Last Updated : 13-June-2023

Editor's Note: In today's rapidly changing economic landscape, it is crucial for businesses to stay informed and proactive in addressing the challenges posed by inflation. By leveraging the power of retail analytics, our blog post delves into the pressing issue of inflation and offers valuable insights and actionable steps for retailers to navigate this challenging environment.

Introduction

Just when we thought it was safe to step back in the game, retailers have been feeling the heat again as inflation lands like a thud in the retail industry.

Inflation has resurfaced in the retail industry, eroding already frayed customer loyalty and causing elevated storage fees, cash flow disruptions, lower revenue, inventory surplus, and shrunken margins. While the National Retail Federation and analysts continue to predict that US retail sales will increase by between 6% and 8% this year, the impending uncertainty around the impact of inflation has left both consumers and retailers searching for answers about the future of the retail business.

Early in 2022, global inflation is anticipated to hover around 5.0% before progressively decreasing in response to a fall in the price of industrial and agricultural commodities. The global consumer price inflation also reached its peak from 2.2% in 2020 to 3.8% in 2021, will average at 4.1% in 2022, and then will decline to 2.8% in 2023. While all retail sectors have been facing inflationary pressures, let’s look at how inflation rattled these key retail industries to the core.

Key Retail Industries Affected By Inflation

Despite the Russia-Ukraine situation, the rising global interest rate, and the growing cost of fuel, the fast-moving consumer goods (FMCG) industry will keep expanding. In fact, the pandemic-hit countries witnessed a significant increase in demand for consumer packaged goods.

However, due to the scarcity of essential resources like cooking oil, tea, etc., the FMCG industry will experience an increase in commodity prices. A lot of FMCG companies have been facing constant pressure to increase their prices as a result of supply chain disruption. A Fortune 500-listed food and beverage firm, Mondelez announced a 6-7% price rise.

The Pharma industry is regarded as an essential commodity and thus significantly affects the household budget. From July 1, 2022, through June 30, 2023, Vizient predicts that medicine prices will rise by 3.09%. It demonstrates how the price of prescription drugs is directly impacted by inflation. Notably, retail costs for some popular prescription medications are projected to rise by a rate twice that of inflation. Since there has been increased demand for pharmaceutical drugs since the COVID-19 pandemic, consumers' overall demand and spending in this industry will stay the same.

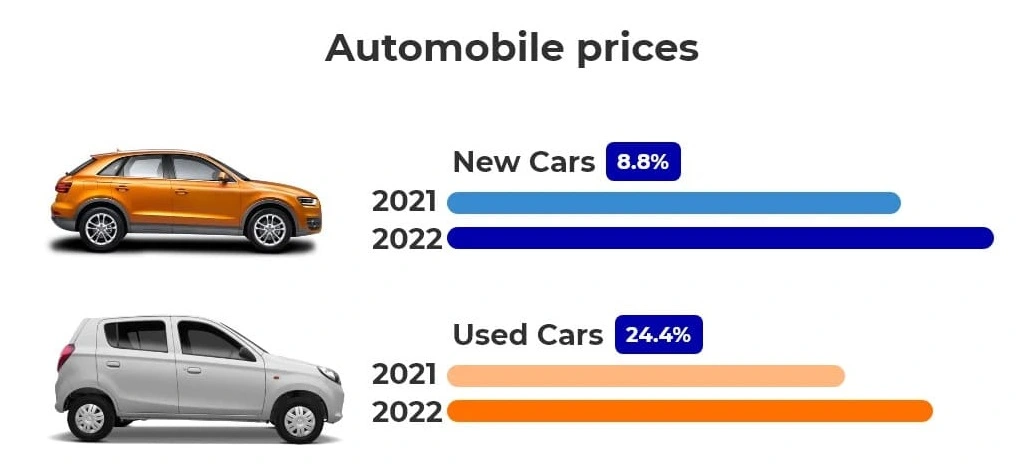

With the onset of the COVID pandemic, inflation has hit the automobile industry with full force. A shortage of semiconductors led to a notable rise in both used and new cars. A report by the Bureau of Labor Statistics reveals that there has been an 8.8% increase in the cost of buying a new car while a 24.4% increase in the cost of used cars.

There is no question that inflation is dominating the retail industry, leaving customers tight on pockets to put toward discretionary spending and everyday expenses. Retailers must build a comprehensive strategy and take action to obtain a competitive advantage by turning inflation challenges into opportunities as costs rise across the value chain, from raw materials to labor and transportation.

Although there is no magic solution to this issue, retailers can adopt a number of innovative actions to curb inflation and spur a step-change in performance to preserve their margins. We’ve listed below 6 key ways retailers can consider to combat inflationary pressures and stay afloat even as the retail sector faces lower customer demand, surging fuel prices, increased costs, reduced bottom lines, and instability.

Navigating Inflation: Six Key Ways For Retailers To Consider

1. Enhance supply chain visibility

Retailers can optimize supply chain and distribution by rerouting shipments through less expensive ocean lanes and ports, creating strategically placed fulfillment centers that reduce last-mile expenses, and balancing labor costs. Retailers can also consider third-party logistics partners for delivery in order to cut costs and capital outlays, enhance operations by leveraging advanced technology and expertise, and find ways to strengthen the distribution network.

With automated supply chain solutions, retailers can use extra in-store inventory to meet online orders, gain end-to-end visibility into online and offline inventories, and enhance overall customer experience.

2. Harness predictive analytics for accurate sourcing

It is more important than ever to stock the right quantities of in-demand products during an inflationary period. Understocked inventory will cause you to lose business in a volatile environment and excess inventory will result in money and warehousing space stuck in dead investments. To ensure accurate inventory sourcing at the right time, predictive analytics helps retailers gain real-time insights into historical data, customer trends, and shopping preferences.

3. Explore digital sales channels

Retailers must consider both online and offline channels in order to combat inflation and prepare for a channel-agnostic buying experience. Despite the fact that many retail companies increased their eCommerce operations during COVID-19 and improved omnichannel operations by providing curbside pickup, BOPIS, and touchless delivery, the future of retail is much more technologically sophisticated, evolved, and diverse.

Consider the metaverse, the newest virtual society for brands and retailers to explore and bring immersive experiences to customers. Gucci, Forever 21, Nike, Louis Vuitton, Tommy Hilfiger, Burberry, and other retail brands have already dipped their toes in the metaverse and sold their products virtually through integrations and stores.

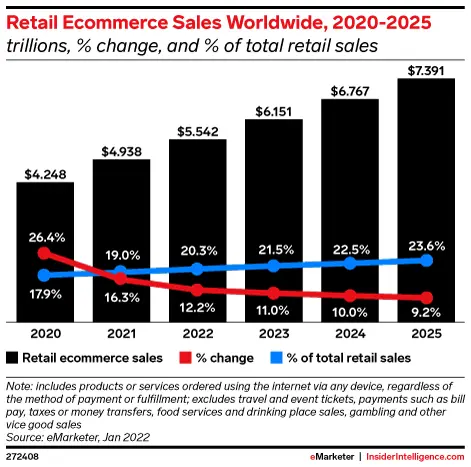

According to a recent eMarketer analysis, online retail sales will account for 20.3% of all retail sales globally in 2022, totaling $5.542 trillion, and 23.6% of all retail sales globally in 2025, totaling $7.39 trillion.

Web3 and the metaverse are already on their way to bringing a radical shift in the retail landscape. Businesses may test these platforms and develop new ways to sell their products against inflation.

4. Channelize pricing solutions to enhance margins

Consumer spending power is directly impacted by inflation and the recession. A single mistake in pricing can significantly affect margins and conversions as retailers compete to offer customers the best deals possible. Given the implications, an effective retail data analytics approach should drive pricing decisions.

Retailers need data that promises speed, accuracy, and insights from many first and third-party sources, checking the 3 Vs of eCommerce data ( variety, volume, velocity) instead of relying on historical data. To gain a competitive edge, retail organizations require an automated pricing solution that can monitor, assess, and adjust prices in response to competitors.

5. Improve Inventory Management

Leverage demand forecasting and inventory management to keep inventories flexible. Modern demand forecasting algorithms enable retailers to predict sales patterns that endure year after year. Retailers can use AI-powered demand forecasting to gather information on trends, seasonality, and other distinct demand drivers. Even in unforeseen conditions, demand forecasting can help retailers avoid overstocking underperforming items while always having their best sellers available.

A few examples:

The Wall Street Journal reports that the Gap is overstocked with joggers, sportswear is piled up at Macy, and Kohl's is overstocked with fleece.

These stores are stuck with surplus inventory because retailers did not expect to see a massive shift in shopping preferences - the way consumers are shifting their preferences from home improvement accessories and casual outfits. These retail stores reiterate how predictive analytics can prove beneficial to sourcing the right inventory at the right time.

An effective inventory management system can also compute profit margins and other KPIs, propose ideal order quantities, automate vendor relationships, find optimal prices, and offer valuable insights into product performance. With advanced allocation and replenishment solutions that use predictive analytics for the highest level of accuracy even in the aftermath of shifting consumer preferences, retailers have the choice to optimize their inventory.

6. Revisit store operations for better productivity

Retailers should reassess their in-store procedures, seek opportunities to reset the store operating model, reset labor allocation and scheduling, and take an end-to-end view of expenses to combat the consequences of labor cost inflation. With the use of recruitment and talent analytics, retailers can re-evaluate competence building, and invest in frontline employee experience and retention to lower costly turnover.

Conclusion

With margins under increasing pressure, the retail climate is expected to stay difficult for some time. However, there is an opportunity for those who are willing to step into the ring and take bold decisive moves. Retailers are well-positioned to emerge as a winner as long as they work immediately by rethinking their pricing and promotional plans, retail clearance strategy, product portfolios, markdown optimization, and supply chain operations to drive incremental growth and boost customer satisfaction.

How Can Polestar Solutions Help?

At Polestar Solutions, we consider your business data across myriad variables like price elasticity, supply chain challenges, seasonality, customer demand patterns, inflationary pressures, etc. to provide valuable insights into resource allocation, assortment, and overall financial planning. By combining professional expertise with state-of-the-art technology, we provide superior demand forecasting ways to tackle shifts in customer demand patterns and increasing inflation.

Whether you want to identify optimal inventory levels or consider an end-to-end merchandising suite to drive revenue across your retail chain, speak to our Retail Consultants today and take your retail business to next level.