The first half of 2022 is into its last leg and the year has seen its fair share of global volatility, in the form of the starting of a war between Russia and Ukraine and its spiraling effect on the global economy in terms of - inflation, demand-supply mismatch and CPG brands response to the war.

Let’s start today’s round-up with one interesting discussion by Eric Falardeau, a research leader at Mckinsey, who questioned, “Was there ever a thing called ‘consumer loyalty’?” He opines that customer loyalty was much to do with customers’ routine-driven inertia, which got shaken up during the pandemic. Hence, the need for companies to try harder than ever to retain and win customers.

Further, there are trends suggesting more affinity for buyers towards electronic products, firstly the increased reliance or dependence on them. Secondly, more savings in the customers’ kitty due to lesser spending outside home and travel.

Another trend that is bringing a significant change in shopper behavior is inflation. The prices of every commodity have gone up and each one of us has experienced that. Everyday-value stores are winning big here, as they have a loyal customer base and they are able to cut through the margins better as compared to their large retail counterparts who are burning bucks in promotions.

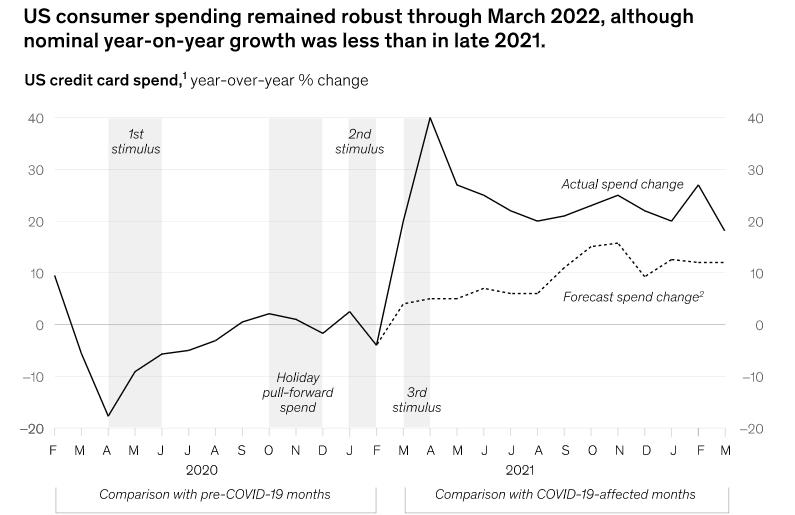

Even though inflation is significantly high, the highest in the past 10 years in the US, it didn't stop consumers in the US from cutting down on spending. This graph throws further light on the trend in the US:

Source: Affinity Solutions data on credit card spending from Feb 2019 to Mar 2022

Reading the graph, the US consumers shelled out 18% more in March 2022 than they did two years earlier, and 12% more than the forecasted estimate based on the pre-COVID-19 numbers. This further substantiates the second point, that is, increased savings in the past two years and hence the capacity to spend more.

Read further on the estate of consumer spending and findings from different studies.

All of these trends hint toward a significant behavioral and demand shift in the consumers’ buying journey. And Stock-outs have shown stark truth during the pandemic:

Experts in the CPG space laid emphasis on analytics and the role it can play in the turmoils of the global economies. It can play a significant role here in terms of:

- Forecasting the demand and predicting the surges or declines

- Formulating an optimum pricing strategy at the store and product-portfolio level

- Effectively manage vendor networks, route-plans, and logistics

- Personalized targeting with timely offers and back-in-stock or substitute recommendation

Read these insights and more in this roundup article from Mckinsey & Co - Taking Pulse of the Consumers

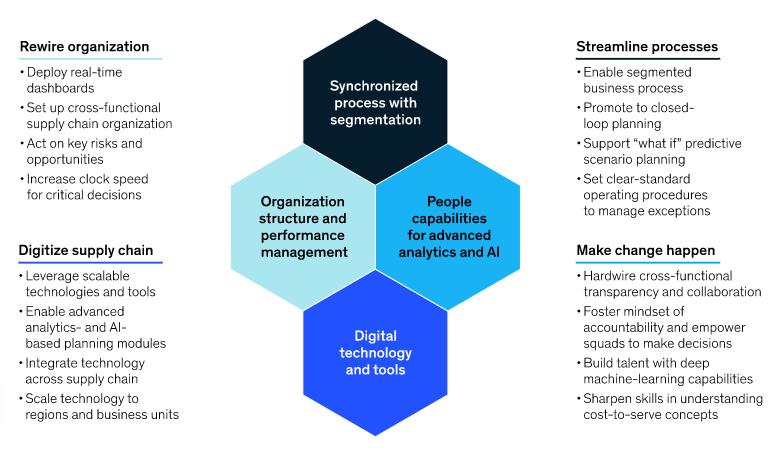

These trends have one common thread that is pivotal to every CPG strategy and could boost the consumer experience - the CPG Supply chain. The stakes are very high for supply chain executives and they require support from different teams in terms of timely information. They need updated stock-level data and need to take into account any promotions or schemes that could result in a demand spike. They need coordination from the finance department for budget allocation and approvals. Doing all of it with the last mile is a complex affair, to say the least.

That’s where technologies like automation, robotics, and IoT come into the picture and the focus and reliance were never any higher. But, taking a step back, for all of it to give the best result, a robust planning framework is a must. One that brings all the stakeholders together. That’s where autonomous supply chain planning can make a difference. The infographic below talks about the four elements to deploy autonomous planning:

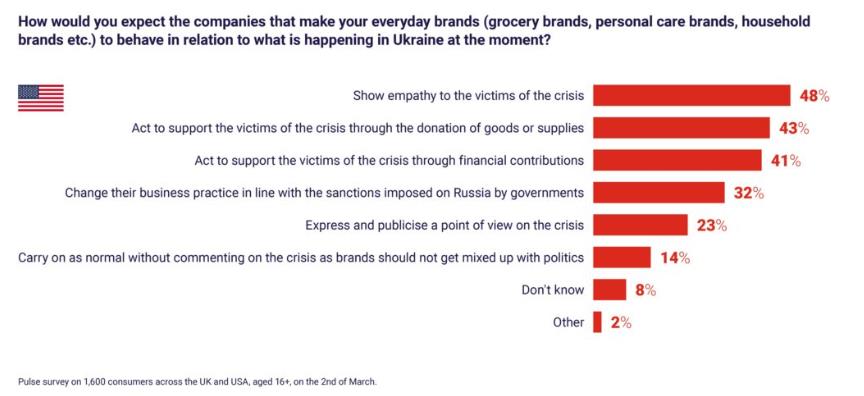

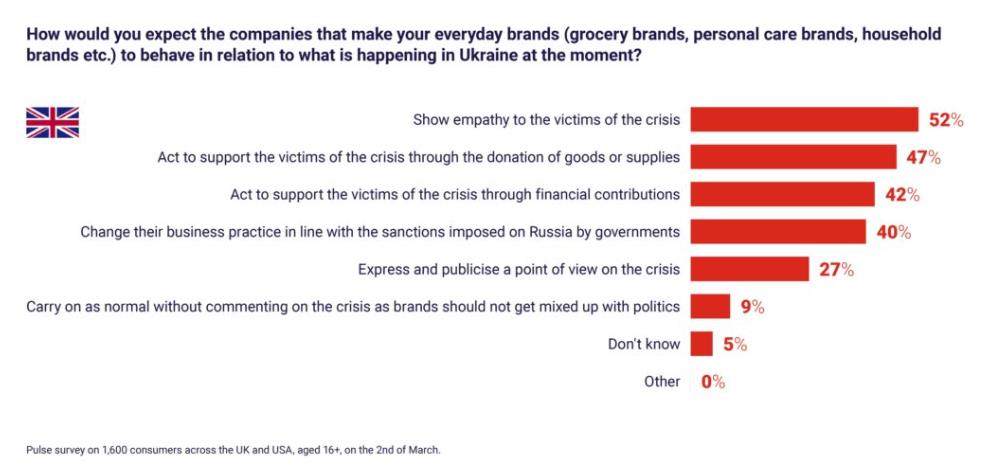

Well, this round-up would not be complete without the mention of the biggest event of the year: the Ukraine-Russia war. We all have heard the response of global brands pulling out their operations from Russia and showing their solidarity with Ukraine. It’s for sure a delicate matter and brands did a lot of things aligned with the beliefs of their loyal customer base.

Our next and last piece in the round-up demystifies what place brands hold in these times-of-crisis. It also covers survey of 1600 consumers across the US & UK on what they believe brands should do in these trying times and here are the findings:

Here’s a summary of actions taken by CPG brands in-the-wake of the war:

- 30 brands completely suspended operations in Russia

- 11 reduced their operations to essential only

- 16 suspended investments

- 7 brands have donated resources to support Ukrainians

Read a detailed analysis of what the CPG brands are doing in this article - The CPG response to Ukraine