ready access to this data, the company promptly devised a regional product mix and promotional strategy instead of opting to remove the SKU from stores.

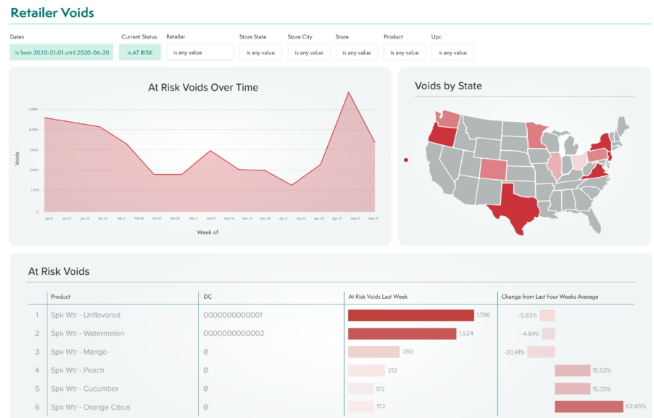

2. Voids

Voids is a state when a product should be accessible to customers and selling but isn’t. Retail voids happen for multiple reasons, typically when the product is:

These gaps can erode the distribution progress you've worked hard to achieve and negatively affect your overall sales. Identifying the root cause of consistent sales disruptions is essential. Once identified, it is crucial to address the issue by promptly communicating with your distributor, retailer, or broker to rectify the situation.

3. Distribution

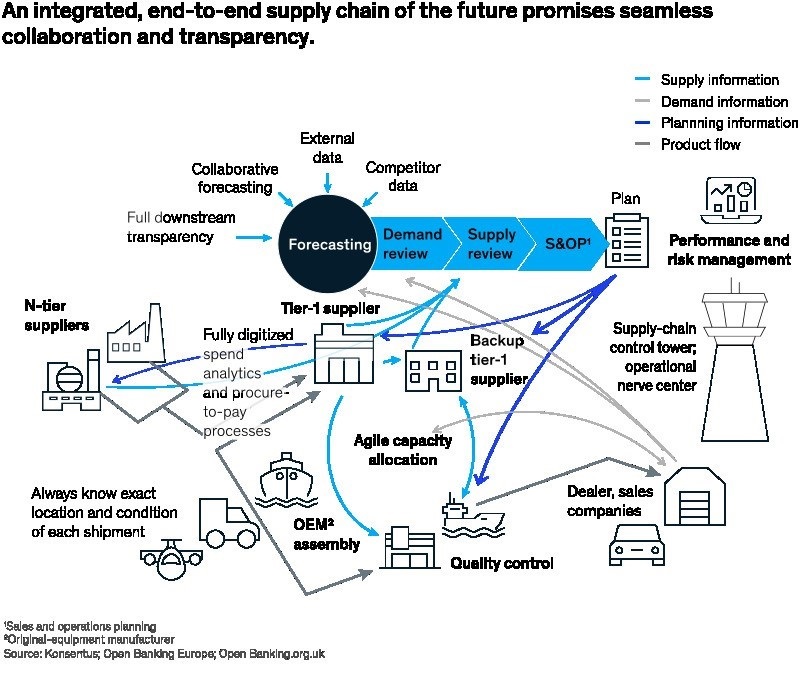

Timely distribution data helps you track where your product is carried weekly and can be broken down into geographic regions, retailer locations, and more. Examining a product's distribution strategy and channels in detail allows CPG brands to pinpoint opportunities for enhancing logistics.

Moreover, CPG brands want to work with savvy suppliers on top of their distribution channels and strategy. By minutely observing distribution activities, they can make well-informed decisions regarding upcoming promotions, maintain optimal shelf stocks, and identify new opportunities to enhance various metrics, such as velocity.

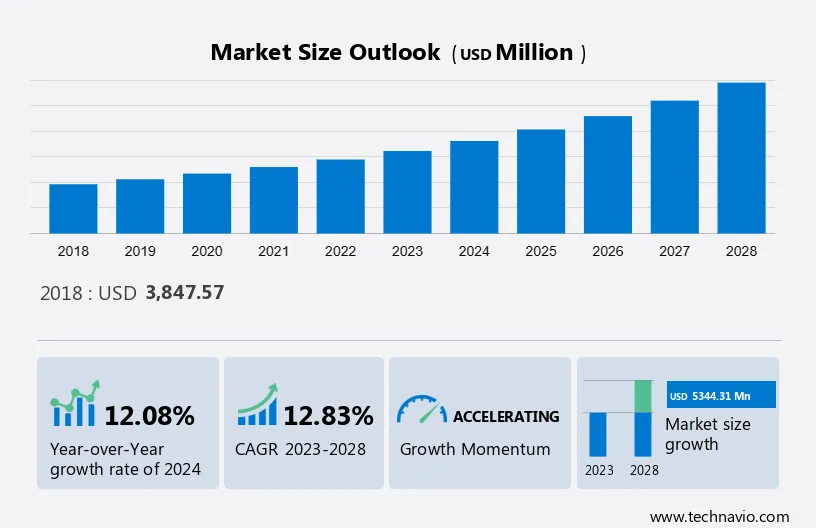

4. Supply Chain

Supply chain data assist businesses to measure the efficiency with which all your products get where they are required to go - from your warehouse to distribution centers to retail stores. With supply chain data at disposal, CPG teams can establish resilient supply chain processes driven by precise data triggers or KPIs, such as specific inventory levels or out-of-stock rates. When these triggers are activated, you'll have a plan to respond—whatever the situation. With prompt data and response processes at disposal, CPG teams can stay lean on forecasting, inventory, and planning, which assists reducing waste and improving cash flow.

Final Thoughts

As the market landscape evolves, CPG brands must recognize the transformative power of data in driving success. Despite the common pain points associated with data analysis, adopting best practices and leveraging advanced technologies can position brands for sustained growth and competitiveness.

Therefore, by unwinding the hidden insights within supplier, distributor, and retailer data, CPG companies can optimize their supply chain, make informed decisions, and meet the cut-throat demand of present-day consumers.

The future towards data-driven excellence needs collaboration, commitment, and a strategic approach to analytics and tech adoption. As the industry evolve, organizations prioritizing data as a strategic accelerator will emerge as leaders in the competitive CPG industry. At Polestar Solutions, you can get in touch with us to explore supply chain possibilities.